5 Important Facts About BTC Price Movement Ahead of November 2025

Jakarta, Pintu News – The price of Bitcoin has shown another gain towards the end of October 2025, marking a potential monthly closing high in history. After falling to the level of Rp1.69 billion (equivalent to $102,000), BTC is now back to the range of Rp1.89 billion ($114,500) and opens up opportunities for further rallies.

Crypto market sentiment has started to improve after a tumultuous week of US-China tariffs and Fed rate cut speculation. Amidst these conditions, many analysts believe that the bullish momentum could continue until the end of the year, with a potential target of breaking Rp2.07 billion ($125,000).

Bitcoin recovers and stays above Rp1.89 Billion

Bitcoin managed to bounce off its low and break the 21-week exponential moving average (EMA) again, which is considered an important level by technical analysts.

Trader Rekt Capital thinks that BTC is currently in a major consolidation phase, with the opportunity to make the September price peak a new support area. He emphasized that the macro trend of Bitcoin is still positive as long as the price stays above the Rp1.81 billion range.

However, not all crypto market participants are convinced by this resurgence. Some analysts like Roman warn of a potential bearish Head & Shoulders pattern if BTC fails to hold the $1.81 billion level.

Relatively declining trading volumes and the RSI indicator showing negative divergence reinforce the view that this rally could be a short-term “bull trap”.

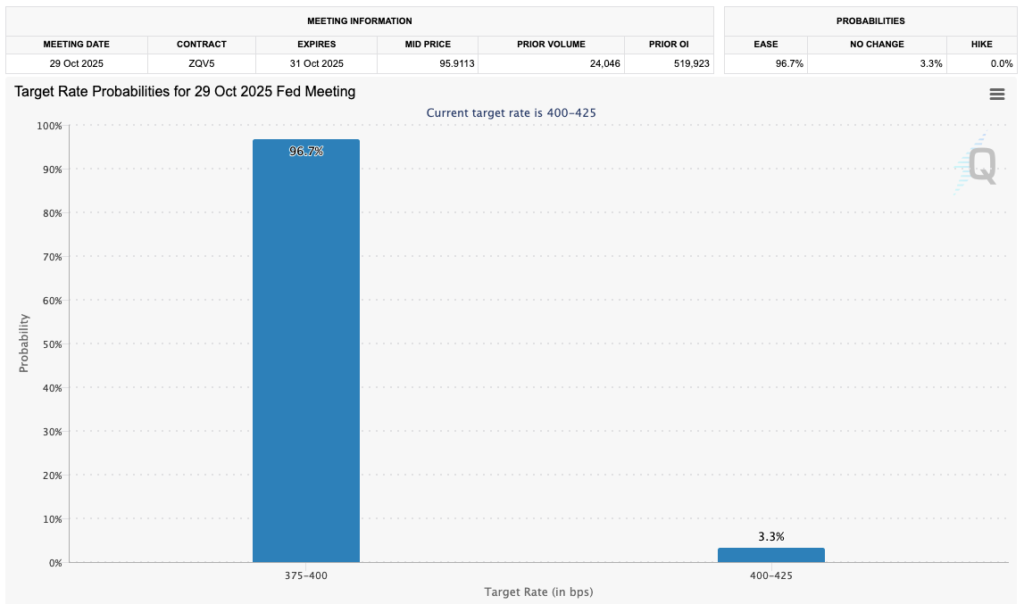

Fed Policy in the Spotlight of Crypto Market

The main focus of the market this week is on the interest rate decision of the Federal Reserve (Fed) which will be announced Wednesday evening US time. Based on CME Group FedWatch Tool data, the chance of a 0.25% rate cut is more than 95%. This move is considered a positive catalyst for the cryptocurrency market as it lowers pressure on the US dollar and increases investor interest in riskier assets such as Bitcoin and Ethereum .

Also read: Strategy adds 390 BTC, bringing total holdings to 640,808 BTC!

In addition, news that trade negotiations between the US and China are said to be on the verge of reaching an agreement also provided a breath of fresh air to global markets. The S&P 500 index jumped sharply after this announcement, adding to the optimism that macro conditions could support positive crypto movements in the short term. This situation reinforces the narrative that Bitcoin could be a hedge against economic uncertainty.

AI Forecasts Bitcoin to Break Rp2 Billion This Month

Network analyst Timothy Peterson presented the results of an AI simulation showing that Bitcoin could potentially reach Rp2.07 billion ($125,000) before the end of October. According to him, whenever central banks conduct monetary easing (quantitative easing), the price of Bitcoin tends to surge due to increased liquidity in the market. Peterson emphasized that there is no excessive price bubble, and that any correction is just part of Bitcoin’s natural growth cycle.

He also highlighted the concept of Metcalfe’s Law, where the value of the Bitcoin network increases as the number of active users grows. With the number of active addresses on the network increasing, this fundamental indicator is a strong reason why the market is still in a long-term bullish phase. If these projections are correct, then October 2025 will be the best “Uptober” in crypto history.

“Uptober” 2025: Bitcoin Avoided the Worst October

Despite the high volatility, data from CoinGlass shows that Bitcoin has gained about 1% compared to the opening of October. This is enough to prevent October 2025 from being called the “worst month in Bitcoin history”. Trader Daan Crypto Trades believes that Bitcoin’s price movement range over the past four months of only 8% indicates an accumulation phase ahead of the next big move.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (28/10/25)

Meanwhile, the Crypto Fear & Greed Index shows that market sentiment is at neutral levels, signaling a balance between investor fear and optimism. If BTC manages to break Rp1.92 billion ($115,750), then this month will record an all-time high monthly close, reinforcing the belief that a new bullish cycle has begun.

Short-Term Investors Return to Profit

Data from CryptoQuant shows that short-term holders (STH) are now back in the profit zone with an average purchase price of IDR1.88 billion ($113,000). This level of profit is the highest since early October. According to historical analysis, whenever more than 80% of Bitcoin’s supply is in profit, there is usually a healthy consolidation phase before the next upswing.

This situation indicates that many market participants prefer to hold their assets instead of selling them. This trend reinforces the expectation that the crypto market still has room to grow, especially if the volume of institutional buying continues to increase in the next few weeks.

Conclusion

With a combination of macroeconomic optimism, positive AI predictions, and strengthening on-chain signals, Bitcoin looks set to close October 2025 with a new record. If this rally continues, it is not impossible that BTC will break Rp2 billion in the near future and take the cryptocurrency market towards its next bullish phase. However, investors are still advised to be cautious of potential short-term volatility ahead of the Fed’s decision.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. BTC price eyes record monthly close: 5 things to know in Bitcoin this week. Accessed October 28, 2025.

- Featured Image: