Dogecoin Inches Up Today: Is DOGE Poised to Finally Break Through the $0.30 Barrier?

Jakarta, Pintu News – Since mid-September, the price of Dogecoin has been flat with no clear direction. The once-high-flying crypto asset has lost its upward momentum and has not been able to sustain a rally like some other large-cap altcoins.

At around $0.25, DOGE is still far below its recent peak. It made several attempts to break the $0.30 level, but each attempt ended in market rejection.

However, not creating a new price peak doesn’t necessarily signal the end of a bullish cycle. Here’s why.

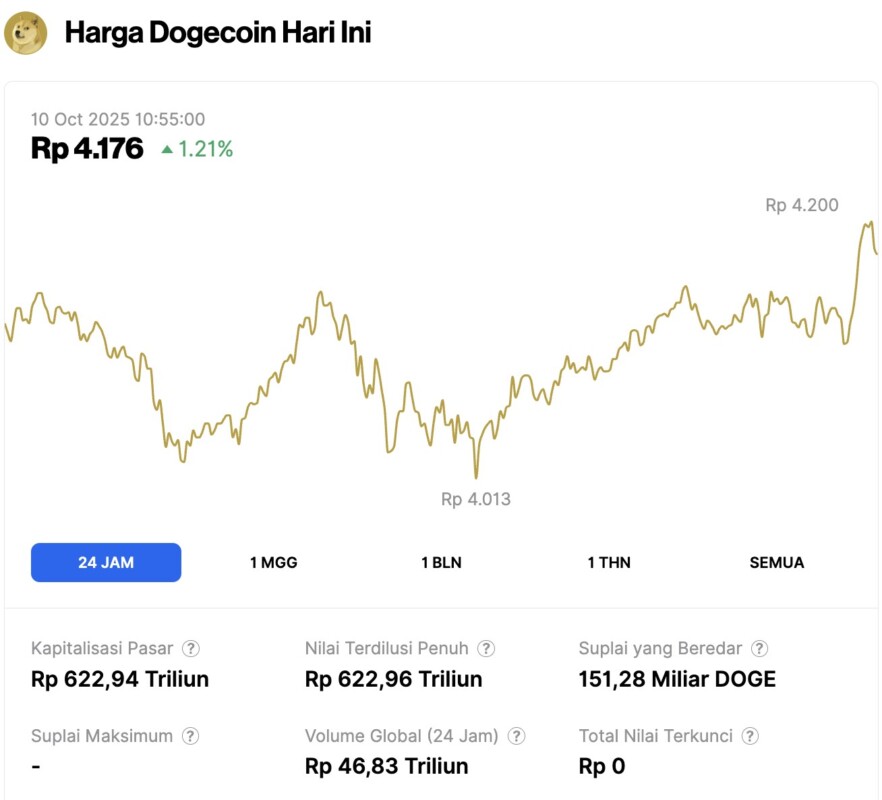

Dogecoin Price Rises 1.21% in 24 Hours

On October 10, 2025, Dogecoin’s price rose 1.21% over the past 24 hours, trading at $0.2515, equivalent to IDR 4,176. During the same period, DOGE fluctuated between IDR 4,200 and IDR 4,013.

As of this writing, Dogecoin’s market capitalization is approximately IDR 622.94 trillion, with a 24-hour trading volume of around IDR 46.83 trillion.

Read also: Ethereum Price Falls to $4,300 as Whales and Long-Term Holders Begin Accumulating

Dogecoin Bears Begin to Lose Control

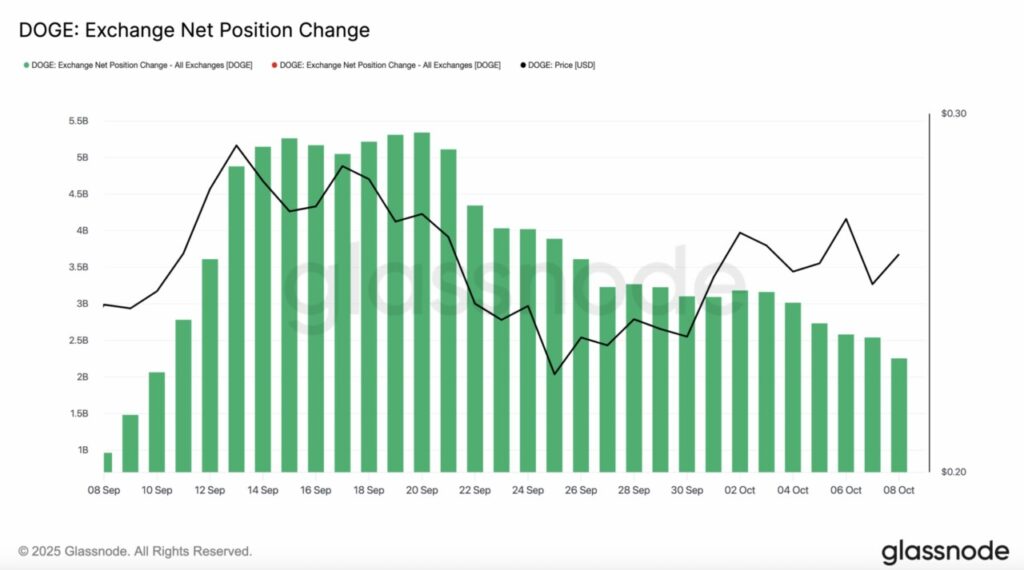

Based on CCN’s findings, one of the reasons Dogecoin’s price struggled to gain momentum until the end of September was the large number of coins stored in exchange wallets.

Data from Glassnode shows that more than 5 billion DOGE were on exchanges during the period – signaling many holders were ready to sell rather than move them into long-term storage.

But now the trend seems to be changing. As of now, Dogecoin’s Exchange Net Position Change has dropped to 2.25 billion, meaning that most of the DOGE has moved from exchanges to private wallets.

This decline usually signals a reduction in selling pressure. Furthermore, this kind of change is often an early sign of a potential price recovery.

As supply on exchanges dwindles, the number of coins available for sale decreases, creating conditions where even moderate demand can trigger price increases. If the trend of DOGE exiting exchanges continues into next week, the Dogecoin price has a chance to rally through the $0.27 resistance and even test the $0.30 level again.

Read also: Dogecoin Soars 445% When This Indicator Turns Green – Can DOGE Rise Another 160%?

DOGE Price Analysis: Slow but Steady Rise

On the technical side (9/10), CCN noted that Dogecoin’s (DOGE) price movement formed a megaphone pattern – a structure that signals increased volatility and potential trend continuation or reversal.

This pattern shows that the price movement range is widening, signaling intense competition between buyers and sellers, with each subsequent move being more aggressive than the previous.

Usually, formations like this appear ahead of a strong move in a particular direction. In this context, the Moving Average Convergence Divergence (MACD) indicator is showing a positive signal, signaling that bullish momentum is gaining strength.

If this momentum continues, DOGE could utilize the widening range of the megaphone pattern as a foothold to break the resistance at $0.28. A close above that level could potentially push the rally towards $0.32, which coincides with the golden pocket ratio of 0.618. In a very bullish scenario, the Dogecoin price could even touch $0.37.

However, if volatility increases while buyers fail to maintain control, DOGE risks testing the lower boundary around $0.22 again. Failing to stay in this zone could trigger a further correction, which could drag the Dogecoin price down to $0.20.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Here’s Why Dogecoin (DOGE) Price Could Be Ready to Beat the Multiple $0.30 Rejections. Accessed on October 10, 2025