Bitcoin Surges to $91,000 — Here’s What the Charts Say

Jakarta, Pintu News – Bitcoin is still struggling to find a clear direction as traders assess the weakening technical structure and significant policy changes from the state of Texas. The asset is moving in a narrow daily range after several weeks of sharp declines.

However, the wider participation of the futures market as well as new allocations at the state level are drawing attention again. This diverse situation creates complex market conditions for the next few days.

Then, how will the Bitcoin price move today?

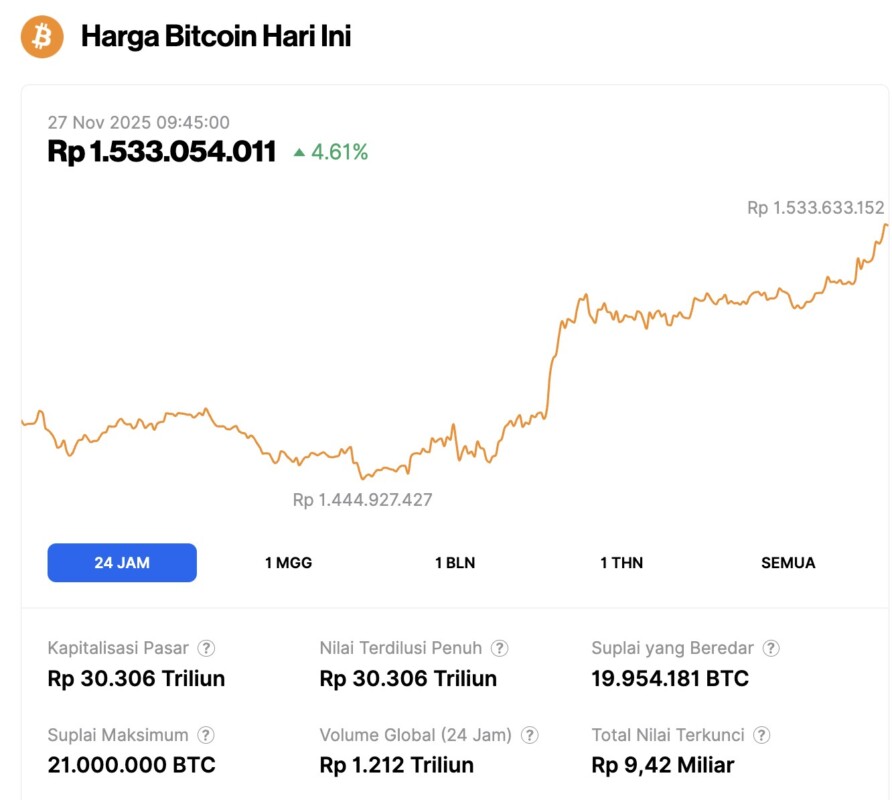

Bitcoin Price Up 4.61% in 24 Hours

As of November 27, 2025, Bitcoin is trading at $91,675, which is equivalent to approximately IDR 1,533,054,011 — marking a 4.61% increase over the past 24 hours. During this period, BTC dipped to a low of IDR 1,444,927,427 and reached a high of IDR 1,535,771,517.

At the time of writing, Bitcoin’s market capitalization is estimated at around IDR 30,306 trillion, while 24-hour trading volume has climbed 10% to reach IDR 1,212 trillion.

Read also: November 2025 Crypto Crisis: Is it Worse Than the FTX Era?

Key Levels Determining Bitcoin’s Short-Term Direction

Bitcoin is still trading in a strong downtrend on the 4-hour chart (11/26). Sellers continue to exert pressure around the short-term EMA level and the Supertrend indicator. The market is trying to form a bottom around $86,700. This zone becomes a temporary support area as volatility begins to subside.

Moreover, the recent reaction from the $80.728 level was an important turning point. The price managed to bounce off that Fibonacci reference point and attempted to build momentum. However, the bullish attempt is stuck around the $91,492 level, which coincides with the 0.236 Fibonacci zone and acts as a strong supply area.

As a result, the next resistance level emerged at $98,151, which was previously the point of sellers’ dominance as the price tried to recover. A push through $103,534 would signal a stronger shift in sentiment. Furthermore, a break of the $108,916 level is considered crucial as this zone often triggers a broader trend change.

On the downside (support), if the price loses ground around $86,700, then the $83,000 level becomes the next target. A deeper drop could bring the price back to test the low of $80,728.

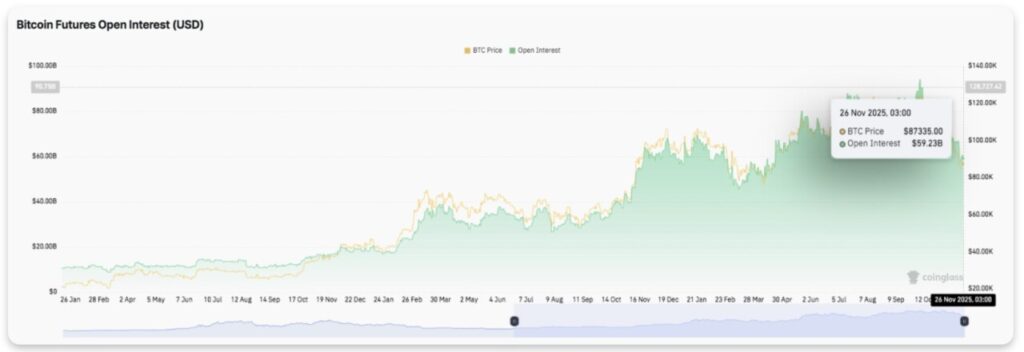

Open interest for Bitcoin futures has remained steady so far this year. Traders increased their exposure as prices began to recover from seasonal weakness earlier in the year. Open interest briefly rose close to $60 billion and stood at around $59.23 billion on November 26.

Moreover, the harmony between rising open interest and stable prices reflects market confidence. Traders continue to reopen positions after each price correction, showing consistent participation despite volatile market conditions.

However, fund flows in the spot market show a different picture. Outflows were greater than inflows in most trading sessions. This pattern indicates ongoing selling pressure. However, the occasional surge in inflows helped slow the decline. This trend indicates cautious demand from large market participants.

Texas Towards a Bitcoin Reserve Model

Texas introduced a new dynamic by confirming the outright purchase of Bitcoin for the first time. The state allocated $5 million in funds at an average price of around $87,000. Texas officials are also planning an additional allocation of $5 million to reserve for this new digital asset.

In the initial purchase, Texas used BlackRock’s IBIT product. However, the long-term plan is to move to a self-custody system managed directly by the state. This framework could potentially serve as a reference for other states exploring digital backup models.

This move by Texas provides institutional weight amidst the technical uncertainty of the market. As a result, Bitcoin is entering a crucial phase influenced by mixed pressures and new momentum signals.

Read also: Chainlink ETF Launching Soon, LINK Price Ready to Rebound?

Technical Outlook of Bitcoin Price

Key levels are still evident as Bitcoin moves within a tight correction structure on the 4-hour time frame (11/26).

The immediate resistance levels are at $91,492, $98,151, and $103,534 – which are the immediate hurdles for the price. If it is able to break these levels, the upside potential could continue up to $108,916, which is the next big reaction zone.

On the support side, Bitcoin price is holding in the range of $86,700-$87,200 as short-term support, followed by continued support at $83,000 and the previous swing low of $80,728.

The resistance level of $91,492, which is also the 0.236 Fibonacci retracement, is an important boundary that must be broken to confirm the medium-term bullish momentum. Technically, BTC is currently trapped within a descending trendline structure, where a convincing breakout or breakdown could trigger increased volatility in either direction.

Will Bitcoin Price Rise?

The next movement of Bitcoin largely depends on whether buyers are able to hold the support zone at $86,700-$87,200 long enough to challenge the Fibonacci zone at $91,492-$98,151.

Currently, the presence of technical pressure and weakening momentum indicators signal the potential for increased volatility in the near term.

If the inflow strengthens and Bitcoin manages to close above $98,151, then the price has a chance to retest the $103,534 level and even push higher to $108,916.

However, if the price fails to hold above $86,700, then a deeper drop towards $83,000 could occur. Breaking below that level opens the risk of a drop to the previous low of $80,728 and potentially invalidating the recovery scenario.

For now, Bitcoin is in a crucial zone. The clarity of direction will be determined by the strength of market conviction and confirmation of transaction volume – whether BTC will reclaim higher levels or test lower support areas.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Bitcoin Price Prediction: BTC Faces Tight Recovery Window as Key Fibonacci Levels Limit Upside. Accessed on November 27, 2025