Pi Network (PI) December 2025 Price Prediction: What to Expect?

Jakarta, Pintu News – December 2025 is predicted to be a crucial month for Pi Coin, which has shown better price resilience than other major cryptocurrencies during November. Despite signs of strength, some early indicators point to potential challenges that may be faced.

With a short but clear history, Pi Coin shows unique dynamics, especially in relation to Bitcoin . We’ll dig deeper into what might happen to Pi Coin in December.

History and Negative Correlation with Bitcoin

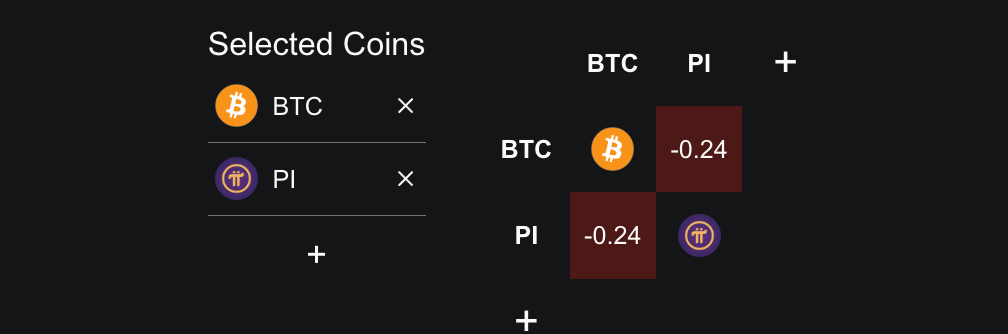

Pi Coin, which is still relatively new to the market, has had a challenging year with only a few months showing gains. Only February and May recorded gains, and November could potentially be the third green month of the year. Pi Coin’s negative monthly correlation with Bitcoin (BTC) which currently stands at around -0.24 suggests that when Bitcoin’s price declines, Pi Coin tends to hold its ground or even experience gains.

Since October, Bitcoin (BTC) has shown a decline, which indirectly favors Pi Coin. In the past one month, Pi Coin has only fallen by about 2.6%, while Bitcoin has fallen more sharply, by almost 19%. Weekly performance also reflects this, with Pi Coin up about 2.7% in the past seven days, making it one of the stable coins in a weak market.

Read also: 2 Altcoins Predicted to Weaken in December 2025

Hidden Bearish Divergence and Big Fund Weakening

Pi Coin’s general structure is still within a converging descending wedge pattern, which is usually a bullish pattern. Pi Coin’s price is currently approaching the upper trend line of the wedge. A breakout from this point is usually considered positive.

However, two indicators are showing early weakness. First is the RSI divergence on the three-day chart, where Pi Coin records a lower high while the RSI records a higher high, suggesting a hidden bearish divergence.

The second indicator is the Chaikin Money Flow (CMF), which measures the flow of money in or out of the market. CMF is still in negative territory on the three-day chart and is now heading towards its uptrend line. CMF’s last visit to this trendline in early October caused Pi Coin to drop by more than 42%.

These two signals together suggest that Pi Coin’s strength in November may not fully continue into December unless there is an increase in funds and the CMF avoids a collapse.

Also read: Bitcoin (BTC) Decline Prediction by Peter Schiff: Will December Be Gloomy?

Pi Coin Price Levels to Watch in December

The chart shows a simple picture: the price of Pi Coin needs to break $0.28 to build momentum. This level aligns with the upper boundary of the wedge. A clean close above $0.28 could open up the opportunity for an increase to $0.36, and if momentum improves further, even $0.46 becomes possible. However, indicators suggest that this is less likely unless the CMF improves. On the downside, $0.21 and $0.20 are the first levels to watch.

A drop below $0.20 reveals the $0.18 zone. If Bitcoin (BTC) suddenly turns bullish, Pi Coin’s negative correlation could lead to unfavorable short-term performance, which might pull Pi Coin’s price towards the lower band of the wedge. The most important line for December is $0.20. Maintaining this level preserves the long-term structure. Missing it brings $0.18, and possibly $0.15, back into view.

Conclusion

Despite some warning signs, Pi Coin still has a chance to close the year stronger than expected. However, this depends entirely on the stabilization of the CMF and whether the descending wedge pattern finally allows the price to break $0.28. If Bitcoin (BTC) weakens and the negative correlation makes Pi Coin more attractive to large investors, there is hope still left.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Pi Coin Price December Outlook Analysis. Accessed on December 6, 2025

- Featured Image: CCN