5 facts about Bitcoin’s sudden $87,000 rally!

Jakarta, Pintu News – Bitcoin scored a major surprise in the crypto market after jumping more than $7,000 in a matter of hours, touching the $87,000 level amid still high market pressure. The sudden rise came on a relatively quiet Sunday, leaving many analysts and traders puzzled over the trigger for the brief spike. In fact, in the previous nine days, more than $1 trillion in crypto market capitalization had disappeared.

1. Surprising Rally After Falling to the Lowest Point Since April

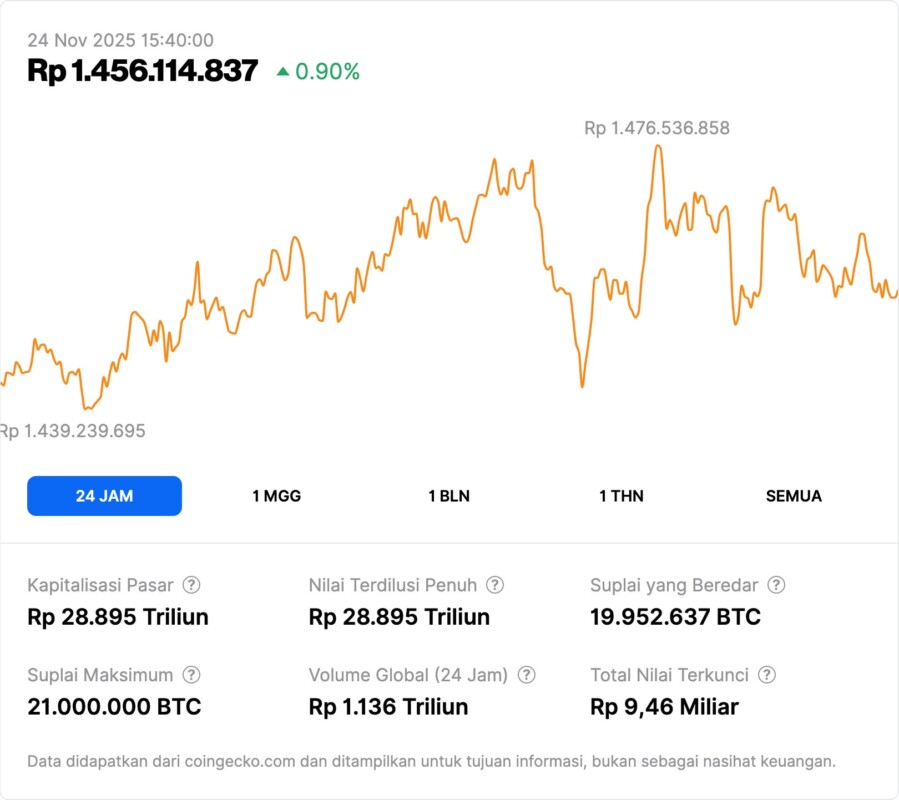

According to a report by Cryptopolitan (November 23, 2025), Bitcoin suddenly jumped from around $80,000 to over $87,000. In fact, BTC previously looked weak after falling more than 33% from the high of $126,000 reached in early October 2025.

However, on a year-to-date basis, Bitcoin is still down around 10%. Some analysts even say this could be the first negative year since 2022 if the downward trend dominates again by the end of the year.

Also Read: Robert Kiyosaki Sells Bitcoin at $90,000: From $250K Target to Real Business, Here’s Why!

2. Selling Pressure Remains Strong: Old Investors Join in Selling

Hyunsu Jung of Hyperion DeFi said that this spike does not change the long-term trend. According to him, the selling pressure comes from large investors who have held Bitcoin for a long time, not short-term traders.

He highlighted that the RSI (Relative Strength Index) indicator did not rise at the same time as prices rose last October. This signaled the potential for further weakness. The price drop below $106,000 triggered a massive wave of selling.

3. US Economic Data to Determine the Next Course

Oleg Kalmanovich from Neomarkets KZ said that the market is now waiting for US consumer spending data to be released on November 25 and 26, 2025. This data could be a signal for the Fed to cut interest rates on December 10.

If the data shows economic weakness, the likelihood of a rate cut increases and could support a rebound in Bitcoin prices. However, if the data is strong, the pressure on BTC could increase again.

4. Strong Technical Support at $80,600 and Important Threshold at $87,000

Vasily Girya of GIS Mining mentioned that big buying came back at the $80,600 level, which helped trigger the initial rise before the rally took place. However, he cautioned that the $87,000 level is an important technical threshold.

If the Bitcoin price drops below $87,000 again before the opening of US exchanges, it could potentially enter a crypto winter phase or long-term stagnation. To maintain momentum, the price needs to rise above $93,000 in the near future.

5. Portfolio Shifts to Dollar, Market Still in “Wait and See” Mode

Kalmanovich also added that many large investors have started shifting their funds from crypto to dollars, as a form of hedging against global uncertainty. This has also depressed demand for Bitcoin in the short term.

This displacement trend was also triggered by weakness in other sectors such as AI, as well as global interest rate uncertainty. Analysts feel that the market is still very sensitive to macroeconomic data and potential monetary policy.

Also Read: Cardano Predicted to Drop Out of Top 20 by 2026, Nansen CEO Mentions ‘Ghost Chain’

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Why did Bitcoin’s price suddenly rise to $87,000?

According to Cryptopolitan, this spike happened suddenly after a big buy at the $80,600 level. However, analysts say this rally is not strong enough to change the market trend, which is still bearish.

Does this rise signal the end of the downward trend?

Not necessarily. Analysts like Hyunsu Jung think that selling pressure is still dominant, especially from long-term investors who have started to unwind their holdings. This suggests that the rally could be temporary.

What macroeconomic factors could affect Bitcoin price in the near future?

Traders are waiting for US consumer spending and retail sales data. If the data is weak, then the Fed could potentially cut interest rates, which could trigger a rebound in BTC prices.

Which price levels are important to maintain Bitcoin’s positive momentum?

According to analysts, the $87,000 level is an important threshold. If Bitcoin price can cross $93,000, then market confidence could return and drive a new uptrend.

Who was called back in favor of Bitcoin when its price crashed?

Polymarket resurrected an old meme about Adam Back, who is symbolically said to have a buy order for all of Bitcoin at $0.01. This reflects the community’s strong belief in BTC despite the sluggish market.

Reference:

- Cryptopolitan. Bitcoin surges past $87,000 in sudden, unexpected rally. Accessed on November 24, 2025