These 3 Altcoins Potentially Liquidated in the Third Week of August According to Coinglass Data

Jakarta, Pintu News – The crypto market is always full of unexpected dynamics. In the third week of August, several altcoins showed the potential for major liquidations that could affect traders and investors.

This article will review three altcoins that are on the verge of high liquidation risk according to liquidation map data from Coinglass, namely Solana , Dogecoin , and Chainlink .

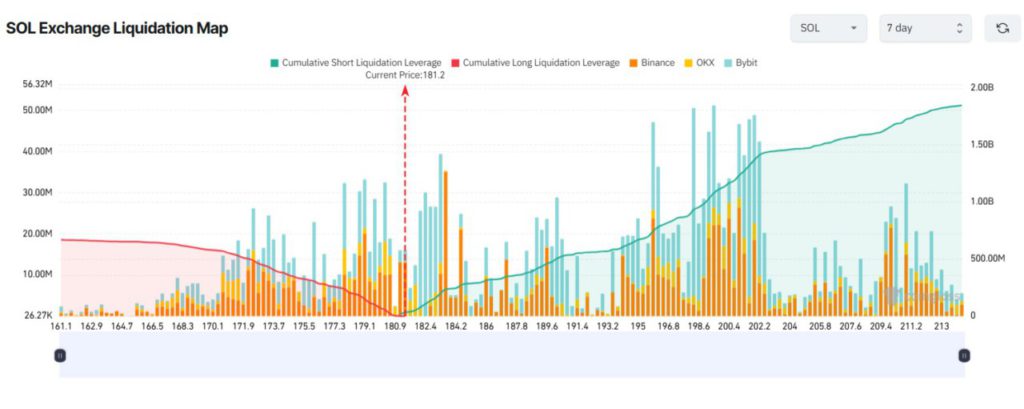

1. Solana (SOL): Recovery Potential and Liquidation Risk

Solana (SOL) looks set to have a busy week with a new governance proposal, SIMD-0326, which aims to speed up block finalization through the Alpenglow Consensus protocol. Additionally, the Solana network recently set a record by processing over 104,000 transactions per second.

If the price of Solana (SOL) manages to recover past $200 this week, liquidation of short positions totaling more than $1.1 billion could occur. However, if the price of Solana (SOL) drops to $161, liquidation of long positions amounting to around $646 million could occur.

Analysts warn of a more worrying scenario, where Solana (SOL) could fall below $170 before bouncing back above $200 within the same week. This suggests that both long and short traders could potentially face liquidation risks.

Also Read: CHILLGUY Price Prediction 2025-2030: Meme Coin Viral TikTok, Is it Still Worth Buying?

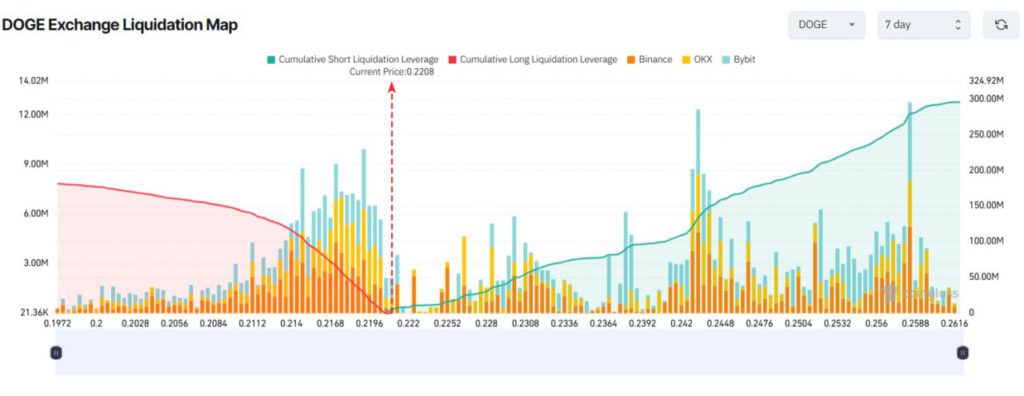

2. Dogecoin (DOGE): Accumulation by Whales and Potential ETF

Dogecoin (DOGE) was in the spotlight in August due to heavy accumulation by whales and investors. Grayscale has applied to the US SEC to convert their $2.5 million Dogecoin Trust into a spot ETF. Meanwhile, crypto bettors at Polymarket give a more than 70% chance that US regulators will approve a Dogecoin (DOGE) ETF before the end of the year.

Despite this bullish news, the Dogecoin (DOGE) liquidation map shows the dominance of short position liquidation volume. If Dogecoin (DOGE) falls below $0.20 this week, the liquidation of accumulated long positions could exceed $176 million. Conversely, if Dogecoin (DOGE) rises back to $0.26, around $290 million of short positions will be liquidated. Tardigrade traders suggest that this is not the time to be bearish on Dogecoin (DOGE).

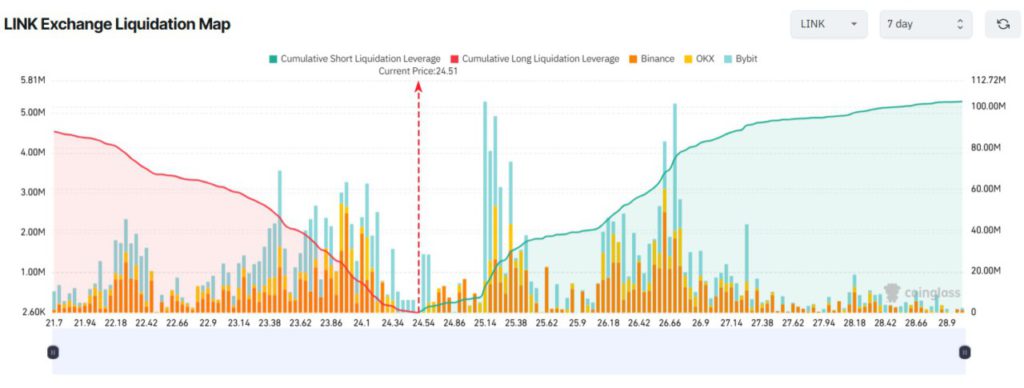

3. Chainlink (LINK): Reserve Initiatives and Price Fluctuations

Chainlink (LINK) caught the attention of investors in August, especially with the announcement of the Chainlink Reserve initiative. A report from BeInCrypto noted that the whale wallet had added more than 1.1 million LINK in the past seven days. However, the same report also showed that LINK reserves on exchanges have increased again, signaling that investors are starting to take profits after a price increase of more than 50% since the beginning of the month.

Chainlink (LINK)’s liquidation map looks balanced, with both bulls and bears having strong incentives. If Chainlink (LINK) falls below $22, around $85 million of long positions could be liquidated. If Chainlink (LINK) rises to $27, around $85 million of short positions will face liquidation. The price range and liquidation volume are almost identical, while the market sentiment remains greedy.

Conclusion: A Critical Week for Altcoin Traders

This week has been critical for altcoin traders and investors. With high liquidation potential in Solana (SOL), Dogecoin (DOGE) and Chainlink (LINK), it is important for market participants to monitor recent developments and prepare for volatility. Investment decisions should be based on careful analysis and a deep understanding of current market dynamics.

Also Read: Worldcoin (WLD) Price Prediction 2025-2031: Bullish Potential or Just Hype?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Altcoins at Liquidations Risk in August Third Week. Accessed on August 19, 2025