Odds of December Fed Rate Cut Jumps to 85% After PPI Data Release

Jakarta, Pintu News – The odds of a Federal Reserve (Fed) interest rate cut in December have reached new highs following the September Producer Price Index (PPI) inflation report. This is positive for Bitcoin and the broader crypto market, as crypto traders bet on a third rate cut this year at the December Federal Open Market Committee (FOMC) meeting.

Fed Rate Cut Odds Increase Sharply Ahead of December FOMC

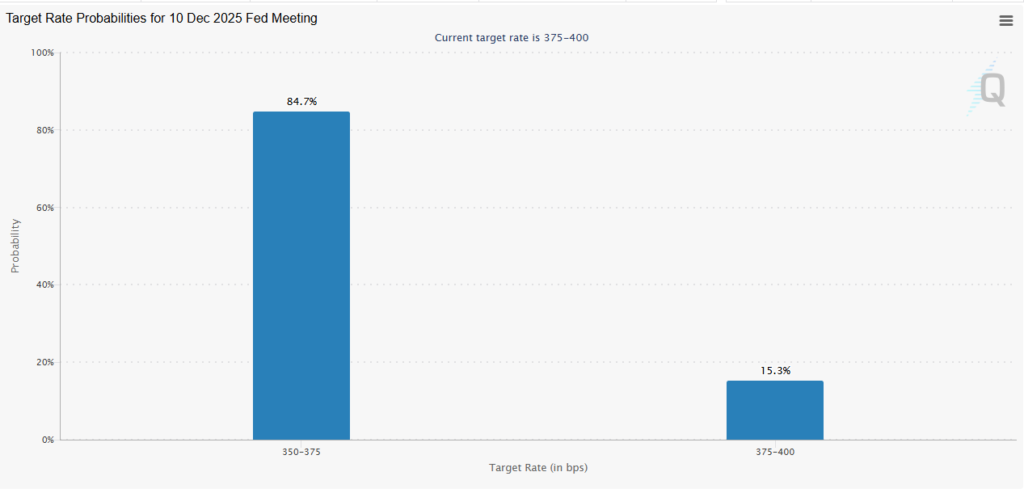

CME FedWatch data shows that there is now an 85% chance that the Fed will cut rates by 25 basis points (bps) at the December FOMC meeting. This is an improvement from last week, when the odds rose above 70%, after dropping to as low as 30% earlier in the week.

Polymarket data also showed a jump in the odds of a 25 bps Fed rate cut next month to 86%, following the release of September PPI inflation data.

The PPI report shows that the weakening labor market is a bigger concern than rising inflation. This is in line with Fed Governor Chris Waller’s view that inflation is not a big issue and the focus is on the weakening labor market, which is currently showing no signs of recovery.

Also read: Gold Jewelry Price Today, Thursday, November 27, 2025

Loose Signals from Fed Officials Drive December Rate Cut Expectations

According to a WSJ report, allies of Fed Chair Jerome Powell have left the door open for another cut at next month’s meeting. This includes San Francisco Fed President Mary Daly, who recently expressed her support for another cut in December as she sees the labor market downturn as harder to control than rising inflation.

In addition, New York Fed President John Williams last week said that there is still room for another short-term rate cut as they seek to bring monetary policy to neutral levels. The odds of a December cut quickly jumped above 70% from around 40% following Williams’ comments.

Markets have taken cues from their comments, especially given that Powell has no public speech scheduled before the next FOMC meeting on December 10. Fed Governor Stephen Miran also stated today that the US economy needs bigger cuts, while once again signaling his support for another cut at next month’s meeting.

Bitcoin (BTC) has bounced from last week’s low of around $81,000 to around $89,000 this week thanks to optimism over a third rate cut this year. Notably, the major cryptocurrency surged to a new record high just before the Fed made its rate cuts in September and October. This rise suggests a strong link between the Fed’s monetary policy and crypto market dynamics.

Conclusion

With the increasing chances of a Fed rate cut in December, financial markets, including crypto markets, look set to continue undergoing dynamic changes. Market watchers and investors will continue to monitor these developments, as any decision from the Fed has the potential to significantly influence market direction.

FAQ

What is the Producer Price Index (PPI)?

The Producer Price Index (PPI) is an inflation indicator that measures the average change in prices received by domestic producers for their output.

Why is the Fed rate cut important for crypto markets?

Fed rate cuts tend to lower the value of the US dollar, which could make assets like Bitcoin (BTC) more attractive as a hedge against inflation and currency weakness.

When is the next FOMC meeting scheduled?

The next Federal Open Market Committee (FOMC) meeting is scheduled for December 10.

Who is Jerome Powell?

Jerome Powell is the Chairman of the Federal Reserve, the central bank of the United States, responsible for the country’s monetary policy.

How do interest rate cuts affect the economy in general?

Interest rate cuts tend to stimulate the economy by lowering borrowing costs, which can boost consumer spending and business investment.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. December Fed Rate Cut Odds Surge to 85% Following PPI Release. Accessed on November 27, 2025

- Featured Image: Fortune