3 Proof XRP Investors Remain Strong Despite Crypto Market Turmoil

Jakarta, Pintu News – Although the value of the Ripple portfolio appeared stagnant during November, several indicators are showing positive signals that contradict the bearish price action of the token. Recent data shows an interesting divergence between the price of Ripple (XRP) and several other key factors that indicate strong investor confidence.

Ripple’s (XRP) dominance increases amid price drop

Data from TradingView shows that although the price of Ripple (XRP) recorded a new low in the past month, the market dominance of Ripple (XRP) (XRP.D) is showing an upward trend.

Currently, XRP.D stands at 4%, up from 3.8% last month. This rise signals that investors may start focusing their investments on Ripple (XRP) when many other altcoins are losing momentum.

Kaito Research’s third quarter 2025 report puts Ripple (XRP) alongside Ethereum , trailing only Bitcoin in six key metrics: Volume, Liquidity, Market Capitalization, Market Availability, Maturity, and Custody Availability.

Read also: Crypto Whale Moves Quietly: What Sign for the Market?

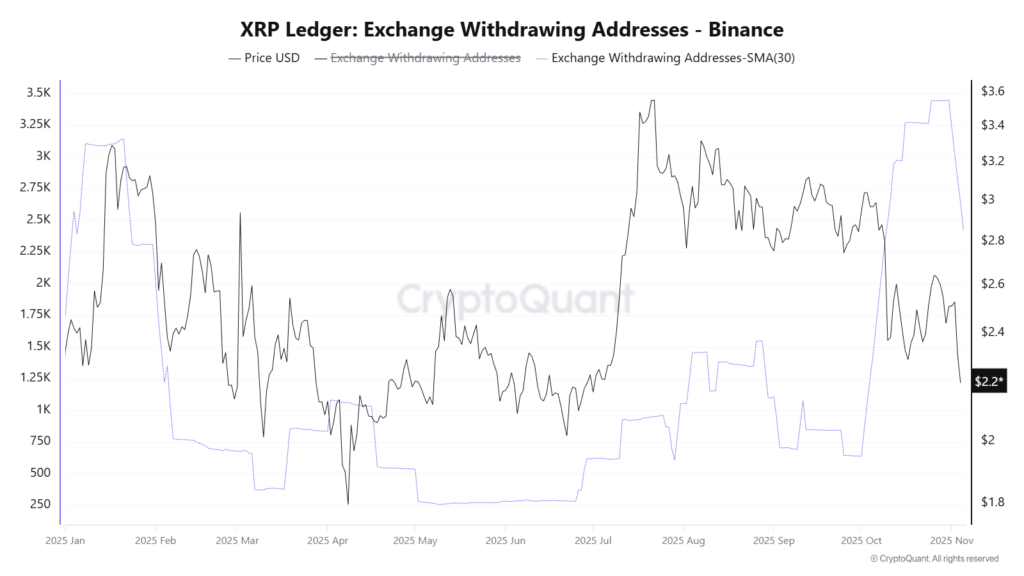

Address Withdrawals from Exchanges Increase

Although the price of Ripple (XRP) continues to decline, on-chain data shows a significant increase in the number of addresses withdrawing Ripple (XRP) from exchanges. Since July, the price of Ripple (XRP) has dropped from above $3.50 to $2.20, yet the 30-day average number of withdrawing addresses has increased from under 1,000 to over 2,500.

Instead of panicking and sending Ripple (XRP) to exchanges for sale, many investors are withdrawing their tokens from exchanges. This move shows long-term commitment and makes the supply of Ripple (XRP) circulating on exchanges even scarcer. A recent report from BeInCrypto revealed that 300 million Ripple (XRP) has been withdrawn from Binance in the last month.

Also read: JELLYJELLY Meme Coin Reaches $500 Million Market Cap Amidst Crypto Market Crash!

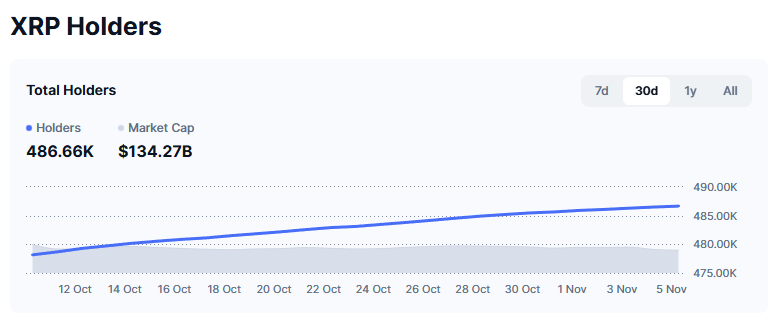

Number of Ripple (XRP) Holders Increases

Data from CoinMarketCap reveals that although the price of Ripple (XRP) fell from above $3 to $2.20 in the past month, the number of holders has increased by more than 8,000.

This trend suggests that many investors see the price drop as an opportunity to accumulate Ripple (XRP) at a better valuation. Recent positive developments may have driven this sentiment.

Franklin Templeton and Grayscale Investments have filed changes to their filings with the US Securities and Exchange Commission (SEC) for a proposed exchange-traded fund (ETF) for Ripple (XRP). Additionally, the Madras High Court in India has recognized Ripple (XRP) as a legal asset, giving it protection under criminal law.

Conclusion

Despite the general market showing a fear-filled sentiment, these divergent signals show that many Ripple (XRP) investors remain confident. Confidence alone may not guarantee success, but it is more important to have a clear capital protection strategy when the market moves against expectations.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Signals Show XRP Investors Remain Confident. Accessed on November 8, 2025

- Featured Image: Coinfomania