Antam Gold Price Chart Today Down IDR 12,000! Check the Up-and-Down Chart Since March 2025

Jakarta, Pintu News – Antam ‘s gold price as of today, Wednesday, September 10, 2025 at 08:05 WIB, shows a decline for two main product types: BRANKAS corporate gold and physical gold.

This decrease was recorded at IDR 12,000 per gram compared to the previous price. This article presents the latest price updates and trend charts of BRANKAS LM gold buying prices over the past 6 months, from March to September 2025.

1. BRANKAS Corporate Gold Price Drops to IDR 2,014,600 per Gram

Based on data from the official website of Brankas LM, the BRANKAS gold purchase price for corporate customers today is set at IDR 2,014,600 per gram. This price has decreased by IDR 12,000 from the previous price, which was IDR 2,026,600 per gram.

This decrease in corporate gold prices is important to note for institutional investors or companies that use digital gold storage services through BRANKAS. It should be noted, however, that this price is specifically for corporate customers, not for individual customers.

Also Read: Dogecoin vs Shiba Inu: Who Will Win Meme Coin in 2025? Latest Data Answers!

2. Physical Gold Prices Also Fall to IDR 2,074,000 per Gram

Just like the price of digital gold, the price of physical gold offered by BRANKAS has also decreased by Rp12,000 per gram. Today’s price is recorded at IDR 2,074,000 per gram, down from the previous price of IDR 2,086,000 per gram.

Physical gold prices tend to be slightly higher than digital gold prices due to production costs, distribution, and seller margins. For individual investors who buy physical gold bars, this downturn could be a momentum to buy at a more affordable price.

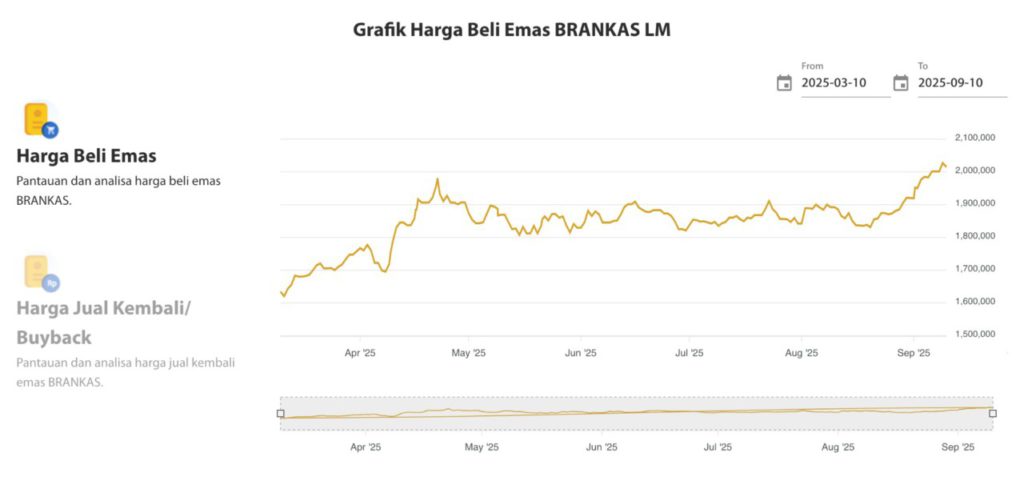

3. LM BRANKAS Gold Price Chart: Significant Rise Since March 2025

Judging from the BRANKAS LM gold purchase price chart displayed on the official BRANKAS dashboard, the gold price trend has fluctuated over the past 6 months. In early March 2025, the price of gold was in the range of Rp1,550,000 – Rp1,600,000 per gram, and continued to rise gradually.

The first significant peak occurred in late April to early May 2025, with prices reaching more than Rp1,950,000 per gram. Although it experienced a correction and stabilization in the range of Rp1,800,000 – Rp1,900,000, the trend returned to strength from mid-August to early September 2025.

4. Positive Trend Ahead of the End of Quarter 3 of 2025

The rise in gold prices since August shows positive signals, which could be influenced by factors such as exchange rate weakness, global uncertainty and inflation. As of September 10, 2025, the price has approached IDR2,100,000 per gram, which is one of the highest points in the last 6 months.

Despite today’s price drop of IDR12,000, the medium-term chart shows that the overall trend is still bullish. This provides hope for investors that gold prices could rally again in the near future.

Conclusion

Antam’s gold prices today for corporate and physical BRANKAS types both fell by IDR 12,000 per gram. However, the price chart for the last 6 months shows an overall upward trend. This price decline could be an accumulation opportunity for long-term investors, especially amid global financial market volatility.

Investors are advised to continue to monitor price developments through the official BRANKAS dashboard and consider their objectives and risk profile before making investment decisions.

Also Read: 4 Reasons El Salvador Moved IDR11 Trillion in Bitcoin: Protection or Sell Signal?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BRANKAS LM. BRANKAS Gold Price Dashboard. Accessed September 10, 2025.