Whale Purchases 320 Million XRP: Will Ripple’s Price Break Through the $3.50 Mark?

Jakarta, Pintu News – In the past 72 hours, large holders of XRP have accumulated 320 million tokens, signaling increased demand from large value investors.

This wave of aggressive buying is in line with the surge in market confidence and easing of sales pressure.

On August 14, Ripple was briefly trading around $3.25, reflecting steady gains despite broader volatility in the market.

Accumulation by “whales” on this scale often limits the liquidity available on exchanges, which can pave the way for potential further price movements to the upside.

Therefore, this wave of strategic buying could be an important factor influencing the direction of the XRP price in the near future.

Can XRP Cup-and-Handle Pattern Trigger a Breakout?

XRP’s daily chart (Aug 14) shows a clear cup-and-handle pattern forming near the critical supply zone between $3.35 and $3.50. This classic pattern usually indicates consolidation before a potential breakout.

Read also: Pi Network and Bitcoin’s Falling Correlation Leads to Mass Exodus of Pi Coin Holders

As of August 14, the Relative Strength Index (RSI) stood at 57.28, indicating neutral momentum with room for upward expansion. However, the price needs to close decisively above the supply zone to confirm the continuation of the bullish trend.

With the recent whale activity and strengthening sentiment, traders may see this as an opportunity to position themselves early before a possible resistance reversal.

Why Do Long Positions Dominate the Derivatives Market?

On Binance’s perpetual XRP market, long accounts account for 85.33% of open positions, while short accounts account for only 14.67%. This overwhelmingly dominant skew highlights traders’ strong belief in XRP’s price upside potential.

The long/short ratio of 5.82 reflects a market that is inclined towards bullish bets. However, imbalances like this can magnify price movements both up and down.

Continued price gains will likely require continued spot buying support from whale and retail investors to maintain momentum and absorb profit-taking pressure.

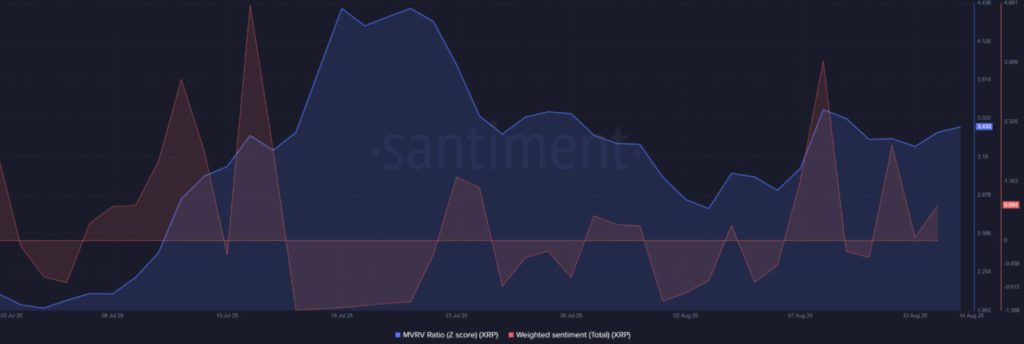

Is Positive Sentiment and High MVRV Supporting the Rally?

As of August 14, Weighted Sentiment remains positive, indicating market optimism despite recent volatility. The MVRV Z-score stood at 3.46, a fairly high level indicating that coin holders are currently in a profit position.

While this can boost confidence, it also increases the risk of profit-taking when the price approaches the resistance level.

Therefore, sentiment and valuation metrics paint a balanced picture-optimism is strong, but traders should be wary of potential selling pressure if profits increase too quickly.

To sustain the bullish momentum, it will most likely require continued accumulation and strong buying interest.

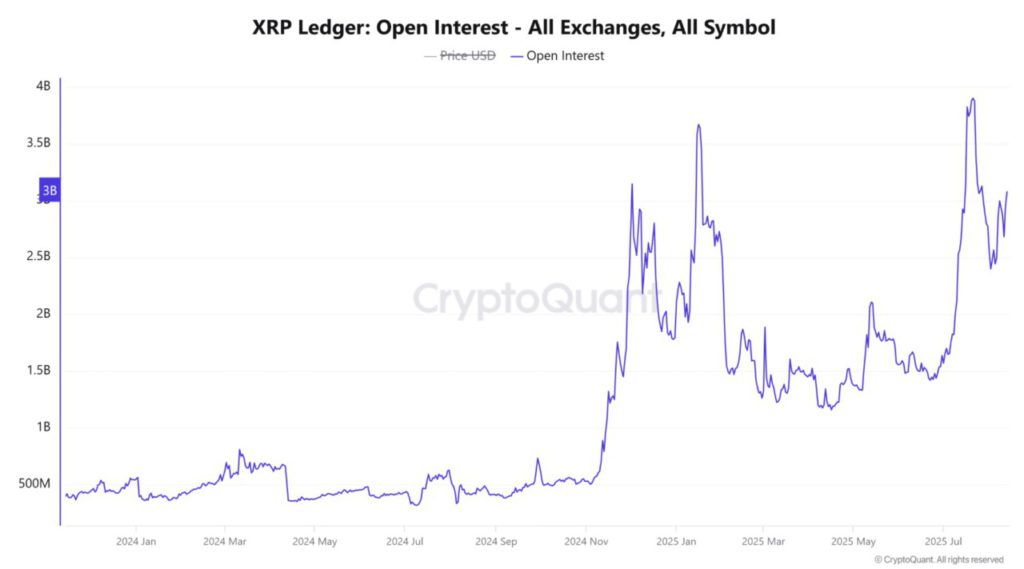

Do Traders Increase Positions with Higher Open Interest?

XRP’s Open Interest (OI) also rose to 3.1451 billion, an increase of 7.14% (14/8), highlighting the surge in market participation using leverage.

This increase indicates that traders are increasingly investing in long and short positions, hoping that market volatility will increase.

Read also: Why Are BTC and ETH Dropping Today (August 15)? Here’s What’s Behind the Crypto Decline

An increase in OI, combined with a bullish Long/Short ratio, often indicates growing confidence and the possibility of sharp price movements.

However, without strong support from the spot market, higher leverage can trigger sudden liquidation. Therefore, monitoring financing levels and market direction flows remains important.

Will XRP Break Its Supply Zone?

XRP has a high probability of breaking out of its supply zone if accumulation by whales continues at the current pace and dominant long positions are maintained.

The combination of a bullish chart pattern, increased OI, and overwhelming trader confidence provided the necessary momentum.

Therefore, a decisive close above $3.50 could confirm the breakout and potentially pave the way for a sustained rise.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Will 320M XRP whale buys push the price past $3.50? Accessed on August 15, 2025