XRP Price Prediction: Selling Pressure Increases Amid Outflows and Declining Open Interest

Jakarta, Pintu News – XRP continues to experience consistent downward pressure despite market interest remaining high and new institutional products starting to emerge. The token is trading at the lower price range of its latest range, while traders are watching several technical zones for signs of stabilization.

Technical Structure Shows Continued Weakness

XRP continues to move down on the 4-hour chart (11/21). The price is below the short-term EMA and the middle line of the Bollinger Bands, indicating consistent selling pressure.

Read also: XRP Price Surge: Will Bitwise’s XRP ETF Fuel the Rise?

The latest attempt to reclaim the $2.20 level failed, indicating weak conviction on the part of buyers. The 0.382 Fibonacci level at $2.16 became the first major obstacle. XRP has also repeatedly failed to break this area, signaling difficulty in recovery.

Currently, the support zone is in the range of $2.05 to $2.06. If this zone is broken, the price risks dropping to the 0.236 Fibonacci level of $1.94. Further down, the $1.58 area becomes a full retracement target.

On the upside, resistance levels are at $2.34 and $2.52. These two levels form a strong supply zone and have stopped several previous rallies. If the price manages to break out of these zones, the potential for an upside towards $2.70 could open up. However, trend pressure remains dominant unless the price is able to return above $2.16 with a strong push.

Leverage and Liquidity Trends Show Mixed Signals

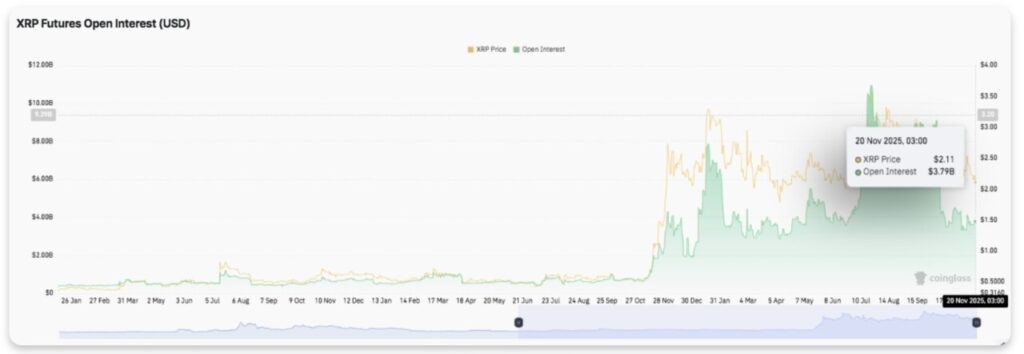

Open interest (open contracts) increased during the end of the first quarter and the second quarter, as traders built up large leveraged positions. It peaked above $8 billion during the big rally and reflected high speculation.

However, it has now decreased to around $3.79 billion. This decline indicates that traders are starting to reduce positions as prices return to the $2.10 area. Despite the correction, participation levels remain higher than at the beginning of the year. Therefore, traders may jump back in if XRP is able to hold at the important support zone.

Spot fund flows showed consistent outflows throughout the year. Some sessions even recorded distributions of over $100 million. On November 20, an additional outflow of $21.64 million was recorded when the price was around $2.12. This data confirms the defensive sentiment and cautious market positioning.

New ETFs Bring a Fresh Narrative

Bitwise has confirmed the launch of the XRP spot ETF on the New York Stock Exchange (NYSE). The fund charges a fee of 0.34%, but will be waived for the first month for initial assets worth up to $500 million.

This launch opens new doors for institutions to gain exposure to XRP. This development has the potential to influence market sentiment, especially if liquidity increases and market conditions begin to stabilize.

XRP Price Technical Outlook

Key levels remain clear as XRP enters the next phase of trading. On the upside, resistance levels are at $2.16, $2.34, and $2.52-which are the major hurdles that the bullish side must break to reverse the short-term momentum.

If the price manages to break $2.52 convincingly, the upside potential could continue towards $2.70 to $2.77, where the resistance on the higher time frames converges with the 0.786 Fibonacci zone.

Read also: Vitalik Buterin Warns of Quantum Threat: Ethereum Ready to Boost Cryptographic Security

On the downside, the $2.05 level is important support and serves as a trend line on the lower time frames. If the price drops below this level, a potential drop to $1.94 opens up as the next support structure. Should the selling pressure intensify, the chart makes room for a deeper drop towards the $1.58-level which reflects a full retracement of the previous impulse.

Technically speaking, XRP is currently compressing below the 0.382 Fibonacci level, forming a narrowing structure-a pattern that is often a precursor to big moves.

A price recovery above $2.16 would convincingly signal a return of momentum, while failure to break the level leaves the trend vulnerable.

Will XRP be able to rebuild its momentum?

The direction in which XRP moves in the short-term depends largely on whether buyers are able to hold the support level at $2.05 long enough to retest the resistance zone in the $2.34-$2.52 range.

Currently, price compression, decreased leverage, and persistent outflows indicate weakening market confidence. However, based on historical patterns, volatility tends to increase when prices test key Fibonacci base levels.

If the inflow of funds strengthens and the price stays above $2.05, XRP has the potential to rebound towards $2.34, and could even go on to $2.52 to $2.70 if the momentum grows stronger.

Conversely, if the current support level fails to hold, then the path towards $1.94 opens up again, and the probability of a deeper drop below that level increases.

For now, XRP is in the crucial zone. The upcoming trading sessions will most likely depend on the liquidity flow, confirmation of the technical structure, and market reaction around the $2.16 level-which is still the deciding point for the next major move.

FAQ

What is XRP?

XRP is a digital token used in the Ripple network to facilitate money transfers between different currencies.

Why does the XRP price continue to decline?

The price of XRP declined due to continued selling pressure and lack of conviction from buyers, despite high interest from the market.

What is the XRP ETF launched by Bitwise?

The XRP ETF launched by Bitwise is an investment product that allows investors to gain exposure to XRP through the New York Stock Exchange at a cost of 0.34%.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. XRP Price Prediction: XRP Weakens as Outflows Build and OI Falls Ahead of Bitwise ETF. Accessed on November 21, 2025