What are Corporate Bitcoin Treasuries?

Jakarta, Pintu News – The global business world is starting to show a new trend in corporate financial management: including Bitcoin as part of financial reserves or corporate treasury.

This strategy is no longer just the experiment of a handful of tech companies, but has now been adopted by more than 180 companies across sectors ranging from telecommunications to energy.

This impulse was borne out of a combination of high inflation, low yields on traditional assets, and global monetary policy uncertainty.

What is Bitcoin Treasury?

According to Coingecko, Bitcoin treasury is a Bitcoin reserve held by companies, governments, or institutions as part of their financial strategy.

Just like cash or gold, these assets are recorded on company balance sheets as a form of long-term savings. The difference is that Bitcoin offers unique characteristics: a fixed supply of 21 million coins and 24/7 global liquidity.

Traditionally, corporate treasuries are filled with ultra-safe assets such as cash, short-term government bonds, or money market funds. However, by adding Bitcoin to the reserve portfolio, companies seek to hedge against inflation, diversify deposits, while gaining exposure to potential cryptocurrency price increases.

Why are Companies Turning to Bitcoin Treasury?

1. Hedging against Inflation

The value of cash can be eroded by inflation, especially when central banks print large amounts of money. During the COVID-19 pandemic, 54 countries representing 93% of the world’s GDP poured in up to $10 trillion in stimulus – triple the 2008 crisis. Bitcoin, with its fixed supply, is considered a hedge asset that is more resistant to currency depreciation.

2. Higher Yield Potential

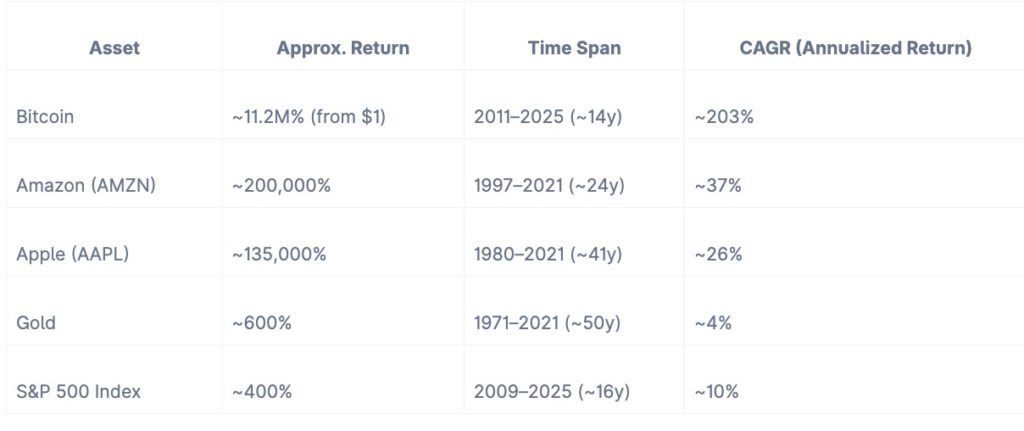

Since 2011, Bitcoin has recorded a yearly average growth rate(CAGR) of around 203%, far outpacing the S&P 500 index return of just 10% since 2009. Compared to gold, Amazon or Apple, Bitcoin remains ahead in terms of value growth, despite its high volatility. For companies with idle cash in low-yielding instruments, BTC represents an opportunity to significantly increase capital value.

Read also: Is Crypto’s 4-Year Cycle Over? Here’s How the Experts See It!

Diversification, Liquidity, and Access to Capital

In addition to the profit potential, Bitcoin offers diversification independent of the traditional financial system. Cross-border transactions can be made without being tied to the monetary policies of one particular country. The 24/7 liquidity of the crypto market gives multinational companies great flexibility.

Interestingly, companies that hold Bitcoin on their balance sheets often trade on the stock market at valuations higher than the value of the BTC they hold. This concept is known as mNAV(market Net Asset Value), which measures how much investors are willing to pay over the actual value of Bitcoin.

This premium gives companies the opportunity to issue shares or convertible bonds at low interest and then use the funds to buy more BTC, creating a mutually reinforcing cycle of rising valuations.

Also read: BTC price reaches $122,000, ETH hits $4,300, what are the factors for the rise?

Strategy and Market Positioning

Companies like MicroStrategy are prime examples of successful Bitcoin treasury strategies. By holding hundreds of thousands of BTC worth billions of dollars, they have managed to attract the interest of global investors and access large amounts of capital at low cost.

This success triggered companies from various sectors – including telecommunications, energy and healthcare – to follow suit.

Adopting Bitcoin treasury is also an effective branding tool. The company is seen as innovative, future-oriented, and ready for the digital economy. This is all the more relevant in an era of widespread cryptocurrency adoption among institutions.

Conclusion

The adoption of Bitcoin as part of corporate treasury represents a major shift in the financial management paradigm. With a combination of profit potential, diversification, and investor appeal, this strategy could be a game changer in the digital economy. However, its success remains dependent on the company’s readiness to manage the risks inherent in cryptocurrency assets.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingecko What Are Bitcoin Treasuries? Accessed August 12, 2025.

- Featured Image: Generated by AI