10 Strong Indicators Suggest ‘Uptober’ Could Trigger a Crypto Market Rally

Jakarta, Pintu News – The month of October, familiarly called “Uptober” by the crypto community, is just days away, and market optimism is getting stronger. A number of analysts consider that there are 10 key indicators from technical, macroeconomic, and on-chain sides that signal that the cryptocurrency market has the potential to experience a major rally this month. Although regulatory risks and macro turmoil are still looming, there are many signs that the market is ready for a new bullish phase.

1. Bitcoin Historical Patterns and ETF Agenda

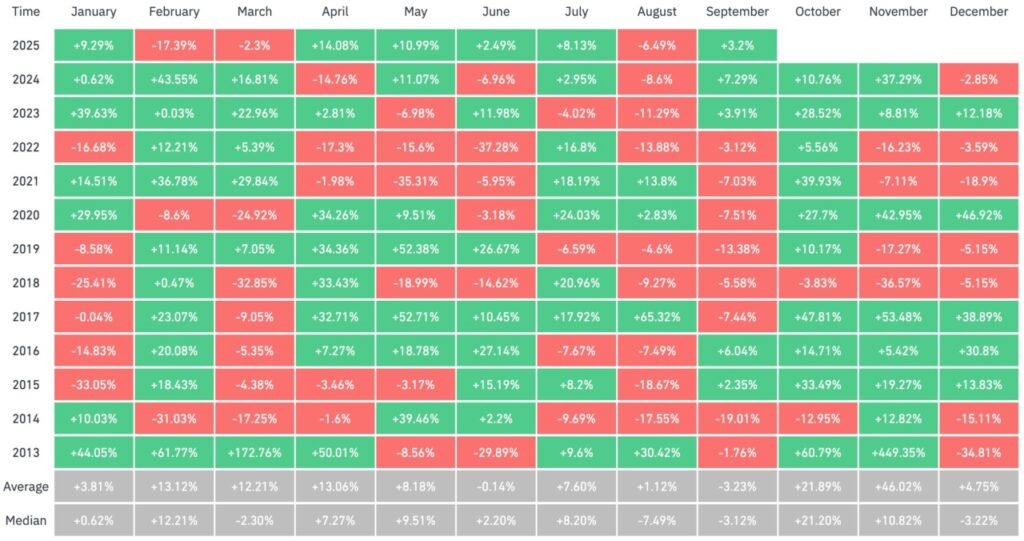

Historically, October has been a positive period for Bitcoin . In the past 12 years, Bitcoin recorded an average gain of 21.89% and managed to close October in the green zone 10 times. This season again gives hope that the bullish trend could extend, not only to BTC but also to major altcoins.

2. Crypto ETF Deadline from SEC

In addition, important decisions regarding crypto ETFs will also fall this October. The SEC is scheduled to make a final decision on a number of altcoin-based ETFs such as Litecoin (LTC), Solana , Dogecoin , Ripple , Cardano , and Hedera (HBAR). If approved, this move has the potential to pour new capital into the market and trigger a larger price rally.

Read also: 3 Crypto Companies Joining the AI Trend and Harvesting High Valuations?

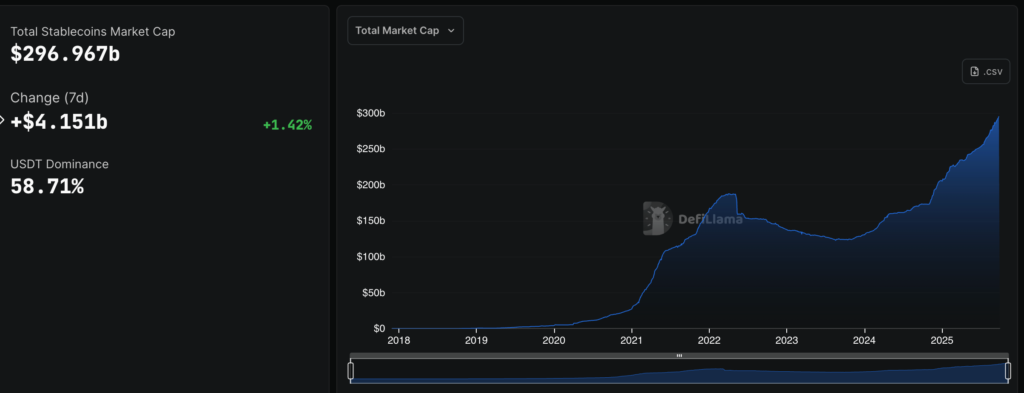

3. Stablecoin supply hits record highs

Data from DefiLlama shows that the total market capitalization of stablecoins reached a new record, approaching $297 billion. This increase signifies greater liquidity in the crypto ecosystem, as stablecoins are often used as an on-ramp for crypto investments.

In simple terms, the more supply of stablecoins, the wider the market expansion usually is. This opens up the possibility that October will see more new fund flows into the crypto market.

4. Market Sentiment: Holder Growing Confident

In addition to the liquidity factor, sentiment indicators are signaling bullishness from the opposite side. Searches for keywords such as “crypto”, “altcoin”, and “Bitcoin” on the internet are seen declining, which means that public attention is low.

This lack of interest from retail investors is actually considered positive. This means that the market is still in the early stages of the cycle before mainstream investors come back in, so there is a lot of room for further upside potential.

Read also: Pi Network (PI) in October 2025: Will it Rise from the Brink?

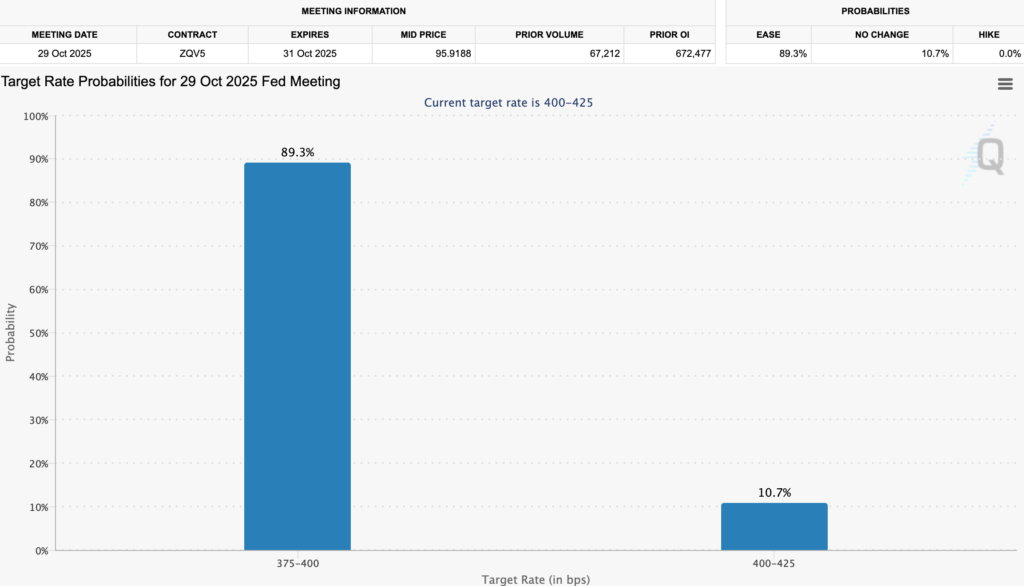

5. Fed Rate and Macroeconomic Impacts

Expectations of an interest rate cut by The Federal Reserve is one of the important catalysts this month. According to the CME FedWatch Tool, the probability of the Fed cutting interest rates in October stands at 89.3%. With lower interest rates, investors are likely to abandon bonds and other safe assets and move into riskier assets such as Bitcoin (BTC) and altcoins.

6. M2 Global Correlation

Macro analyst Raoul Pal emphasizes that Bitcoin has a correlation with global money supply (M2) with a lag of about 12 weeks. This relationship was severed in July 2025 due to the withdrawal of $500 billion worth of liquidity by the US Treasury. However, Pal believes the effects of the tightening are beginning to subside.

If this correlation returns, Bitcoin could potentially continue its upward trend as the global money supply increases. This could be a strong signal that the crypto market is ready to enter a new phase of expansion.

7. Bitcoin RSI Signal

Technically, Bitcoin’s 30-day RSI is currently in the oversold area. This position is similar to the conditions in April 2025 and September 2024, which were then followed by a significant price recovery.

Read also: Crypto ETFs in Thailand to Expand Beyond Bitcoin

This RSI signal is an indication that bullish momentum is strengthening. Technical investors consider conditions like this to usually be an important turning point before the uptrend continues.

8. Bullish Altcoin Structure

Many analysts highlight that altcoins are forming bullish technical patterns, including cup and handle. These patterns are considered advanced formations that usually lead to major breakouts.

Analysts also mentioned a potential “Altseason” in the fourth quarter, with Uptober, Moonvember, and Pumpcember. If this pattern is confirmed, the altcoin market could follow the big rallies like the ones in 2017 and 2021.

9. Holder Confidence in On-Chain Data

On-chain data shows BTC inflows to exchanges from “wholecoiners” (owners of ≥1 BTC) have dropped dramatically. From an annual average of 45,000 BTC in May 2024, it is now only around 30,000 BTC. This decline means investors prefer to hold onto assets rather than sell them.

Additionally, indicators such as Coin Days Destroyed (CDD) and SOPR show a decrease in profit-taking activity. This confirms stronger holder confidence and less selling pressure in the market.

10. MVRV Ratio Drops to Neutral Zone

Bitcoin’s Market Value to Realized Value (MVRV) indicator is now at around 2.0. This position indicates that the market is in a healthy phase-not in a state of panic, but also not yet entering an excessive euphoria.

Historically, the MVRV neutral zone is a reset moment before the market goes into its strongest expansion phase. If this pattern repeats itself, Uptober could be the entry point to a major crypto market rally later in the year.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Uptober: Bitcoin & Crypto Market Signals Bullish. Accessed on October 2, 2025

- Featured Image: Generated by AI