5 Reasons Why Crypto is Down Today: Macroeconomics to ETH Leverage Risk (1/9/25)

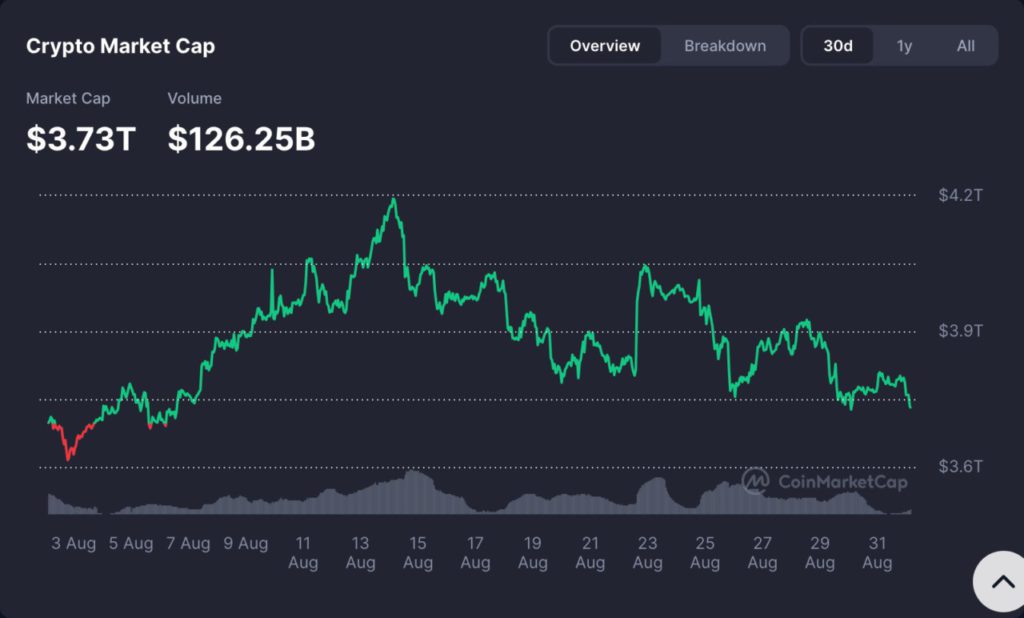

Jakarta, Pintu News – The cryptocurrency market has again shown significant weakness. In the past 24 hours, the total market capitalization fell by 1.87% from around Rp61.6 quadrillion ($3.73 trillion equivalent) to Rp60.4 quadrillion ($3.66 trillion), extending the weekly downtrend that has now reached 5.5%.

The following are the five main factors driving the decline according to data and analysis from CoinMarketCap.

1. Declining Macroeconomic Sentiment: Investors Shift away from Risky Assets

According to a report by CoinMarketCap, both Bitcoin and gold ETF products recorded simultaneous outflows of funds in August, something that rarely happens. This suggests increased investor caution on macroeconomic conditions, especially ahead of the latest policy announcement from the US Federal Reserve.

The correlation between the crypto market and the Nasdaq index rose to +0.50 in the last 7 days, signaling that the pressure in the stock market is dragging down crypto performance. At the same time, the 24-hour correlation between crypto and gold is negative (-0.30), indicating that digital assets are no longer considered a reliable hedge.

Also Read: Can Ripple (XRP) Make Investors Millionaires? Here Are the Prospects According to Analysts!

2. Ethereum (ETH) Leverage Risk: Liquidation Potential Increases

Based on data from Coinglass, Ethereum short positions worth more than IDR 19.3 trillion ($1.17 billion) are in danger of liquidation if the ETH price breaks IDR 75.1 million ($4,550). On the other hand, long positions worth IDR 16.6 trillion ($1.01 billion) could be forced to close if the price drops below IDR 72.5 million ($4,400).

With Ethereum prices currently hovering around IDR73.9 million ($4,483), the market is in the midst of asymmetric pressure that could trigger further volatility. Data shows that Bitcoin liquidations in the last 24 hours jumped 147% to around IDR 462 billion ($28 million), of which 88% came from long positions that were forced to close.

3. Regulatory Uncertainty: Institutional Investors Still Waiting

The delay in the passage of the CLARITY Act governing the oversight of the crypto industry led to continued regulatory uncertainty. A report from CoinDesk mentioned that inflows into BTC and ETH ETFs fell 2.8% to IDR2.39 quadrillion ($144.9 billion) and IDR388.8 trillion ($23.6 billion) respectively in the past week.

The US Senate Banking Committee is scheduled to release a draft of the bill on September 30. If regulatory certainty is achieved, this could trigger new capital flows from institutional investors who have been waiting for certainty between the SEC and CFTC jurisdictions.

4. Technical Breakdown: Market Capitalization Breaks 30-Day Average Support

Technically, the current crypto market capitalization has dropped below its 30-day moving average which stands at around IDR63.5 quadrillion ($3.85 trillion). This is a technical bearish signal that usually triggers further selling by algorithms and short-term traders.

According to technical analysis from CoinMarketCap, this level is an important reference in determining the direction of the medium-term trend. A drop below this level could trigger more profit-taking and short-term panic among retail traders.

5. Fear Dominates: Fear & Greed Index Down and BTC Dominance Up

The crypto Fear and Greed Index currently stands at 39, indicating the dominance of fear in the market. At the same time, Bitcoin’s market dominance rose to 57.4%, indicating that investors are starting to shun altcoins and return to perceived safer assets like BTC.

Ethereum trading volume on decentralized exchanges (DEXs) actually set a new record of IDR 2.3 quadrillion ($140 billion) during August. However, this was not enough to balance the selling pressure due to uncertainty and increased liquidation risk.

Conclusion

Today’s price drop is not due to one single factor, but a combination of macroeconomic, technical, and regulatory pressures. With ETH in a critical zone and crypto’s correlation with equity markets continuing to strengthen, the market is still in a sensitive phase to global sentiment.

Will September, historically known as a weak month for Bitcoin, repeat its negative trend, or will it be driven by positive developments such as stablecoin regulation?

Also Read: 4 Interesting Facts Why 1 in 4 Brits are Interested in Crypto Investment for Retirement Funds

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinDesk. Bitcoin and Gold ETFs Combined Break $500B Barrier. Accessed September 1, 2025.

- CoinGlass. ETH Liquidation Levels and Leverage Risk. Accessed September 1, 2025.

- CoinMarketCap. Crypto Market Overview. Accessed September 1, 2025.