Libra-Related Wallet Withdraws IDR 64 Billion, Investors Suddenly Buying Solana?

Jakarta, Pintu News – Wallets associated with the Libra token continue to attract attention with their massive action in buying Solana crypto assets, despite facing asset freezes and fraud investigations. This includes significant withdrawals from failed memecoins and rotations into other cryptocurrencies.

Fund Withdrawal and Solana Purchase

The wallet associated with the Libra token, which received a controversial endorsement from Argentina’s President Javier Milei, has withdrawn nearly $4 million from its memecoin liquidity. The funds were used to buy Solana (SOL) when its price dropped.

Two crypto wallets associated with the Libra team, known as “Libra Deployer” and “Libra: Wallet,” have bought $61.5 million worth of Solana at an average price of $135 per SOL.

According to data from the Onchain Lens platform, prior to the $4 million withdrawal, Deployer’s Libra wallet had an additional $13 million in USDC, while Libra wallet ’61yKS’ had $44 million in USDC. These funds were then used for SOL purchases.

Read also: Grab Expands Stablecoin Usage with Web3 Wallet and StraitsX Payment System

Controversy and Investigation

Wallets linked to the Libra scandal continue to suck up liquidity and divert it to new digital assets, despite ongoing investigations and previous asset freezes.

In May, US judge Jennifer Rochon froze $57.6 million in USDC in a class action lawsuit against crypto venture firm Kelsier Ventures and its three brother founders, Gideon, Thomas, and Hayden Davis, alleging they misled investors through the creation of the Libra token.

However, on August 21, Judge Rochon reopened the $57.6 million freeze, arguing that the defendant had not caused “irreparable harm” as funds to compensate victims were still available.

Conclusion

Despite legal challenges and controversies, wallets associated with the Libra token continue to be active in the crypto market. Solana’s massive purchase may signal a new strategy or adaptation in the face of changing market conditions.

FaQ

What are Libra tokens?

The Libra token is a cryptocurrency embroiled in controversy and fraud investigations, which also has the support of the President of Argentina, Javier Milei.

How many Solanas does a Libra wallet buy?

The wallet associated with the Libra token has bought Solana (SOL) for $61.5 million.

Why did the US judge freeze and then reopen Libra assets?

US Judge Jennifer Rochon initially froze the assets due to the class action lawsuit, but reopened the freeze as she found that the defendant had not caused irreparable harm.

What is the impact of Solana’s purchase by Libra wallet?

This purchase indicates a shift in strategy by the Libra wallet, perhaps in response to market conditions or as part of a diversification effort.

Who is involved in the creation of the Libra token?

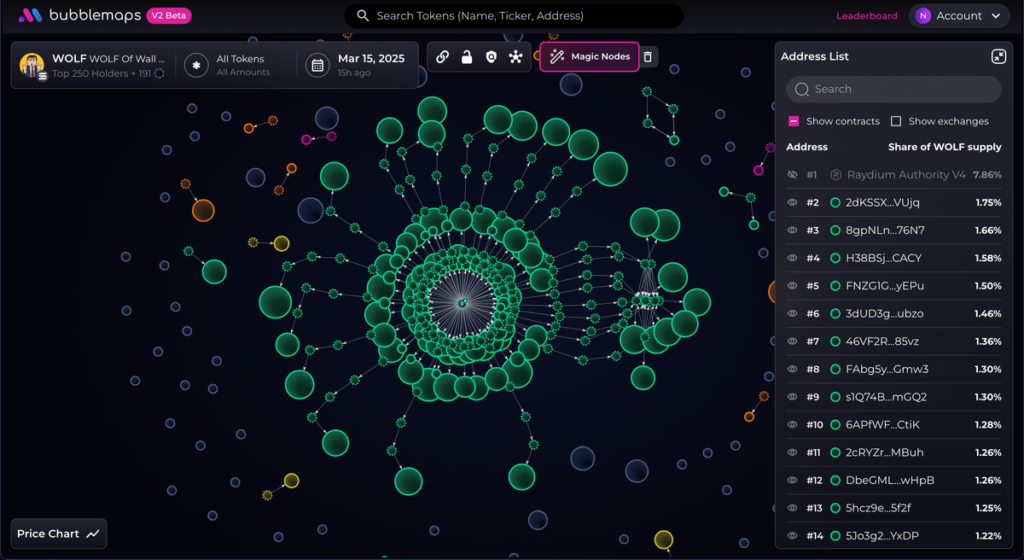

The Libra token was created by Davis, who is also the co-creator of the Official Melania Meme (MELANIA) and Wolf of Wall Street-themed Wolf (WOLF) memecoins.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Libra wallets drain liquidity, believes Solana. Accessed on November 19, 2025

- Featured Image: Crypto Rank