3 Cryptocurrencies September 2025 Breakthrough Predictions: Potential Market Surprise?

Jakarta, Pintu News – The cryptocurrency market seems to be on the verge of a major change with some assets showing potential for recovery, while others are struggling to return to the peak values of a few weeks ago.

With different dynamics among major assets such as Shiba Inu , Bitcoin , and Ethereum , market participants should be wary of the next moves.

1. Shiba Inu (SHIB): Waiting for Momentum

Shiba Inu (SHIB) seems to be preparing for a big surge. The symmetrical triangle pattern that has been forming since mid-August suggests that SHIB may experience high volatility in the next few days. With the current price hovering around $0.00001236, SHIB is showing signs of a breakout given the tightening price pattern.

Technical indicators show uncertainty, with the Relative Strength Index (RSI) sitting at 47, indicating that the asset is neither overbought nor oversold. The consistent decrease in volume during this consolidation is a classic indication that a major move may be on the horizon. Traders should watch the $0.00001297 level for potential upside and $0.00001200 for potential downside.

Also Read: 3 Major Factors that Could Drive a September 2025 Bitcoin (BTC) Rally!

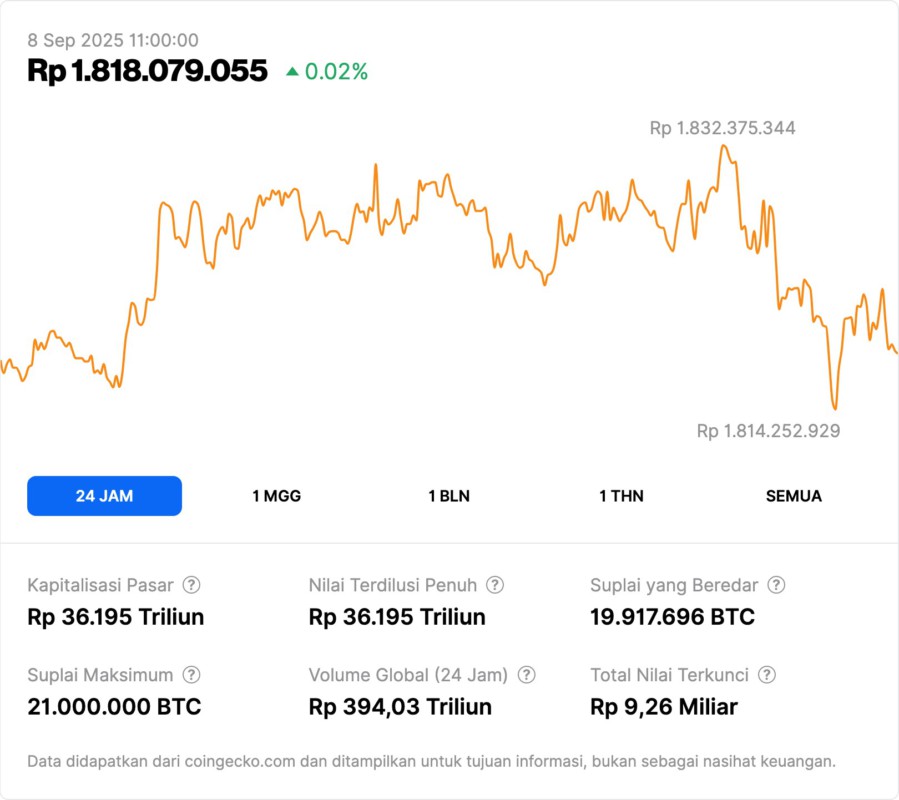

2. Bitcoin (BTC): Struggling to Reach Recovery

Bitcoin (BTC) is having a hard time recovering after the latest price drop. After trying to break through critical resistance in the $112,000 area, BTC failed and bounced back down. This suggests that there is still further downside potential in the current price structure.

With its current position around $111,121 and below its 50-day moving average, Bitcoin (BTC) looks set to test its next support at $110,785. If this level does not hold, it is likely that Bitcoin (BTC) will reach the 200-day moving average at $104,520, which would mark a deeper correction phase. Momentum indicators also support this bearish view, with declining trading volumes indicating a lack of buyer strength.

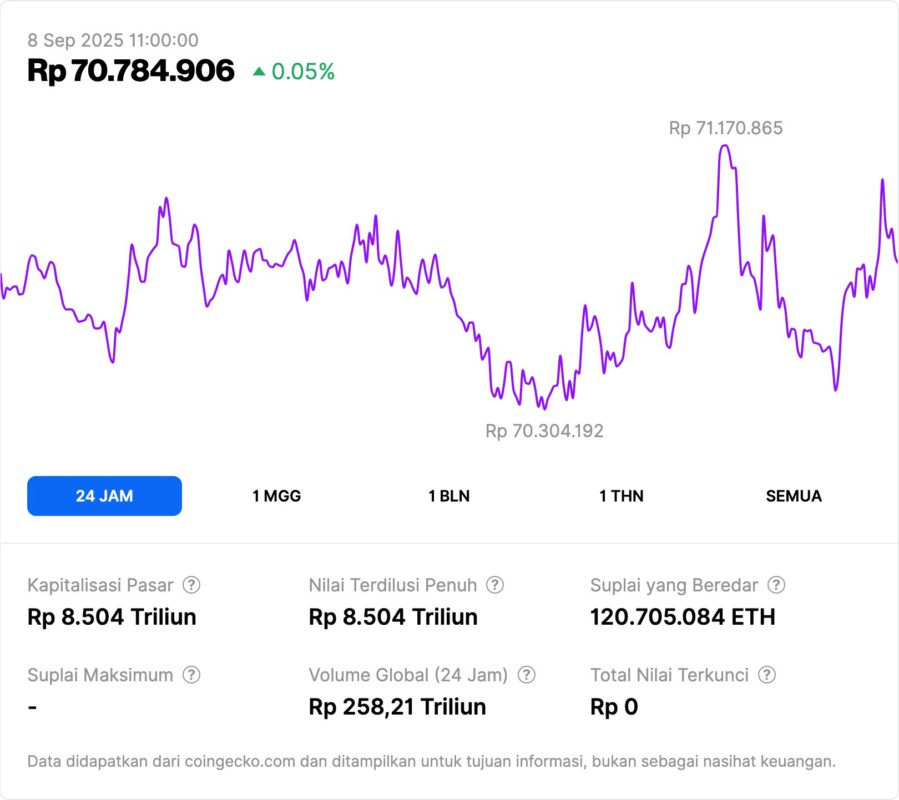

3. Ethereum (ETH): Stagnant Phase

Ethereum (ETH) is currently in a stalemate phase after a period of high volatility. With the price fluctuating around $4,300, ETH seems to be struggling to gain significant momentum. This suggests that there could be more price drops ahead if sellers continue to dominate the market.

Ethereum (ETH) is stuck between the 26-day and 50-day exponential moving averages (EMAs), which is usually an indication of a breakout. However, the current configuration is more bearish. If the selling pressure continues, Ethereum (ETH) might test the 100-day EMA at $3,607. Failure to hold this level could take ETH to the 200-day EMA around $3,190, signaling a deeper correction phase.

Conclusion: Crypto Market at a Crossroads

With mixed market conditions, market participants should remain vigilant and prepared for any eventuality. While some assets show potential for recovery, the general trend still suggests that the market may experience more downturns before it can fully recover. Investment decisions should be made with caution, taking into account the current market dynamics.

Also Read: 4 Reasons El Salvador Moved IDR11 Trillion in Bitcoin: Protection or Sell Signal?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Shiba Inu (SHIB) Biggest 2025 Breakout Is Around: Bitcoin (BTC) Recovery Failed, Ethereum (ETH) Worst Since. Accessed on September 8, 2025