3 Low-Cap Altcoins Gaining Attention From Crypto Traders Right Now

Jakarta, Pintu News – The crypto market in October recorded a number of notable achievements in the Perpetual DEX (Perp DEX) sector. Several altcoins from the Perp DEX platform, such as Hyperliquid (HYPE), Aster (ASTER), and Avantis (AVNT), managed to record significant gains.

If this trend continues, it is possible that capital flows will continue to move into small-cap altcoins. Quoting the BeInCrypto page, on-chain data also shows that a number of low-cap Perp DEX altcoins are experiencing strong accumulation. This is reflected in the increasing balance in whale wallets and decreasing reserves on exchanges.

Perp DEX Sets a Record, Driving Interest in Small-Cap Altcoins

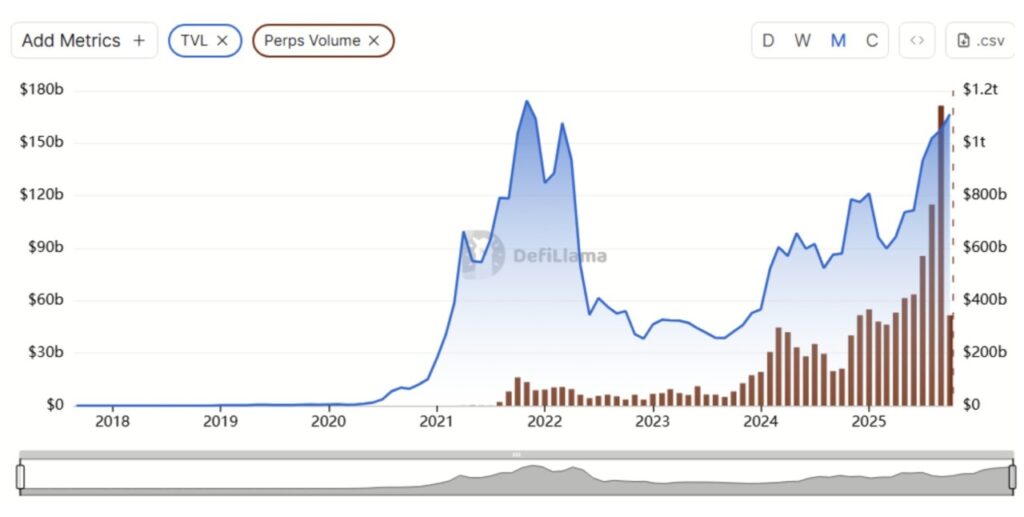

Data from DefiLlama shows that perpetual trading volume (Perps) on DEX surpassed $1.1 trillion in September, becoming the highest level in DeFi history.

Read also: Crypto Whales Are Accumulating — Could Dogecoin Be Heading for a 60% Surge?

Entering October, this trend continued at a rapid pace. In the first three days alone, the trading volume has grown by more than $340 billion, opening up the opportunity to set a new record this month.

This surge was triggered by the rush of investors towards derivatives trading on DEX, which was boosted by the airdrop program as well as support from industry leaders.

If the trend continues, a number of small-cap altcoins (under $50 million) could potentially experience significant price rallies. Currently, these tokens are already showing signs of early accumulation in the market.

Adrena (ADX)

Adrena is a Solana based decentralized perpetual exchange that is open-source and peer-to-peer. Currently, ADX has a market capitalization of just under $40 million.

Data from Nansen showed that exchange reserves fell by more than 3% in the last week of September, while the ADX price rose from $0.028 to $0.038. At the same time, major whale wallets increased their holdings by 0.87%.

Although these changes look relatively small, there are several factors that support the ADX’s growth potential going forward.

- Perps Adrena volume according to DefiLlama recovered to surpass $600 million in the past month, the highest level since June.

- As of October 3, Adrena ranked second in daily trading fee revenue among Solana-based DEX derivatives, losing only to Jupiter .

- The project also appeared in the trending list on Coingecko, signaling increased interest and an influx of new traders.

These factors combined suggest that Adrena is starting to gain wider attention in the decentralized derivatives market.

Perpetual Protocol (PERP)

Perpetual Protocol is an Ethereum based decentralized futures exchange. The PERP token has been listed on Binance since 2020, but its price has plummeted by almost 99%, making its market capitalization now only around $22 million.

Nevertheless, the renewed investor enthusiasm for the Perp DEX narrative managed to bring renewed attention to the token.

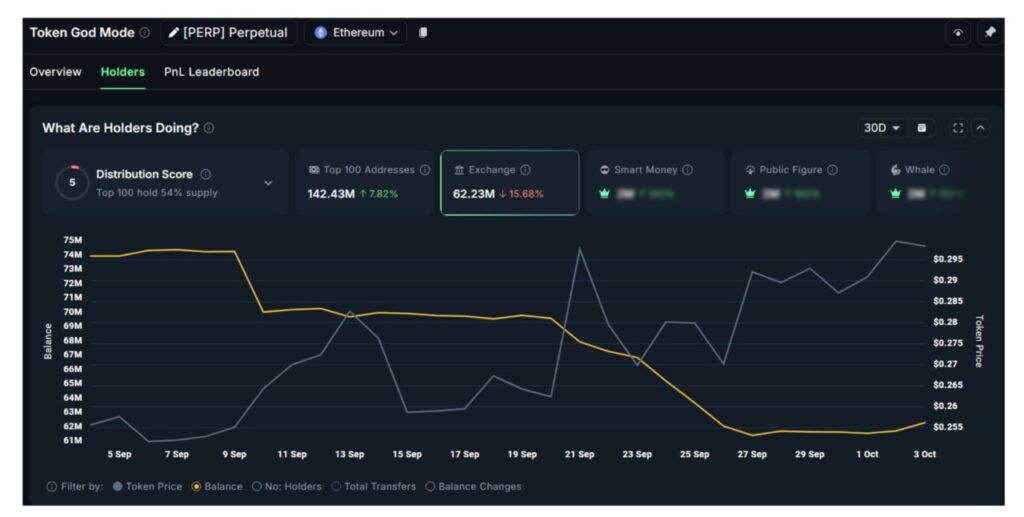

Data from Nansen showed that PERP reserves on exchanges fell by more than 15.6% over the past month, while balances in whale wallets rose by 7.8%.

From a technical perspective, several analysts highlighted PERP’s price structure in 2025. The token is no longer printing lower lows, but rather starting to form a bullish pattern, which could potentially open up opportunities to rise to more than 130% towards the end of the year.

The combination of on-chain accumulation signals with supportive technical formations could be an important catalyst for PERP’s bullish scenario in the coming months.

Read also: Sui Launches suiUSDe and USDi Stablecoins With Ethena & BlackRock-Backed Token Funds

Bluefin (BLUE)

Bluefin is currently the leading perpetuals platform in the Sui ecosystem. A recent report from BeInCrypto highlighted positive signs that suggest the project has the potential to attract more investor interest throughout October.

BLUE’s market capitalization is in the range of $39 million. According to DefiLlama data, this DEX generates annual revenue of over $13.6 million. Of this amount, Bluefin committed to use 25% (approximately $3.4 million) to conduct a BLUE buyback program.

The buyback value, which is equivalent to nearly 10% of the market capitalization, has the potential to be a strong price catalyst and encourage more investors to accumulate. The buyback program officially started in October, and many analysts expect BLUE prices to break $0.20 this month.

However, like other small-cap altcoins, BLUE still carries two major risks:

- Liquidity Risk – Low trading volumes and thin market depth can trigger sharp price fluctuations.

- Sentiment Risk – If the Perp DEX trend loses momentum, projects that lack real utility could potentially lose users, which could ultimately push the token price back.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Crypto Traders Are Buying These 3 Low-Cap Perp DEX Tokens In Early October. Accessed on October 3, 2025