3 Big Events that Made the Crypto Market Volatile This Week

Jakarta, Pintu News – The cryptocurrency market was volatile again this week after a series of major events shook global investor confidence. From the United States’ economic policies triggering a massive sell-off, to the surprising moves of major assets such as Bitcoin and Ethereum , the entire market seemed to be in a phase of uncertainty. Amidst this high volatility, three major events took center stage as they had a direct impact on the price direction and sentiment of crypto market participants around the world.

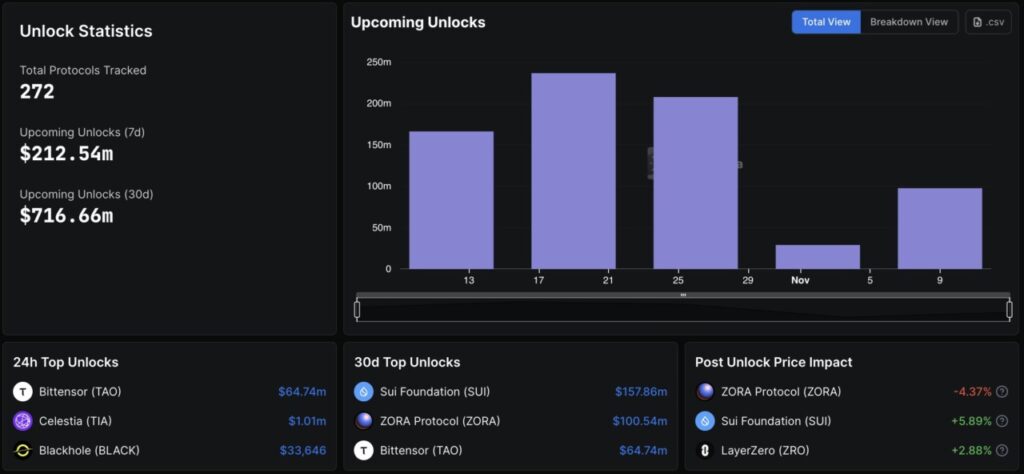

Unlock Tokens Worth Millions of Dollars

This week, the crypto industry will be abuzz with token releases worth more than $200 million. According to data from DeFi Llama, some of the tokens that will be released include those from Bittensor, DeepBook, Arbitrum, ApeCoin , and LayerZero.

However, the actual figure is likely to be higher as CoinMarketCap notes other tokens that will also be released such as Bubblemaps, Babylon, Tezos , Onyxcoin, and Mantra.

This token release is often considered a bearish factor as it increases the number of tokens circulating in the market. This can depress the price of those tokens as supply increases while demand remains constant or even decreases.

Read also: Crypto Market Crashes on Weekend, Liquidating Over $20 Billion!

US-China Trade Tensions

Geopolitical tensions between the US and China are also in the spotlight impacting the crypto market. President Trump recently announced 130% tariffs on Chinese goods in response to Beijing’s actions limiting the supply of rare earth metals and imposing new tariffs on ships coming from the US.

Crypto markets tend to react to geopolitical uncertainty as investors seek assets that are perceived as safer. The upcoming meeting between Donald Trump and Xi Jinping will be closely monitored, as the outcome could have a major effect on global market sentiment and crypto markets.

Read also: Crypto market recovery, why did the market rise today (10/13/25)?

Third Quarter Earnings Season

In addition, the third-quarter earnings season that begins on Tuesday is expected to have a significant impact on the crypto market. Major American companies such as JPMorgan, Citigroup, Wells Fargo, Bank of America, and BlackRock will release their financial reports.

It is estimated that profit growth for the third quarter will be in the range of 8% to 13%, marking the ninth consecutive quarter of profit growth. Stock markets often react positively to strong financial reports, which in turn can boost the value of crypto markets.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Top Crypto Market News That Will Impact the Industry This Week. Accessed on October 13, 2025

- Featured Image: Generated by AI