Will Bitcoin Rebound or Retreat Further in December 2025?

Jakarta, Pintu News – The price of Bitcoin in December is now in the spotlight, given that the market closed November with a weak performance. During the month, Bitcoin plummeted more than 17%, deviating from its historical pattern in November and raising the question: was the recent spike to $80,000 really the bottom?

Historically, December has been a mixed performance for Bitcoin. Early data for this year also indicates a cautious attitude, both from transaction flows in the spot market and on-chain signals.

This analysis will review three key aspects: seasonal performance, ETF fund flows, as well as insights from price charts and on-chain data to project next month’s movements.

Bitcoin History in December and What ETF Flows Reveal

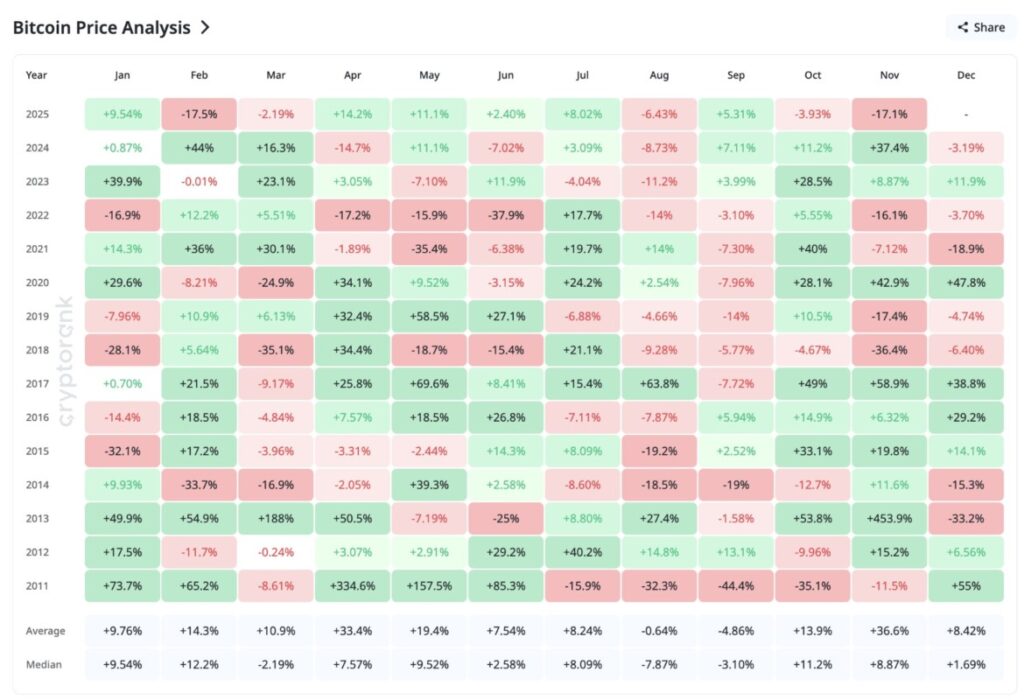

Historically, December has not been a strong period for Bitcoin. The average long-term return is 8.42%, but the median is only 1.69%. The last four years have also shown mixed results, with December closing negative three times.

Read also: December 2025 XRP Price Prediction: XRP History and Key Levels, Bullish or Bearish?

Last November’s performance further reinforced the market’s cautious attitude. Instead of following a strong seasonal pattern, Bitcoin fell by more than 17% during the month.

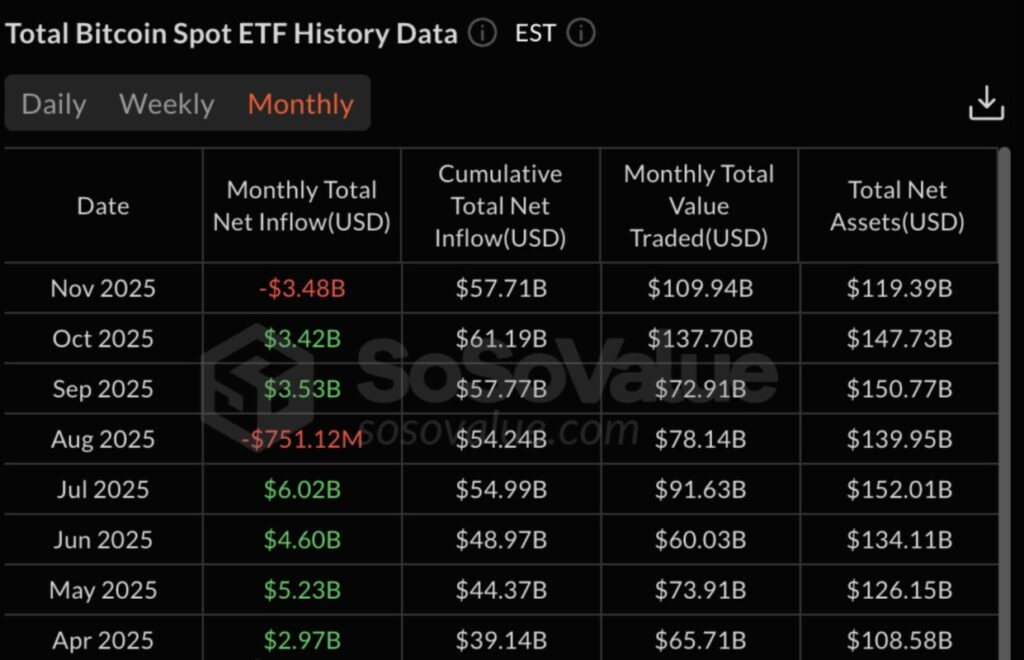

Fund flows from ETFs also reflect the same caution. At the end of November, there was a net outflow of -$3.48 billion from spot Bitcoin ETFs in the US. The last time there was a consistent medium-term inflow trend was between April and July.

Since then, fund flows have been volatile, and the movement in November confirms that institutions are still on the defensive.

Shawn Young, Chief Analyst at MEXC, told BeInCrypto that stronger and stable ETF demand is essential before Bitcoin can experience a significant recovery:

“The clearest indicators for the next potential Bitcoin price rally are the return of risk sentiment, improved liquidity conditions, and increased market depth. When spot Bitcoin ETFs start to record inflows of $200-$300 million for several days in a row, it could be a signal that institutional investors are starting to reallocate funds to BTC, and the next rally is underway,” he said.

Meanwhile, Hunter Rogers, Co-Founder of TeraHash, added that the outlook for December is still likely to be flat, even after the big drop in the previous month:

“I don’t expect December to be very volatile – there will be neither big spikes nor sharp drops. A relatively calm month with a slow upward movement makes more sense. If ETF flows start to stabilize and volatility remains low, Bitcoin might give a small positive surprise. But so far, the market is still in a recovery phase,” he said.

The combination of seasonal patterns and ETF flows suggests that December will likely remain in cautious mode – barring a sharp spike in ETF demand.

On-chain data still shows lack of market confidence

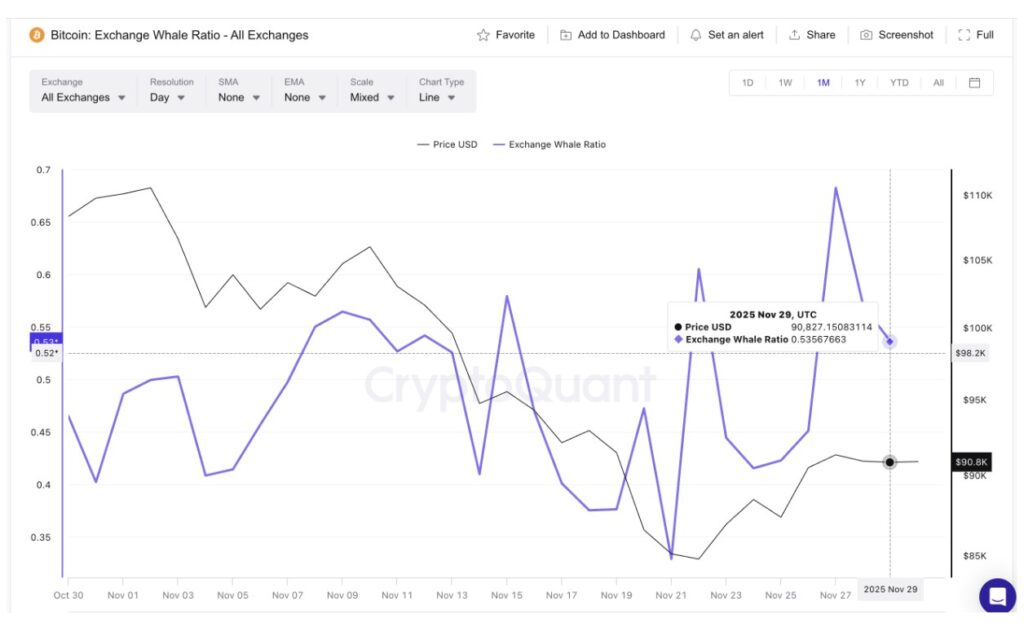

Bitcoin’s on-chain data to date has not shown the pattern that usually marks the formation of a price bottom in December. Two key indicators convey the same message: market whales are still sending coins to exchanges, and long-term holders are still in the distribution phase.

The Exchange Whale Ratio – an indicator that measures how much of the total inflows to an exchange come from the top 10 large wallets – increased from 0.32 at the beginning of the month to 0.68 on November 27.

Although it briefly dropped to 0.53, the number remains within the zone that historically reflects the whales’ ready-to-sell behavior, not accumulation. Usually, a strong bottom is not formed when this ratio stays high for several weeks.

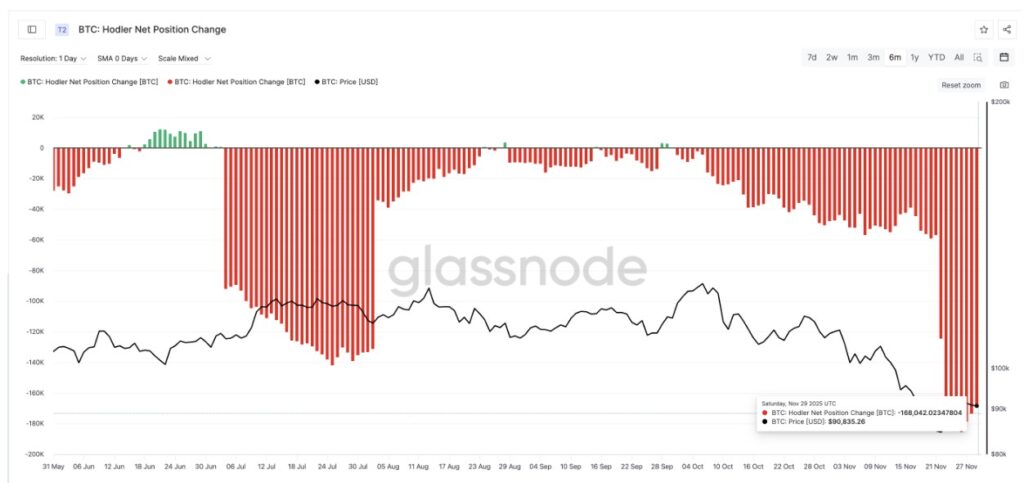

Hodler Net Position Change, which monitors long-term holder behavior, also remains deep in the negative zone. These wallets have been steadily reducing their holdings for more than six months. Bitcoin’s previous big rally only happened after this indicator turned green in late September – a point it has yet to reach again.

As long as long-term holders continue to circulate coins back into the market, the potential for sustained price increases remains limited.

Read also: Why is Crypto Dropping? This is why the crypto market is collapsing today!

Shawn Young asserts that the real trend change will only begin if the long-term sellers start to pull back:

“A price rally could start when ‘OG’ sellers stop moving coins to exchanges, whale accumulation returns to positive, and market depth increases across major platforms,” he explained.

A similar view is shared by Hunter Rogers, who attributes the potential trend reversal to healthier supply behavior from miners and long-term wallets:

“When long-term holders start to quietly accumulate again, it is a sign that supply pressure is starting to ease,” he said.

But so far, both trends have not changed. Whale is still actively sending coins to exchanges, and long-term holders are still in distribution mode.

Overall, this suggests that the Bitcoin price in December is still at risk of a retest to the downside before there is a chance of a stronger recovery.

Bitcoin Price in December: Key Risks and Confirmation Signals

The Bitcoin price is currently at a crucial point, where even a small movement could determine the market direction for December. In general, the trend is still leaning bearish, and the chart structure reinforces the signals already shown by ETF data and on-chain indicators.

Recently, BTC broke the lower boundary of the bear flag pattern that has been forming over the past few weeks. This drop hints at the potential for further weakness down to the $66,800 range, although prices may not head there immediately if market liquidity conditions remain stable.

For December, the first key level to watch is $80,400. This zone was previously a bounce point, but now it still looks fragile.

If BTC closes net below $80,400, it’s likely to hit a new low – as per Shawn Young’s view, who said the situation could still lead to a “liquidity purge” before a stronger recovery attempt.

He explains more in an exclusive interview:

“Bitcoin’s current market structure favors a quick liquidity sweep scenario (wick-style), rather than a long sustained decline,” he said.

On the other hand, the market structure will only turn bullish if BTC manages to reclaim the $97,100 level, which is the midpoint of a larger pole-and-flag pattern. A daily close above the level would invalidate the bear flag pattern and pave the way towards resistance around $101,600.

Hunter Rogers added that price increases are meaningless if they are not accompanied by volume increases:

“If Bitcoin is able to hold above the breakout zone and the volume increases, then the area could start to be considered a strong base,” he explained.

For this month of December, the breakout zone to watch is between $93,900 to $97,100. It is in this area that technical charts, ETF flows, and on-chain conditions need to transform from defensive to supporting the uptrend.

As long as there is no such confirmation, the downside potential still outweighs the upside. Bitcoin’s price decline could continue deeper if outflows from ETFs increase or whales keep sending coins to exchanges.

For now, the Bitcoin price in early December is between two important walls:

- $80,400 as the final lower limit to hold, and

- $97,137 as an upper limit which, if broken, could reverse the direction of market momentum.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What To Expect From Bitcoin Price In December 2025. Accessed on December 1, 2025