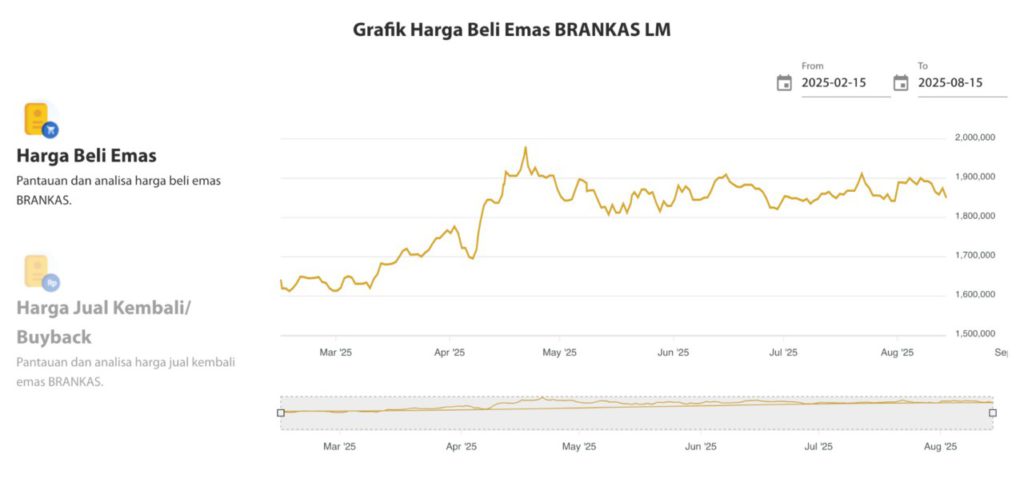

Antam Gold Price Chart August 15, 2025: Down IDR 24,000 per Gram

Jakarta, Pintu News – Gold prices in the domestic market on Friday, August 15, 2025, recorded a significant decline of Rp24,000 per gram compared to the previous day. Based on BRANKAS LM data, the current corporate gold purchase price is at Rp1,849,600/gram, while the physical gold purchase price in the market is at Rp1,909,000/gram.

This decline occurred after the gold price had stayed in the range of Rp1.87 million to Rp1.93 million per gram over the past few weeks. This price change is potentially influenced by exchange rate fluctuations, global gold prices, and investment market sentiment.

1. Corporate and Physical Gold Price Comparison

The BRANKAS gold purchase price for corporate customers is currently lower by approximately Rp59,400 than the physical gold price. This difference reflects the difference in management and storage costs between digital gold (BRANKAS) and physical gold.

The previous price for corporate BRANKAS gold was IDR 1,873,600/gram, while physical gold was at IDR 1,933,000/gram. Both price categories experienced a daily decline of IDR 24,000.

Also Read: 10 Crypto Airdrop Telegram 2025: How to Claim Free Tokens from Telegram to DeFi

2. Price Trend of Last 6 Months

Based on the graph for the period February 15, 2025 to August 15, 2025, the gold price was around Rp1.6 million/gram at the beginning of the period. A sharp upward trend occurred from the end of March 2025, reaching a peak above Rp1.95 million/gram at the end of April 2025.

After that, the price experienced a moderate decline, then moved steadily in the range of Rp1.85 million to Rp1.93 million per gram from June to August 2025. This condition indicates that the gold market is in a consolidation phase after a sharp surge at the beginning of the year.

3. Factors Affecting Price Movement

Global gold prices are influenced by various factors, such as US dollar movements, inflation rates, central bank interest rate policies, and geopolitical uncertainty. The price drop on August 15, 2025 is most likely related to the temporary strengthening of the US dollar against the rupiah.

In addition, investors’ interest in safe haven assets like gold is also affected by the movements of the stock and crypto markets. When stock markets and cryptocurrencies show a recovery, some capital shifts out of gold, depressing its price.

4. Gold Price Outlook Going Forward

With a stable price trend in the range of Rp1.85 million to Rp1.93 million per gram in the last two months, there is a possibility that gold prices will remain sideways in the near future. However, the potential for an increase is again open if there is a weakening rupiah or increased global uncertainty.

Investors are advised to monitor the development of international gold prices (USD per troy ounce) and the rupiah exchange rate to estimate future price movements. Based on the exchange rate of 1 USD = IDR 16,153, changes in world gold prices will be quickly reflected in the domestic market.

Also Read: 7 Ethereum (ETH) Developments to Anticipate in 2025

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BRANKAS LM. Gold Price Dashboard. Accessed August 15, 2025.