ETH plummeted 1.73%, why did the crypto market crash today (10/28/25)?

Jakarta, Pintu News – The global cryptocurrency market has weakened again in the past 24 hours, with the total market capitalization falling by around US$7 billion (Rp116.3 trillion). This decline represents a minor cooling off after the previous strong rally, where the total market cap briefly touched US$3.89 trillion (Rp64.6 quadrillion). Investors appear to be more cautious in the face of ever-changing sentiment fluctuations in the global crypto market.

Despite the drop, the total capitalization is still holding above the important support level of US$3.81 trillion (IDR63.3 quadrillion). If this level is successfully maintained, the crypto market has the potential to continue its healthy consolidation before attempting a comeback. However, if this support level is broken, selling pressure could intensify and push the market down to US$3.73 trillion (€61.9 quadrillion).

Crypto Market Capitalization at a Decisive Point

Data from TradingView shows that the total crypto market cap is now in a crucial phase. A rebound from the US$3.81 trillion area could signal renewed buying interest from investors, as well as be the starting point for a recovery towards US$3.89 trillion (IDR64.6 quadrillion). This scenario would suggest market confidence is recovering, especially if supported by increased trading volumes.

However, if the selling pressure continues, the market could lose its positive momentum. Global macroeconomic uncertainty-including interest rate policy and a stronger US dollar-remain the main factors limiting the rally. Analysts think that investors need to pay attention to the movement of the total crypto market cap in the next few days to determine the direction of the next trend.

Also read: Will BTC Surge? JPMorgan Predicts Fed Policy Will Change!

Bitcoin (BTC) Held Below Resistance Level Again

Bitcoin price has again failed to break through the psychological resistance area around US$115,000 (Rp1.91 billion). In the past 24 hours, BTC has stagnated at US$114,416 (Rp1.90 billion), showing limited upward momentum. This condition indicates that market participants are still hesitant to push prices higher in the short term.

If Bitcoin fails to break the area again, a correction towards US$112,500 (Rp1.87 billion) or even US$110,000 (Rp1.82 billion) could occur. This decline is likely due to profit-taking and investor caution in the face of global economic uncertainty. However, Bitcoin’s Relative Strength Index (RSI) indicator is still in the positive zone, signaling a potential rebound if buying pressure increases.

Also read: Is the $200,000 Bitcoin (BTC) Price Target by Christmas Achievable?

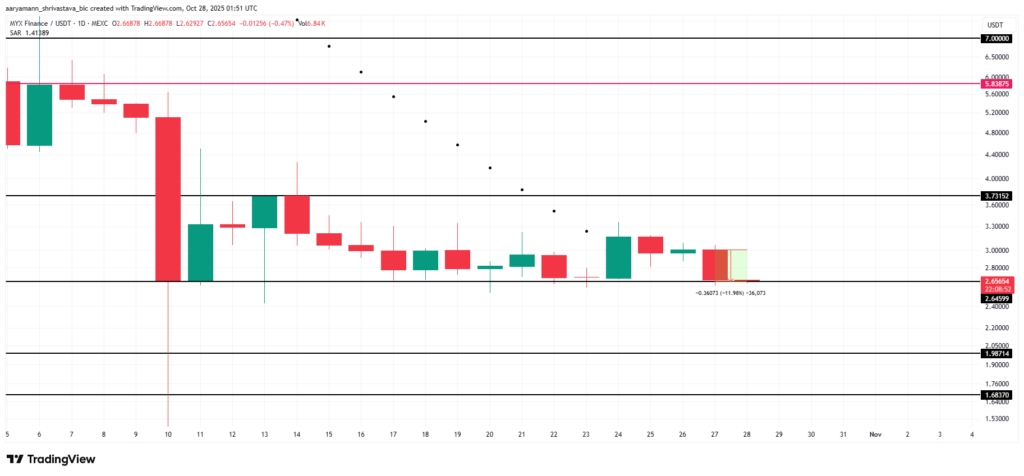

MYX Finance Holds Above Important Support

Meanwhile, altcoin MYX Finance (MYX) is down about 12% in the past 24 hours, but is still able to hold above the crucial support level of US$2.64 (IDR43,000). This level has been tested several times and has so far shown solid enough buyer strength to withstand a deeper drop.

If selling pressure increases, MYX risks dropping all the way to US$1.98 (IDR32,900) before finding stronger support. However, the Parabolic SAR technical indicator is still showing an active uptrend, which means the potential for recovery is still open. If MYX is able to rebound from current levels, the token could climb back towards US$3.73 (Rp62,000) in the next few days, invalidating the temporary bearish sentiment.

Conclusion: Consolidation Phase Before Further Upswing?

Overall, the crypto market currently appears to be entering a healthy consolidation phase after the big rally of the past few weeks. Although declines are seen in some key assets such as Bitcoin and MYX, support in key areas is still quite strong.

If selling pressure can be muted and buying volume increased, rebound opportunities remain wide open. Investors are advised to remain wary of short-term volatility while keeping an eye on the direction of global market capitalization movements.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Harsh Notariya. Why Is The Crypto Market Down Today? Accessed October 28, 2025.

- Featured Image: Generated by AI