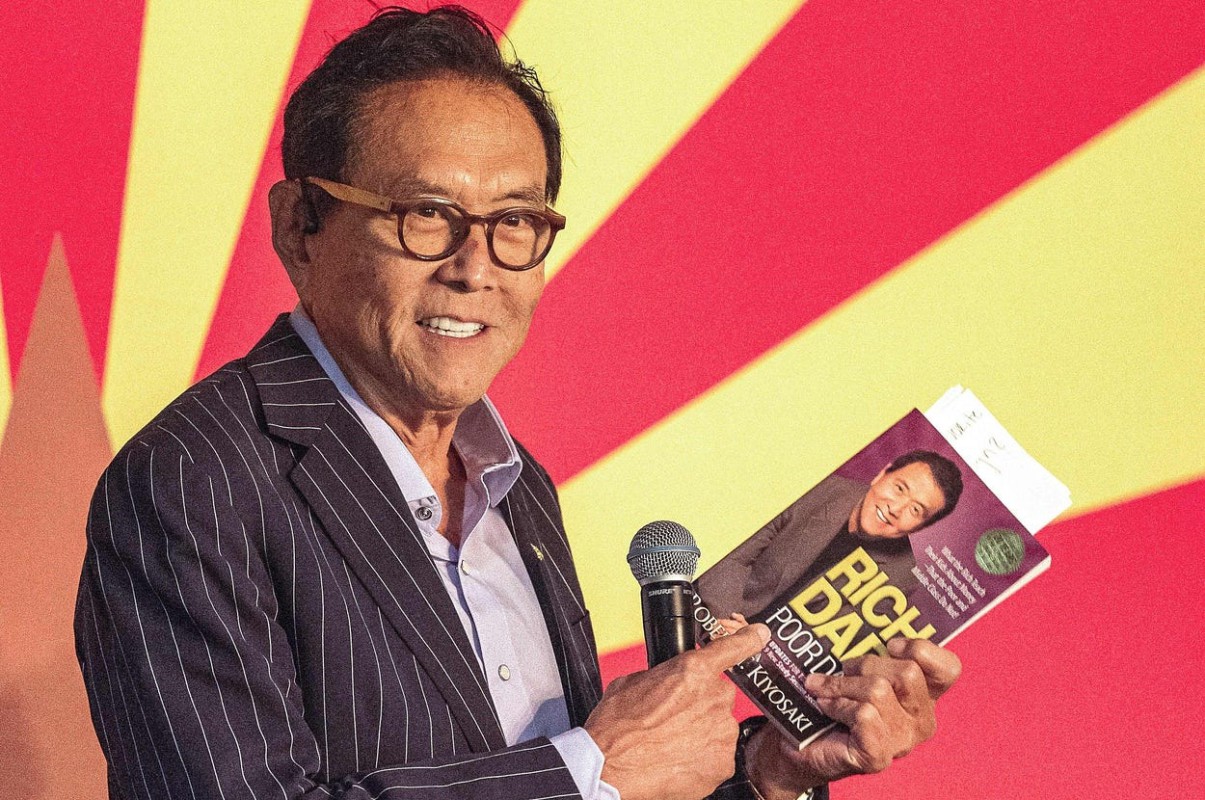

New Robert Kiyosaki Documentary Predicts the Dollar’s Demise and the Future of Bitcoin

Jakarta, Pintu News – Robert Kiyosaki, bestselling author of “Rich Dad Poor Dad” and Bitcoin advocate, recently announced a documentary that highlights the weaknesses of the Federal Reserve and praises Bitcoin (BTC) as the future of finance. The documentary, titled “Money Disrupted: End the Fed,” features interviews with notable figures such as BlackRock’s Larry Fink and others.

A Controversial Documentary

In the upcoming documentary, “Money Disrupted: End the Fed,” Robert Kiyosaki delves into the history of the devaluation of the US dollar that has been going on since 1971, when President Nixon went off the gold standard.

The documentary trailer shows how the Federal Reserve has been over-printing money, especially since the start of the pandemic in 2020, during which about 40% of the entire money supply in the world was printed.

Also Read: 5 Reasons Bitcoin Allocation on Wall Street Will Explode by the End of 2025

History and Criticism of the Federal Reserve

The documentary reveals that since the abolition of the gold standard, the US dollar has lost most of its exchange value. This has been compounded by the Federal Reserve’s money-printing policy, which, according to many experts, has led to inflation and significantly reduced the dollar’s purchasing power.

The criticism of the Federal Reserve in this documentary comes not only from Kiyosaki but also from other financial figures who highlight how this policy has affected the global economy. They argue that in order to restore stability, there needs to be a radical change in the way money printing is organized.

Bitcoin and the Financial Technology of the Future

In the documentary, Bitcoin (BTC) is portrayed as a stable and strong form of money that could be the solution to the ongoing financial crisis. Larry Fink, CEO of BlackRock, who was previously skeptical, has now expressed his support for Bitcoin (BTC).

Meanwhile, Jamie Dimon of JPMorgan expressed his support for blockchain technology, although he is still skeptical of Bitcoin (BTC). Vlad Tenev of Robinhood added that in the future, all real assets are expected to be represented on the blockchain. This represents a major shift in traditional financial thinking and may be key in overcoming the devaluation of fiat currencies.

Bitcoin Future Predictions

Robert Kiyosaki has long been a supporter of Bitcoin (BTC), accumulating it along with physical gold and silver. He believes that Bitcoin (BTC) is a new form of real money that can save the dying dollar. Kiyosaki even predicts that Bitcoin (BTC) could reach a value of up to $250,000 within the year.

This prediction is based on an analysis of current trends and the increasing adoption of Bitcoin (BTC) as a safe haven asset. Kiyosaki and other experts in this documentary emphasize the importance of understanding and possibly adopting cryptocurrencies as part of a future financial strategy.

Conclusion: What to Expect from This Documentary?

With the release of the documentary “Money Disrupted: End the Fed,” it is expected that there will be further discussion regarding the Federal Reserve’s policies and their impact on the global economy. The documentary is also likely to reinforce the position of Bitcoin (BTC) and blockchain technology as a viable alternative in the face of fiat currency instability.

Also Read: Maartunn Analyst Says December 2024 Crypto Market Pattern Repeats, What Does It Mean?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- U.Today. Rich Dad Poor Dad Author Teases “End the Fed” Documentary and Here Comes Bitcoin. Accessed on September 17, 2025