Shiba Inu Faces Mini Death Cross: Will There Be an Unexpected Price Revival?

Jakarta, Pintu News – A recent technical pattern on the Shiba Inu chart suggests the possibility of a significant change in price direction. The 50-day moving exponential average (EMA) has crossed below the 100-day EMA, forming what is known as a mini death cross. This phenomenon is often considered an early indicator that momentum may begin to weaken, especially when combined with a decrease in trading volume.

Death Cross Mini Explanation

A mini death cross occurs when the 50-day EMA moves below the 100-day EMA, signaling a potential short-term decline. It differs from the traditional death cross, which involves the 50-day EMA and the 200-day EMA, and usually indicates a stronger and longer-lasting bearish trend.

In the case of Shiba Inu, this pattern emerged after a 40% price drop in inflows to the exchange, which also added to the bearish sentiment. This decrease in inflows not only reduced the potential for sudden selling but also indicated a decrease in speculative interest and lower liquidity.

This makes Shiba Inu more vulnerable to unexpected price fluctuations, as the market seems hesitant to invest capital at current price levels.

Also Read: 3 Major Factors that Could Drive a September 2025 Bitcoin (BTC) Rally!

Technical Analysis and Key Levels

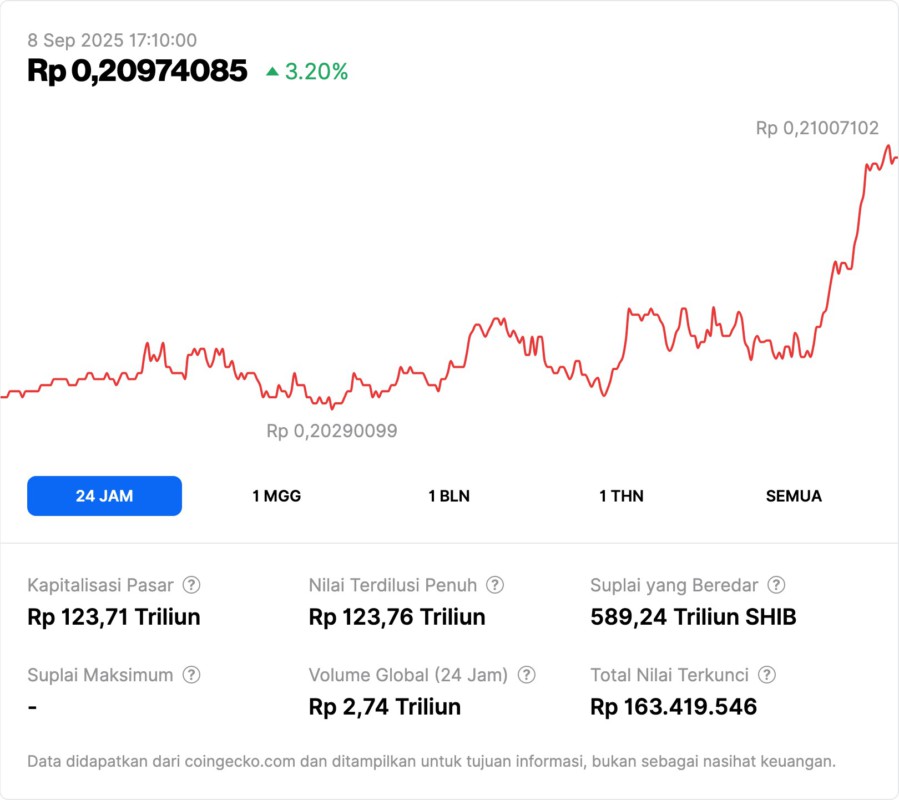

Currently, Shiba Inu is in a narrowing consolidation pattern and is hovering around the price of $0.00001236. An important support zone is $0.00001200; a break below this could accelerate losses.

If the price drops below $0.00001150, it could strengthen the bearish trend as that level is a stronger downside cushion. On the other hand, if the Shiba Inu can return to the $0.00001297 level, which is the 100-day EMA, this will weaken the mini death cross signal. A further recovery to $0.00001388, which is the 200-day EMA, could even turn the overall trend back to bullish.

Trading Volume and Market Sentiment

The Relative Strength Index (RSI) is currently hovering around 47, reflecting market uncertainty and a broader consolidation phase. The still-low trading volume compared to the July peak suggests that neither side, bulls nor bears, has complete control over the market.

This suggests that the market may still be looking for a clear direction before making a larger commitment. The combination of the mini death cross and the sharp decline in inflows to the exchange suggests that there may be a short-term bear market.

However, as has happened before, the Shiba Inu may surprise. If buyers can hold the support at $0.00001200 and push the price past $0.00001297, this mini death cross signal might lose its relevance.

Conclusion

In the current market conditions, caution remains the prudent approach. Investors and traders should pay attention to technical signals and trading volume to anticipate the next price movement. Although the Shiba Inu has shown resilience in the past, the newly formed mini death cross pattern should not be overlooked.

Also Read: 4 Reasons El Salvador Moved IDR11 Trillion in Bitcoin: Protection or Sell Signal?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Shiba Inu Mini Death Cross Unexpected Price Turnaround. Accessed on September 8, 2025