Dogecoin Surges 6% Today (Aug 14): Is $1 Within Reach for DOGE?

Jakarta, Pintu News – Dogecoin is showing signs of renewed momentum as market activity increases, with trading volumes continuing to grow and liquidity on major exchanges remaining strong.

DOGE’s recent price movements suggest that the asset is consolidating near key levels, signaling the potential for a longer upside phase.

Analysts project short-term targets in the $0.27-$0.30 range, with medium-term forecasts between $0.31 to $0.36, and some optimistic predictions even reaching $0.52.

Then, how is the current Dogecoin price movement?

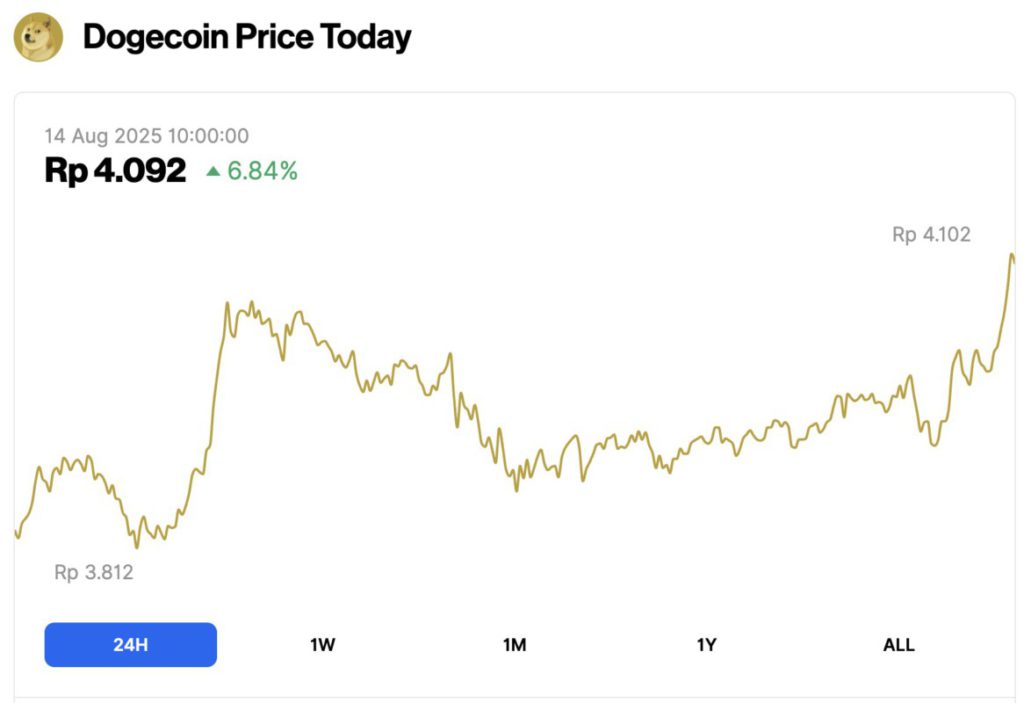

Dogecoin Price Rises 6.84% in 24 Hours

On August 14, 2025, Dogecoin saw a 6.84% gain over 24 hours, reaching $0.2524, or approximately IDR 4,092. During the same period, DOGE traded between IDR 3,812 and IDR 4,102.

At the time of writing, Dogecoin’s market cap stands at around $38.24 billion, with trading volume rising 50% to $4.33 billion within 24 hours.

Read also: Ethereum Soars to $4.700 Today as Market Cap Tops Netflix and Mastercard!

Factors Affecting the Dogecoin Price Rise

On August 13, Dogecoin experienced a significant spike, with the price rising about 11.4% to $0.2463. According to Coinpedia (13/8), some of the main factors driving the increase in DOGE include:

- Whale Accumulation: Large investors have bought over $200 million worth of DOGE, now controlling almost 50% of the total outstanding supply. This accumulation increases demand and liquidity.

- Technical Indicators: The formation of a “golden cross”, which is when the short-term moving average crosses above the long-term average, has historically been associated with significant price increases.

- Market Sentiment: Positive investor sentiment, driven by the latest bullish trend and speculative interest, further strengthened buying pressure.

These factors combined create conditions that favor DOGE prices to continue their upward trend.

Dogecoin (DOGE) Price Analysis – Can it Reach $1?

In the short term, the DOGE price recorded consecutive higher highs and higher lows, indicating increasing bullish strength. Although the price has experienced some corrections, since the beginning of 2024 the price has remained relatively high.

After a strong uptrend, the Dogecoin price is now entering an important resistance zone, so a break above this level could push the price closer to the $0.5 target.

Read also: Bitcoin Hits $123K, Reaching a New All-Time High Amid Rate Cut Speculation!

Since the Q4 2024 breakout, the price of DOGE is trapped in a symmetrical triangle that dictates the direction of the market. Currently, the price is between the important resistance levels $0.2436-$0.2494.

In addition, the 50/200-day MA is heading towards a bullish crossover (Golden Cross), signaling the token is likely to break the pattern soon and reach $0.3 in no time.

On the other hand, the RSI is increasing and approaching the upper limit. Once it enters the overbought zone, Dogecoin price is likely to start a new surge. Initial upside targets include $0.36 and then $0.46.

A safe rise above $0.5 could attract additional liquidity, pushing the price towards the current ATH above $0.75. Once this level is reached, reaching $1 is not impossible.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Doge on the Rise: Can Dogecoin Outshine Other Memecoins and Reach $1? Accessed on August 14, 2025