5 Facts of Trump’s Rp246 Trillion Lawsuit to the New York Times for Meme Coin TRUMP Plummeted 88%

Jakarta, Pintu News – Donald Trump is back in the public spotlight, this time not because of political policies, but his legal action against The New York Times. On Monday, September 16, 2025, Trump officially sued the media giant for $15 billion (around Rp246 trillion, at an exchange rate of 1 USD = Rp16,420).

The lawsuit is motivated by alleged defamation that is said to have damaged Trump’s business reputation, including his cryptocurrency project: TRUMP Coin.

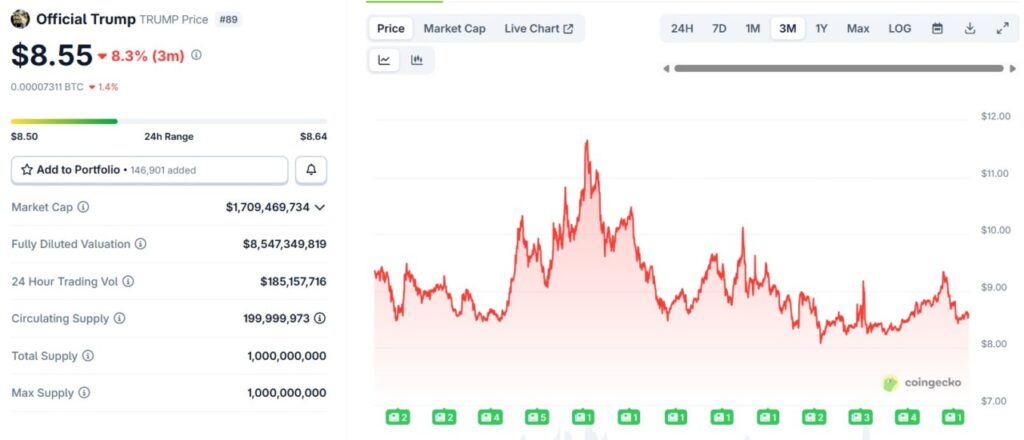

1. TRUMP Coin Down 88% Since its High, from $73 Billion to $8.6 Billion

According to a report from CoinCentral, the TRUMP Coin meme token launched in January 2025 had reached a full valuation of $73 billion. But after the negative news released in late 2024, its value plummeted by 88%, down to $8.6 billion.

In a lawsuit filed in the Florida District Court, Trump claimed that the media reports “directly undermined market confidence” in his crypto project. This decline is said to be one of the main triggers for the $15 billion lawsuit.

Also Read: 5 Reasons Bitcoin Allocation on Wall Street Will Explode by the End of 2025

2. The New York Times Report Considered Damaging to Trump’s Image and Brand

The lawsuit targets four senior journalists of The New York Times – Susanne Craig, Russ Buettner, Peter Baker, and Michael S. Schmidt – as well as publisher Penguin Random House. Their book, “Lucky Loser: How Donald Trump Squandered His Father’s Fortune and Created the Illusion of Success” is claimed to have caused great harm.

Trump considers these reports not only attack his character, but also systematically damage the reputation of businesses, including his social media company Trump Media & Technology Group (TMTG) which also has involvement in the cryptocurrency sector.

3. Lawsuit Called Politically Motivated, Linked to 2024 Elections

In the lawsuit documents, Trump alleges that The New York Times knowingly published the report to derail his election campaign in 2024. In fact, it is stated that the news is intended to influence public opinion, jurors and judges.

The editorial report in favor of Kamala Harris and the release of the book close to the launch of The Apprentice movie trailer were cited as evidence of the media’s role as a mouthpiece for opposition politics.

4. Times Reply: Baseless Lawsuit and Intimidation Attempt

In response to this lawsuit, a spokesperson for The New York Times mentioned that the lawsuit has “no legal basis” and is an attempt to silence independent journalism.

The media affirmed its commitment to Freedom of the Press and the First Amendment, and promised not to flinch in the face of pressure from public figures. They emphasized that they will continue to pursue facts and deliver the truth to the public.

5. Trump Keeps Profiting from Crypto: Wealth Rises by Rp98 Trillion

Despite TRUMP Coin’s sharp decline, a report from CoinCentral also noted that the wealth of Trump and his family increased by about $6 billion this month. This happened after their new token, WLFI (World Liberty Financial) was launched into the market.

The WLFI platform is part of the Trump family’s business expansion in the crypto and financial tokenization sectors. However, WLFI was not named as an affected party in the lawsuit against The New York Times.

Conclusion

The IDR 246 trillion lawsuit is one of the biggest legal cases involving crypto and the media. Although the TRUMP Coin project took a nosedive, this lawsuit shows how media and political sentiment can impact the price of cryptocurrency assets.

The case also highlights the tension between press freedom and the power of public figures in an increasingly political crypto ecosystem. Whatever the outcome, this case is likely to set an important precedent for the cryptocurrency industry and the media going forward.

Also Read: Maartunn Analyst Says December 2024 Crypto Market Pattern Repeats, What Does It Mean?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Trader’s Edge/CoinCentral. Trump Sues New York Times for $15 Billion Over Meme Coin Damage Claims