Aave Transforms: L2 Closure and $100 Million Push for GHO Spark Controversy

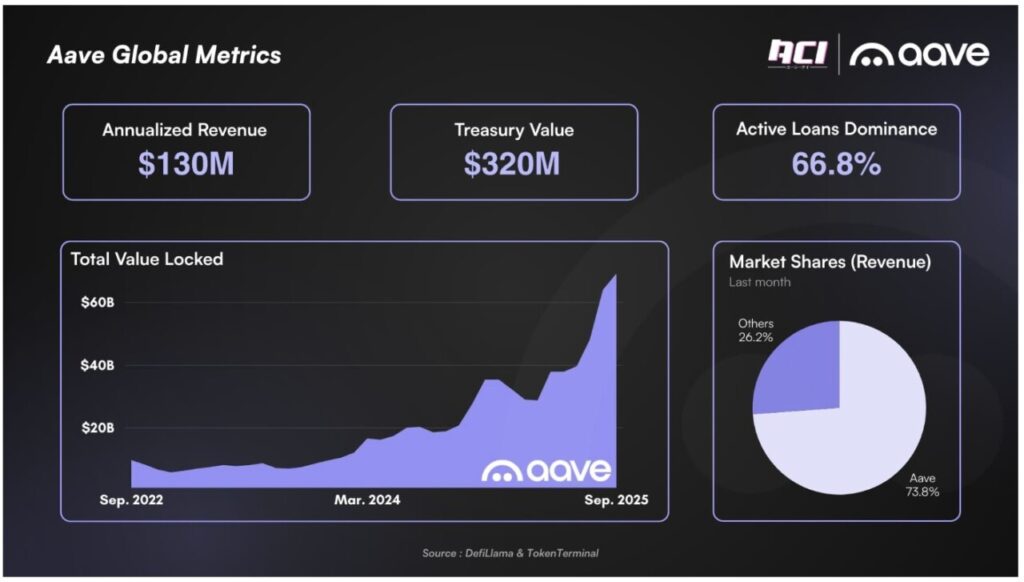

Jakarta, Pintu News – In the latest “State of the Union” report by the Aave Chan Initiative (ACI), it was revealed that Aave is now leading in several important metrics in the DeFi market, such as Total Value Locked (TVL), revenue, market share, and loan volume.

With annual revenue reaching $130 million, Aave managed to outperform the combined cash reserves of its competitors. However, ACI’s recent decision to shut down 50% of their layer 2 (L2) generated heated debate among observers and users.

ACI Proposes 50% L2 Closure

ACI proposed the closure of half of Aave’s L2 operations as a strategic move to deal with internal challenges and turbulence in the DeFi market. This decision is based on the analysis that the on-chain lending business has low margins and TVLs are fragmented across multiple chains resulting in high labor costs and incentives.

Meanwhile, most of the revenue is still generated on the mainnet. The closure of L2 is expected to focus resources on networks that offer specific advantages, thereby improving business performance. This approach also aims to effectively reduce operating costs, allowing Aave to better compete in an increasingly tight market.

Also read: Forward Industries Launches $4 Billion Program, Analysts Predict SOL to Reach $500!

A Sensible but Risky Decision

While the logic behind ACI’s decision seems sound, the move is not free of risks. Reducing the presence on L2 could limit Aave’s accessibility and flexibility in reaching out to users across different blockchains. It could also affect the perception of the community who may feel disillusioned by the reduction in services.

However, with a more concentrated focus, Aave has the potential to improve its operational efficiency and effectiveness. This decision is also expected to strengthen Aave’s position as a market leader by utilizing resources more efficiently and reducing operational redundancies.

Read also: Thumzup Taps Jordan Jefferson into its Team of Crypto Experts, What’s the Strategy?

$100 Million Push for GHO

In addition to the L2 restructuring, ACI also announced plans to encourage the use of GHO stablecoins with an investment of $100 million. This initiative aims to strengthen GHO’s position in the stablecoin market, which is currently dominated by big players such as Tether and USD Coin .

This investment is expected to increase the adoption of GHOs, providing a more stable and trusted alternative for DeFi users. With strong financial backing, GHO has the potential to become a top choice for users seeking stability in their transactions.

Conclusion

Aave’s decision to close 50% of its L2 operations and invest heavily in GHOs represents a bold move in the face of growing competition in the DeFi market.

Despite the risks, this move is expected to strengthen Aave’s position as a market leader by focusing resources on the most profitable aspects and increasing the adoption of GHO as a reliable stablecoin.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Aave Restructures L2 Closures and $100M GHO Push Spark Debate. Accessed on September 18, 2025

- Featured Image: Cryptoslate