Dogecoin Fell 3% Today — Here’s What Caused the Dip

Jakarta, Pintu News – According to Coin Edition (28/10), the price of Dogecoin is trading near the $0.20 level, remaining stable while traders try to assess whether the recent decline is just a temporary pause or the start of a deeper correction.

Market movements appear to be narrowing around the $0.197 support level, signaling that many market participants are waiting for the next direction. Meanwhile, fund flow data from exchanges and derivatives markets show a divided sentiment – some are optimistic about the recovery, while others are bracing for a potential further decline.

So, how is the Dogecoin price moving today?

Dogecoin Price Drops 3.20% in 24 Hours

On October 29, 2025, Dogecoin’s price slipped by 3.20% over the past 24 hours, trading at $0.1929, or roughly IDR 3,210. During the same period, DOGE fluctuated between IDR 3,373 and IDR 3,183.

At the time of writing, Dogecoin’s market capitalization is estimated at around IDR 487.24 trillion, with a 24-hour trading volume of approximately IDR 44.75 trillion.

Read also: Ethereum Price Dragged Back to $3,995 Today: ETH Setup Still Looks Balanced

Buyers Defend $0.20 Base Level Ahead of Breakout Test

On the 4-hour chart (28/10), Dogecoin’s price movement is within a narrow upward channel after successfully recovering from the October low. The 20, 50, and 100 exponential moving averages (EMAs) are in the range of $0.199 to $0.203, forming a tight support cluster that traders are currently actively defending.

The Supertrend line around $0.197 has also proven to be a price support several times this week, providing a short-term foothold for the bulls. On the upside, the 200 EMA and the upper line of the ascending channel around $0.214 are the closest resistance boundaries. If the price manages to break this area clearly, Dogecoin could potentially resume its rise towards $0.22 to $0.23.

However, if the $0.197 level fails to hold, then the price could slip to the lower demand zone at $0.178, while risking breaking the existing ascending channel structure.

Spot Flows on the Defensive as Outflows Shrink

On-chain data shows a net outflow of around $1.4 million on October 28 – a relatively small figure compared to the massive withdrawals that took place in early 2025.

Dogecoin’s recent price volatility has been accompanied by softer outflows, suggesting that traders are not in panic selling or aggressive accumulation mode.

This neutral flow condition reflects a market that is still waiting for direction. Large transaction activity on exchange wallets also declined, indicating a lack of urgency from both sides. A shift towards larger outflows and increased spot volume would be an early signal of re-emerging market confidence. But for now, the setup is still in a cautious phase.

Futures Ease, Options Traders Begin to Re-enter

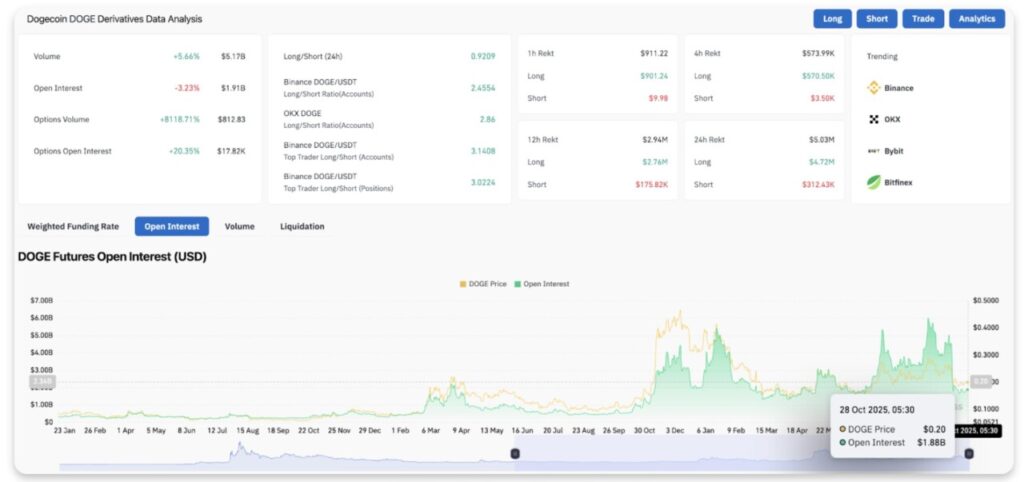

The Dogecoin derivatives landscape showed a decrease in leverage after the liquidation that took place last week. Open interest in the futures market fell 3.2% to $1.91 billion, although trading volume rose 5.6% to $5.17 billion. This combination indicates the unwinding of short-term positions, rather than aggressive new position formation.

However, the most striking figure came from options volume which jumped sharply to $812 million – the biggest daily gain this month. The surge was driven by speculation of price increases, in line with the long/short ratio on Binance and OKX being above 2.5.

Read also: Bitcoin Price Drops to $112,000 Today: FOMC Triggers BTC Volatility!

Although sentiment is leaning towards bullishness, overall participation is still below the peak levels seen in the mid-year rally.

This balance shows that traders are still selective: long positions remain dominant, but new leverage is gradually entering. If open interest continues to approach the $2 billion mark, it could be a strong signal that the uptrend will continue.

Daily Chart Builds Pressure Inside a Symmetrical Triangle Pattern

In a broader view of the daily chart (10/28), Dogecoin’s current price prediction is focused on the symmetrical triangle pattern that has shaped price action since June. The lower trendline at $0.172 has been holding off any major corrections, while the upper limit near $0.23 is still a major breakout threshold.

The Bollinger Bands have narrowed to one of the lowest levels of the quarter, signaling a potential spike in volatility in the near term. The Parabolic SAR indicator is still above the price, which keeps the bias slightly bearish until a daily close above $0.21 occurs to reverse the signal.

Historically, this kind of narrowing condition is often followed by an impulsive move once the price breaks out of the major boundary with enough volume.

Will Dogecoin Price Rise?

The current Dogecoin price still maintains a short-term uptrend as long as it remains trading above the $0.197 level. If it is able to break the resistance at $0.214, then a path towards $0.23 and even $0.25 could open up – completing the trend reversal pattern for the medium term.

However, if the $0.197 level fails to hold, the technical structure will weaken and prices will most likely retest support at $0.178 before the bulls try to bounce back. Fund flows from the exchanges are still relatively quiet, so a spike in spot activity or significant changes in derivatives funding would be important signals to watch.

At this stage, Dogecoin’s recovery relies heavily on its ability to form higher lows while approaching the top of the symmetrical triangle. Confirmation of a breakout above $0.214 would shift the market bias clearly in a bullish direction, whereas if the price continues to hold, then it is likely that Dogecoin will remain moving in a limited range until early November.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coin Edition. Dogecoin Price Prediction: Market Braces For Breakout With $812M Options Spike. Accessed on October 29, 2025