Ripple (XRP) ETF Attracts Investor Interest: 94% Chance of Approval!

Jakarta, Pintu News – The cryptocurrency market is abuzz again with speculation of high chances of exchange-traded fund (ETF) approval for Ripple . The latest data from Polymarket shows that the chances of Ripple (XRP) ETF approval have surged beyond 90%, with the current figure almost reaching 94%.

Analysts from Bloomberg have also confirmed the almost certain prediction of this ETF’s approval, despite concerns from some cryptocurrency skeptics.

Ripple (XRP) ETF Approval

Most likely, the Ripple (XRP) ETF will get the green light from regulators this year. This is supported by data from Polymarket and statements from Bloomberg analysts showing high confidence in the approval. Despite concerns from Caroline Crenshaw, a Democrat known to be anti-crypto, the market seems optimistic about the prospects of this ETF.

This approval is considered an important step in increasing the adoption and acceptance of Ripple (XRP) among institutional investors. ETFs allow investors to participate in the crypto market without directly owning digital assets, which can minimize some of the security risks and practicalities of storing digital assets.

Also Read: 3 Major Factors that Could Drive a September 2025 Bitcoin (BTC) Rally!

Market Demand for Ripple (XRP) ETFs

While ETF approval seems to be in sight, the big question that remains is how much interest the market will show. Nate Geraci, an ETF analyst, predicts that the Ripple (XRP) ETF will surpass market expectations, similar to what happened to the Bitcoin and Ethereum ETFs.

However, skepticism still exists, with some arguing that these products will show a lack of institutional interest in Ripple (XRP). The absence of large firms such as BlackRock and Fidelity in the Ripple (XRP) ETF race also raises questions about potential future demand.

Fidelity, for example, has applied for a Solana based ETF but not for Ripple (XRP), which could be interpreted as an indication of lack of interest.

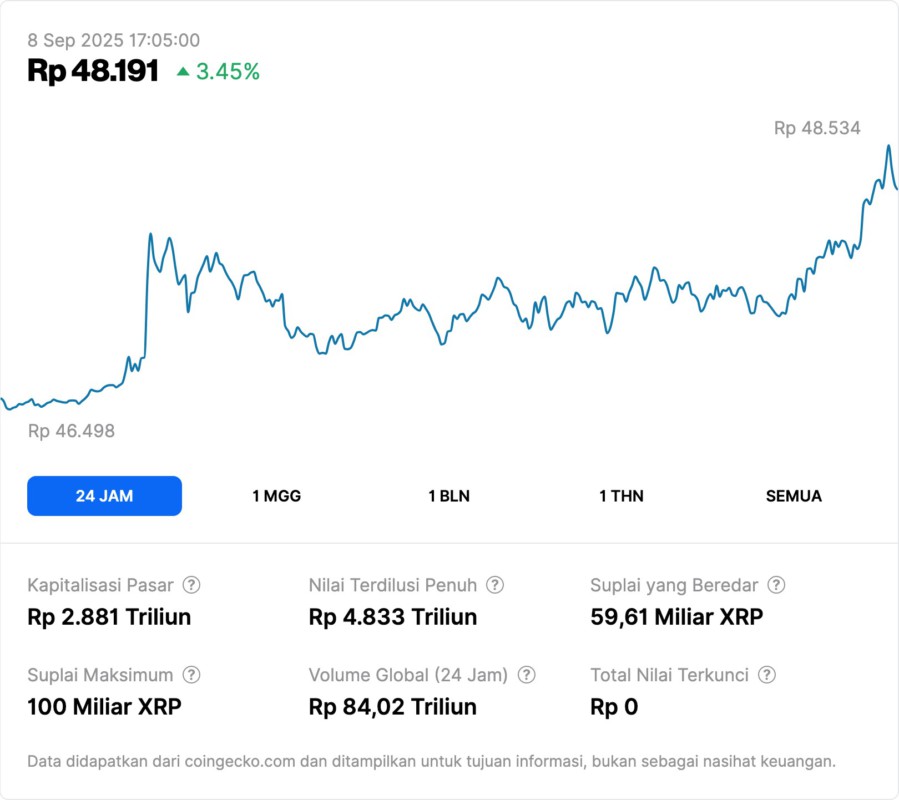

Ripple (XRP) Price Condition

Currently, the price of Ripple (XRP) is at $2.84, according to data from CoinGecko. Ripple (XRP) has experienced relatively low volatility after losing the psychologically important $3 level. Despite this, the current price is still down about 22% from its record high reached in July of $3.65.

This decline has raised concerns among investors about the long-term prospects of Ripple (XRP). However, with the high potential for ETF approval, there is hope that this could be a catalyst that will drive price gains in the future.

Conclusion

With high approval odds and huge market potential, the Ripple (XRP) ETF may be a watershed moment for this cryptocurrency. Despite some concerns and challenges, optimism in the market seems high. Investors and market watchers will look forward to the next developments with great enthusiasm.

Also Read: 4 Reasons El Salvador Moved IDR11 Trillion in Bitcoin: Protection or Sell Signal?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. XRP ETF Approval Odds Top 90% Yet Again. Accessed on September 8, 2025