Bitcoin Slips to $101,000 Today — Can It Rebound to $110,000?

Jakarta, Pintu News – Bitcoin price continued to decline and fell below $105K on Nov. 4, extending the bearish trend that has been looming over the market. In 24 hours, Bitcoin declined by 4%, bringing the total weekly loss to 10%.

The “risk-off” sentiment in the stock market exacerbated the crypto market’s fall. The decline was also triggered by a series of liquidations in the cryptocurrency market, further adding to the overall pessimistic mood.

Bitcoin Price Drops 5.14% in 24 Hours

On November 5, 2025, the price of Bitcoin was recorded at $101,400 or equivalent to Rp1,702,687,343, a decrease of 5.14% in the last 24 hours. During this period, BTC touched its lowest level at Rp1,660,464,688 and its highest price at Rp1,802,351,366.

As of writing, Bitcoin’s market capitalization stands at around IDR33,680 trillion, with trading volume in the last 24 hours rising 55% to IDR1,951 trillion.

Read also: XRP Price Prediction: Can ETF Launch Push XRP to $3?

Bitcoin Price Under Pressure Amid US Government Shutdown

The US government shutdown, now in its second month, has had a major impact on financial markets, including depressing the price of Bitcoin.

The Congressional Budget Office estimates that the shutdown could slow US GDP growth by up to 2% in the fourth quarter of 2025, costing the economy 7 to 14 billion dollars in economic output.

However, it’s not just fiscal uncertainty that is weighing on the market – a severe liquidity freeze is also a major factor, and this is clearly reflected in Bitcoin’s on-chain metrics.

Bitcoin reserves on exchanges rise amid market uncertainty

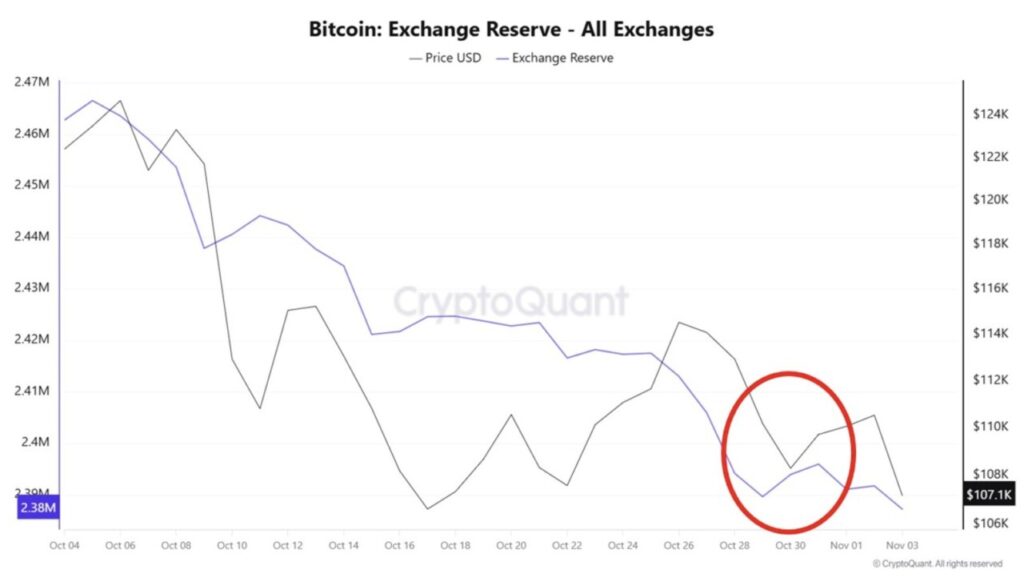

According to on-chain data from CryptoQuant, Bitcoin reserves on exchanges have increased for the first time in six weeks. This indicates that investors are starting to put their coins back on exchanges. This phenomenon often signals risk-taking or risk-reduction, indicating that traders are anticipating market volatility.

In addition, miners’ Bitcoin reserves are now at their lowest level since mid-2025. This indicates that miners are likely to start selling Bitcoin to cover operating costs, following the end of energy subsidies and tax incentives due to the government shutdown.

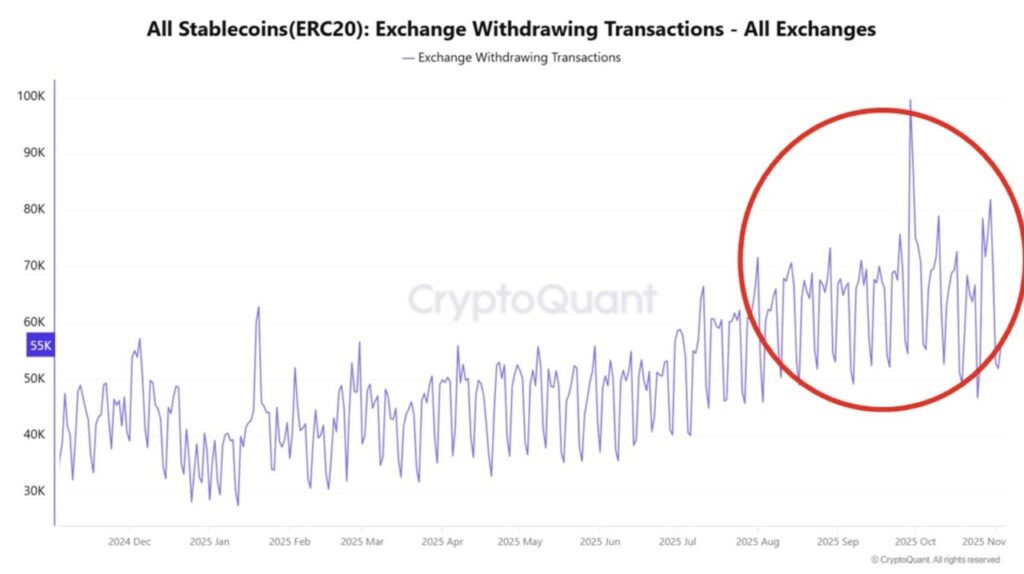

Stablecoin Surge Shows Move to Safe Assets

Along with these developments, the number of stablecoin withdrawals from exchanges surged to a record high. Investors were seen shifting funds to US dollar-backed assets in droves as a form of protection. This action, along with rising Bitcoin reserves on exchanges and falling miner reserves, points to a general trend of risk aversion.

Read also: Altcoin Season Hasn’t Ended, Analysts Say Bitcoin’s Dominance Is Still Below 62%

While there is potential for price recovery when the US government resumes operations, it is likely that the recovery in Bitcoin price will be delayed.

Can BTC Price Recover to $110,000 Soon?

As of November 4, Bitcoin price stood at $104,209, recording a mild decline of 4%.

The Relative Strength Index (RSI) indicator shows 29, which indicates that Bitcoin is in an oversold zone. This could signal a potential price recovery if there is a buying push from the market.

If the price manages to bounce off the current support level, there is a possibility of an increase towards $105,000. If the bullish momentum strengthens, the price could continue to rise all the way to $110,000. Plus, the latest on-chain data is showing signs of recovery, providing a long-term outlook that remains positive for Bitcoin.

However, if the market fails to hold the support level at $104,000, a further drop towards $100,000 is highly likely. The Moving Average Convergence Divergence (MACD) indicator also shows a bearish trend, with a divergence between the MACD line and the signal line. This indicates that the downward pressure is still strong. The red histogram indicates that selling sentiment is still dominating the market at the moment.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Will Bitcoin Price Recover When US Govt. Opens? On-chain Data Shows Recovery Might Take a While. Accessed on November 5, 2025