3 Reasons Why This DeFi Subcategory Could Be the Leader in the Next Altcoin Season!

Jakarta, Pintu News – Altcoin season hasn’t arrived yet, but traders are already starting to notice the first signs of its emergence. One of the most prominent niche sectors in the DeFi world is decentralized exch anges (DEXs).

Amidst the weak market,whales have started collecting DEX tokens, and their price movements suggest that they could move independently when Bitcoin slows down.

If the next altcoin season is truly coming, this sector is one of the few groups that is already showing signs of leadership early on. Let’s understand why!

Reason 1: DEX Trading Share Continues to Rise Compared to CEX Spot and Perpetuals

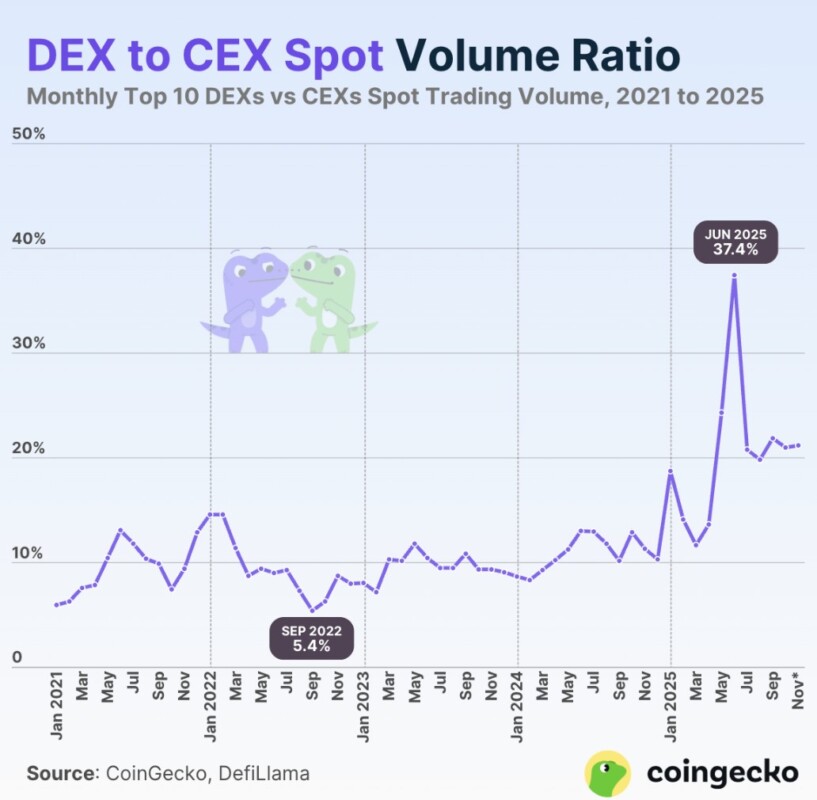

The DEX market has continued to show growth throughout the year. Spot trading volumes on DEX, when viewed as a percentage of global spot volumes, have increased from 5.4% in September 2022 to 21.19% in November 2025.

Read also: Pi Network Beats Bitcoin and Ethereum in November 2025, Here’s the Key Catalysts

In fact, in June 2025, the figure reached an all-time high of 37.4%. This shows that more and more users are moving their spot trading activities to on-chain, despite the general weak market conditions.

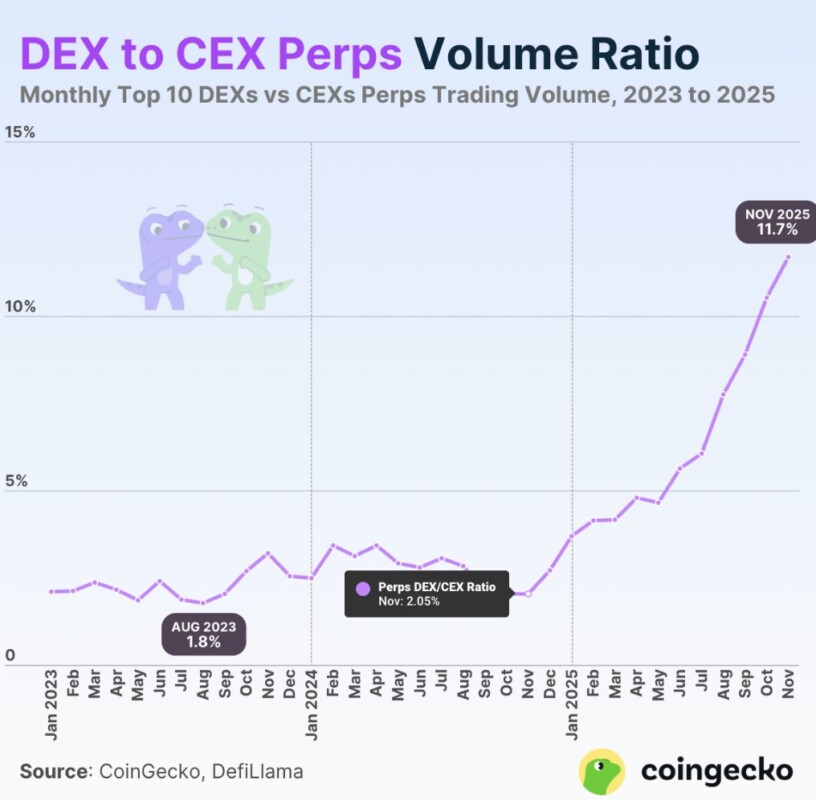

The perpetual trading ratio between DEX and CEX has also jumped, from 2.05% in November 2024 to 11.7% this month-the highest figure ever achieved. When more traders choose on-chain perpetual trading over centralized exchanges, it indicates that confidence in the DEX system is growing.

Despite showing strength in terms of fundamentals, the DEX token category actually fell by 3.9% in the past week. In contrast, CEX tokens have increased by 3.9% in the same period. This discrepancy suggests a potential undervaluation of DEX tokens, which means there is still room to rise if market sentiment improves.

This is the reason why this subcategory is one of the first sectors traders look at when they start shifting focus away from the major assets.

Reason 2: Whale is Quietly Accumulating Major DEX Tokens

The price movement of DEX tokens may look weak on the surface, but big wallets are consistently accumulating. In the past 30 days, whales and mega-whales have added to their holdings in various major DEX tokens, even when the price was moving sideways or down.

Uniswap recorded a decline of 3.4% in the last 30 days, but ownership by mega-whales rose by 11.66%. Currently, the top 100 addresses control 8.98 million UNI – indicating strong accumulation, while supply on the exchange continues to shrink.

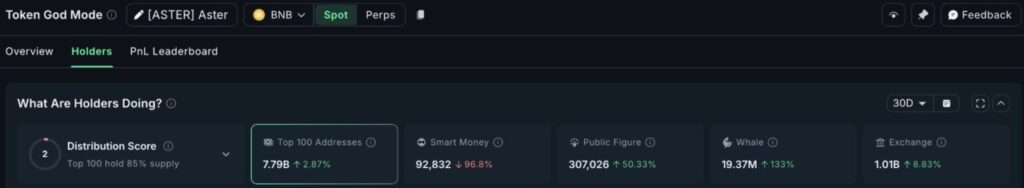

Aster was relatively flat with a 0.9% gain on the month, but the signals from whale were much more striking. Whale holdings jumped 133%, and top-tier addresses added 2.87% to the total supply.

While retail wallets are still selling (as evidenced by the green stock exchange netflow ), early accumulation by whales is usually the first signal that a sector is about to undergo a change in direction-even before the price moves up.

PancakeSwap saw a 5.4% drop in the last 30 days, but the top 100 addresses (mega-whale) increased their balance by 40.51%.

This similar pattern emerging across three different DEX ecosystems suggests one consistent message: large holders are building exposure when the market is weak-not exiting positions.

When a sector shows increased on-chain adoption alongside increased whale demand, it is often one of the first to benefit when investor risk appetite returns.

Read also: Top 5 Crypto that Shined More than Bitcoin and Ethereum This Week

Reason 3: DEX Tokens Move Differently When Bitcoin Weakens

Monthly correlation trends show that major DEX tokens are no longer moving in line with Bitcoin . Correlation here refers to the Pearson correlation coefficient, which measures the extent to which two prices move together. A negative value means the movement is in the opposite direction.

The UNI token shows a mild negative correlation to Bitcoin at -0.13. Meanwhile, ASTER shows a much stronger negative correlation of -0.57 – a rarity in a market still led by Bitcoin.

This means that when the price of Bitcoin drops, these tokens often don’t fall with it. In fact, in some cases, they are the target of early speculative flows due to their independent movements. This independent nature is often the first sign of an altcoin rotation.

Chart analysis also supports this view.

ASTER’s 12-hour chart shows a bearish crossover between the 20-period and 50-period EMA (Exponential Moving Average) that has now completed. However, the bearish pressure that has emerged since then has continued to weaken.

When a token that is negatively correlated to BTC starts to lose bearish strength post-crossover, it becomes an early candidate to potentially bounce first if market conditions turn positive.

For the record, the EMA is a moving average that gives greater weight to the most recent price.

Meanwhile, UNI is currently moving in a narrow pennant pattern with a weak upper trendline that has only two touchpoints. If UNI is able to break the $6.91 level, then the next targets are at $8.06 and $10.26. However, confirmation is still needed from the OBV(on-balance volume) indicator-which measures volume flows.

Without an increase in OBV, the potential breakout could fail. Nonetheless, the current technical structure favors an accumulation pattern by whales and a negative correlation to BTC.

This combination-accumulation by whales, weakening bearish pressure, and price movement independent of Bitcoin-is the hallmark of a potential altcoin leader that usually emerges before a major cycle begins.

But Altcoin Season Hasn’t Started Yet

According to BlockchainCenter’s Altcoin Season Index, the score currently stands at 33, well below the 75 threshold that signals the start of the real altcoin season.

Read also: 5 Must-Know Crypto Market Predictions for 2026!

The index also shows that it has been 63 days since the last altcoin season spike, while the average lag between seasons is 67 days. This means that the market is currently close to the window of time where rotations usually start to occur-but it hasn’t actually gotten to that point yet.

Bitcoin’s dominance is still high, which means that most of the fund flows in the crypto market are still concentrated on Bitcoin. To create the ideal conditions for altcoin season, two important things must happen simultaneously:

- Total crypto market capitalization should grow, and

- Bitcoin’s dominance should come down at the same time.

The combination of the two suggests that traders are starting to shift funds from Bitcoin to altcoins. Only under these conditions can an altcoin sector experience a sustained price surge.

If that shift does happen in this cycle, DEX tokens have a strong chance of leading the initial wave. They are already showing:

- Growing share of trade volume,

- Consistent demand from whales, and

- Negative correlation with Bitcoin-

three characteristics that are often seen in sectors that rotate first before other altcoins catch up.

FAQ

What is DEX and how does it compare to CEX?

DEX or decentralized exchange is a platform that allows users to trade cryptocurrencies directly between users (peer-to-peer) without intermediaries, in contrast to CEX or centralized exchanges managed by companies as a third party.

Why is DEX trading volume increasing?

DEX trading volumes are increasing due to users’ confidence in the more transparent and secure blockchain system, as well as a desire to avoid the risks associated with centralized exchanges.

What is altcoin season and how is it determined?

Altcoin season is a period where altcoins, or cryptocurrencies other than Bitcoin (BTC), experience significant price increases. The Altcoin Season Index, whose score of 75 or more signifies altcoin season, measures Bitcoin’s market dominance over altcoins.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoin Season: DeFi Category Could Lead. Accessed on December 1, 2025