Dogecoin ETF Hype and Retail Interest Drive DOGE’s Bullish Outlook in September

Jakarta, Pintu News – In the past month, the market capital flowed more into Ethereum . However, now the market is starting to show a potential turning point. One asset that is predicted to be the next destination for capital flows is Dogecoin .

What makes Dogecoin so likely? Some of the following recent developments may help explain the possibilities.

Retail Investors Turn to DOGE

One important indicator for Dogecoin is the Short-Term Holder Supply (STH Supply). Currently, the metric is showing an increase, signaling that short-term investors are starting to accumulate DOGE.

Read also: Dogecoin Climbs to $0.23 Amid $2 Million Whale Accumulation — Is a Bull Run Underway?

STH Supply measures the amount of DOGE held in wallets for less than 155 days. A rise in this metric reflects new capital coming in from investors, which usually triggers increased buying pressure.

Based on Alphractal’s data, historical records show that Dogecoin’s STH Supply had significant spikes in 2017 and 2021. Both periods coincided with explosive bull markets, when the price of DOGE rose many times over.

As of early September 2025, STH Supply is showing an upward trend again after a brief decline. Although the movement has not been very strong, this signal indicates a new capital inflow into DOGE, which could potentially trigger the next price rally like previous cycles.

“Dogecoin could rally if STH Supply continues to increase – and signs of accumulation are already starting to show. Historically, whenever STH Supply goes up, it triggers a big bull market for DOGE. The last few weeks this metric has indeed moved up, and if the trend continues, this is very promising for memecoin,” said Joao Wedson, founder of Alphractal.

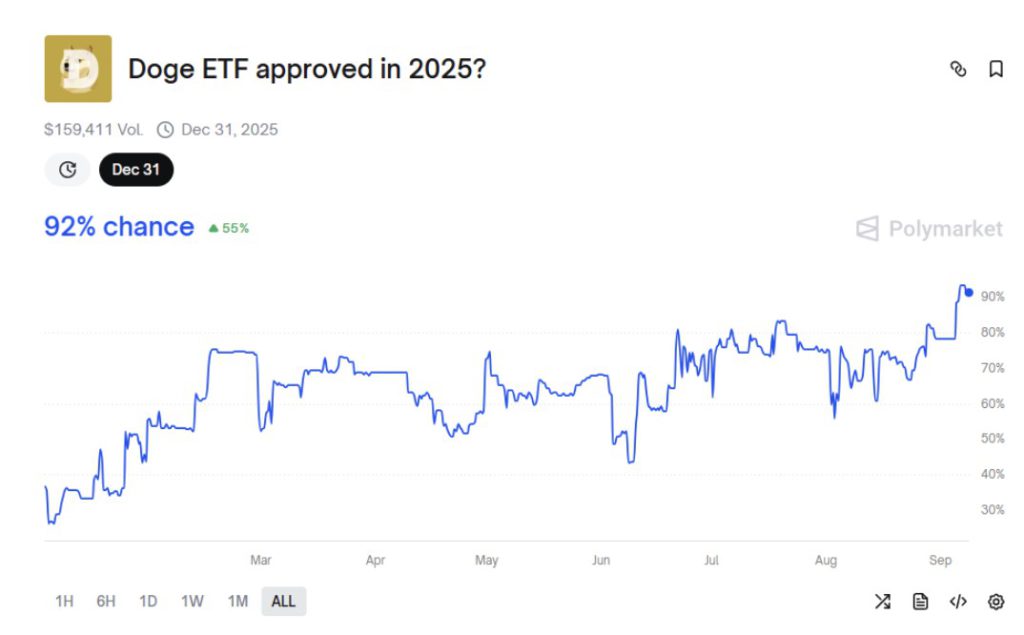

Dogecoin ETF Approval Chance Reaches 92% at Polymarket

Another factor that strengthened capital flows to DOGE in September was investors’ expectations of Dogecoin ETF approval. According to Polymarket data, in September the chances of a DOGE ETF approval jumped to over 90%, the highest level so far this year.

Read also: Whales Scoop Up $630 Million Worth of XRP: Can the Rally Continue?

Recently, Rex Shares and Osprey Funds announced plans to launch DOJE, an ETF that tracks the performance of the popularecoin Dogecoin (DOGE).

“DOJE will be the first ETF to give investors direct exposure to the performance of the iconicecoin, Dogecoin,” said Rex Shares.

However, the DOJE is not a spot ETF like the ones already approved for Bitcoin and Ethereum. It is a 40-Act ETF, designed to speed up the regulatory approval process.

Meanwhile, the SEC is still reviewing a number of applications for spot Dogecoin ETFs from major issuers such as Grayscale, Bitwise, and 21Shares. On the other hand, technical analysts highlighted an expanding wedge pattern, which indicates the potential for the DOGE price to break through to $1.4 by the end of this year.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Retail Investors Show Interest in DOGE. Accessed on September 9, 2025

- Coingape. Dogecoin Leads Altcoin Market Rally Amid DOGE ETF Optimism. Accessed on September 9, 2025