Bitcoin (BTC) Surges to $106,000 as Crypto Market Liquidations Hit $341 Million

Jakarta, Pintu News – The crypto market recently experienced a massive liquidation of $341.85 million, amidst Bitcoin’s price surge back to $106,000. Read the full analysis here!

Bitcoin (BTC) Price Recovery and Its Impacts

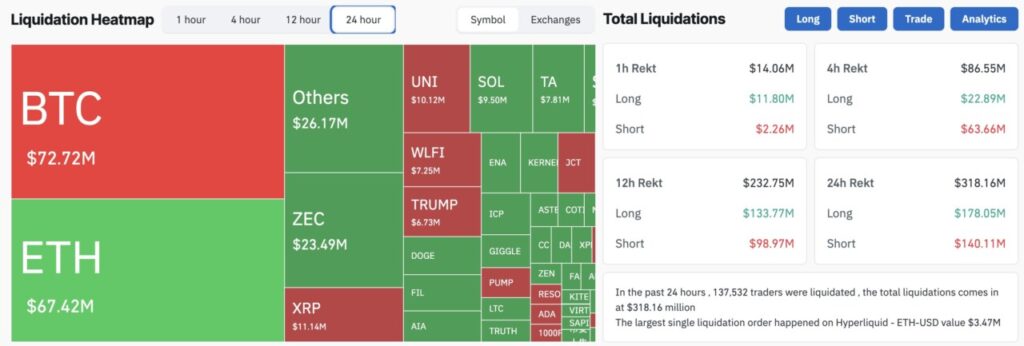

In the last 24 hours, recorded liquidations in the crypto market amounted to $341.85 million, with Bitcoin (BTC) leading the liquidations, recording a loss of $115.98 million. Most of these losses were incurred by traders who positioned themselves in short positions, expecting the price of Bitcoin (BTC) to continue to decline. However, their predictions were missed when the price of Bitcoin (BTC) experienced a significant recovery.

Traders who were short trading were especially hit as they did not anticipate the price increase. They lost around $106.75 million, while traders who were long trading only lost $9.22 million. This price increase coincided with comments from Shanaka Anslem Perera, a writer in the journal Science, stating that Bitcoin’s (BTC) bullish trend is not over yet.

Read also: 1 Pi Network (PI) Price in Indonesia Today (11/11/25)

Other Crypto Asset Liquidations

Ethereum also experienced considerable liquidation, with total losses reaching $92.01 million. Just like Bitcoin (BTC), traders who were short trading on Ethereum (ETH) experienced the largest loss, which was around $76.02 million. Traders who were long trading on Ethereum (ETH) experienced a lower loss of $15.99 million.

Other crypto assets such as Dogecoin , Litecoin , and tokens related to Ripple were also affected. Although not as large as Bitcoin (BTC) and Ethereum (ETH), the liquidation of these assets also shows the high volatility in the ever-evolving and rapidly changing crypto market.

Also read: 5 Reasons Why Crypto Markets Are Up Today

Crypto Market Shows Signs of Recovery

The overall crypto market capitalization has shown strong signs of recovery. In one day alone, the crypto market managed to add around $170 billion, with the total market capitalization now standing at $3.56 trillion. This marks a gain of 3.91% in the last 24 hours.

This recovery was driven by several favorable events, including the US Senate’s decision to end the stalemate of the past few weeks by passing a funding bill to end the government shutdown. Additionally, the Depository Trust & Clearing Corporation (DTCC) has added several proposed Ripple (XRP) spot ETFs to its “Active and Pre-Launch” list.

Conclusion

With Bitcoin (BTC) price recovering to $106,000 and major market liquidations, crypto market dynamics continue to show significant volatility and opportunity. Investors and traders are expected to remain vigilant and inform themselves with the latest developments to manage risks and capitalize on opportunities.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coinspeaker. Crypto Liquidation Hits $341M, Bitcoin $106K. Accessed on November 11, 2025

- Featured Image: Investing News Network