Pi Network Edges Higher as Short-Term Optimism Builds

Jakarta, Pintu News – The price of Pi Network experienced a sharp decline this week, indicating a short-term bullish pattern although the long-term outlook looks weak. The altcoin is attempting to stabilize after experiencing recent volatility, but macro conditions suggest that the recovery may only be temporary before a potential deeper decline occurs.

Then, how will the Pi Network price move today?

Pi Network Price Up 1.2% in 24 Hours

On December 3, 2025, the price of Pi Network was recorded at $0.2359, an increase of 1.2% in 24 hours. If converted into the current rupiah ($1 = IDR 16,632), then 1 Pi Network is IDR 3,923. Throughout the day, PI moved in a price range of $0.2288 to $0.2368.

Read also: Pi Network Price Threatened? December’s 190 Million Pi Coin Unlock is in the Spotlight

With a market capitalization of approximately $1,967,790,195 (almost $2 billion), Pi Network currently ranks 62nd on the list of crypto assets by market valuation. In addition, the trading volume in the last 24 hours was recorded at $21,442,306.

Pi Coin unable to escape bearish pressure

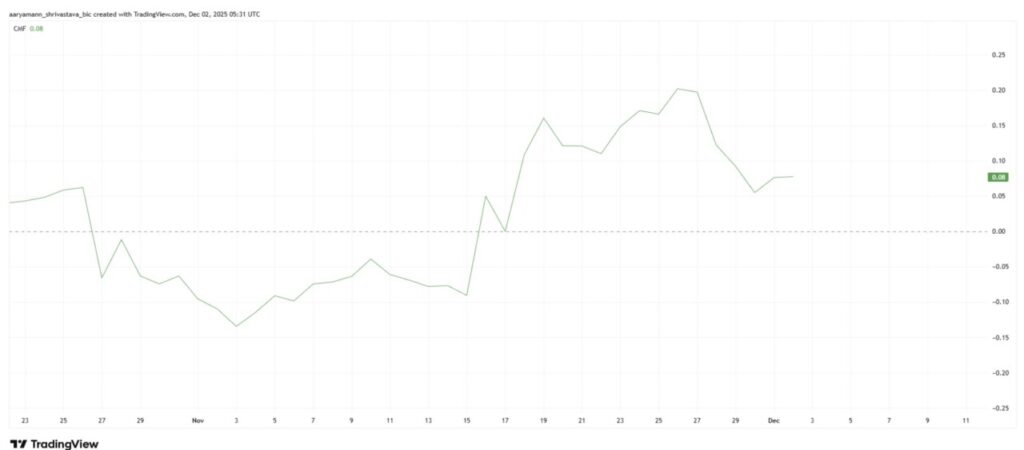

The Chaikin Money Flow (CMF) indicator shows that the inflow of funds is starting to slow down, although it hasn’t completely disappeared. This indicates that investors have not completely abandoned Pi Coin, despite the recent price decline.

The persistence of inflows provides a mild positive signal as it reflects some confidence in the asset’s short-term recovery potential.

However, this sentiment is fragile. A change in market conditions or the re-emergence of selling pressure could easily reverse the weak inflows into outflows. For now, the CMF indicator still favors a moderate bullish reaction, but the ongoing uncertainty weighs on investor confidence.

From a macro point of view, Pi Coin shows a bearish pennant pattern beginning to form. This pattern generally appears in the middle of a downtrend and indicates a continuation of bearish momentum after a brief consolidation phase.

Pi Coin has exhibited the two main components of this pattern – a clear downward trend in price and consolidation within a narrow range – which reinforces the possibility of a continued decline.

If this bearish pennant pattern is confirmed, Pi Coin could potentially experience a deeper decline, with a macro price target in the range of $0.182. This level is in line with the overall technical weakness and reflects the market’s lower appetite for risky assets.

Read also: Dogecoin Surges 9% Today as Whale Activity Drops Sharply

PI Price Shows Short-Term Optimism

As of December 2, Pi Coin was trading at $0.232, recording a 16% drop in the last few days. Currently, the altcoin is still holding above the $0.224 support level and moving in anascending channel pattern, while testing the lower trendline as an area of support.

This position has the potential to encourage a short-term price bounce. Pi Coin has the opportunity to recover towards $0.246 and can even break above $0.250 if the channel structure is maintained. This movement is in line with the short-term bullish sentiment reflected in the CMF indicator.

However, if market conditions deteriorate or investor confidence weakens, Pi Coin risks losing the $0.224 support level. A break below this level could push the price down to $0.217 or lower, which would invalidate the short-term bullish scenario and further strengthen the overall bearish pattern.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Chart Warns of Pi Coin Price Crash After Short Bullish Spike. Accessed on December 3, 2025