5 Ways to Short Bitcoin Futures Easily

Jakarta, Pintu News – Short selling in crypto trading is increasingly in demand, especially when market volatility drives traders to look for opportunities from downward price movements.

Bitcoin , as the largest cryptocurrency asset, is often the instrument chosen for short strategies. Various methods of short selling are now available, including through derivatives platforms such as Pintu Futures which provides easy access to Bitcoin futures trading from Indonesia.

This article outlines the five main ways to short Bitcoin futures based on industry practice and global guidelines, along with an explanation of the risks and mechanics!

Understanding Short Bitcoin Futures

Short Bitcoin futures is a strategy that allows traders to profit when the price of Bitcoin (BTC) drops. In a futures contract, traders open a short position with the expectation that the asset’s price will move lower at a certain time.

This method is widely used in the volatile cryptocurrency market, especially when bearish momentum dominates. Pintu Futures provides tools that allow traders to access these instruments efficiently, including using leverage with measured risk controls.

Futures contracts differ from spot trading in that they do not require ownership of physical assets. Traders open positions based on expectations of price direction, so short sells can be made without having to own Bitcoin first.

With platforms like Pintu Futures, the entire process is made easy through fast execution, transparent margins, and risk management features. This flexibility makes short futures a popular choice in portfolio protection strategies when crypto markets are under pressure.

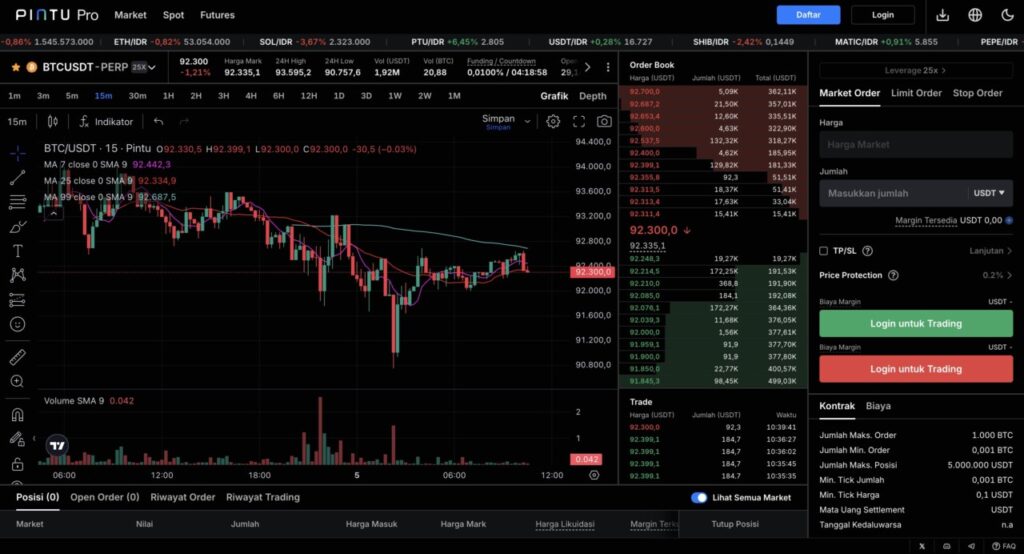

1. Standardized Short Futures Through the Pintu Futures

The first method is short selling through regular futures contracts available on many crypto exchanges. Traders open short positions by borrowing exposure to Bitcoin (BTC), and then close them when the price drops to make a profit difference.

At Pintu Futures, perpetual contracts can be used for this strategy, providing flexibility with no expiration date. The leverage feature allows positions to be enlarged, but also increases risk so disciplined margin management is required.

In traditional short futures, opposing price movements will lead to potential losses. A liquidation mechanism may occur if the margin value is insufficient to withstand market volatility.

Therefore, traders must understand the parameters of funding rate, initial margin, and maintenance margin. Pintu Futures provides a real-time view of risk parameters to help traders make more measured decisions.

2. Short Through Margin Trading on Crypto Exchanges

Margin trading allows traders to borrow assets to open short positions. In the context of Bitcoin (BTC), traders borrow BTC, sell it on the market, then buy it back at a lower price to repay the loan.

Certain exchanges offer margin trading with varying levels of leverage, giving traders the opportunity to increase their exposure to price movements.

The risk of margin trading is quite high as traders can face multiple losses when prices move up. The margin call system may force the closure of a position if the collateral value is insufficient.

In addition, borrowing costs may increase in volatile conditions, magnifying the cost of the short strategy. Traders should assess market conditions, liquidity, and risk tolerance before using this method.

Read also: Coinbase Prediction: December to be a ‘Cheerful’ Month for Bitcoin (BTC)

3. Short Bitcoin Through CFD (Contract for Difference)

CFDs are derivative instruments that allow traders to speculate on the price movements of Bitcoin (BTC) without owning the asset. Traders can simply open a short position and profit if the price drops.

CFDs provide great flexibility as they can be traded in small units and with leverage. This instrument is widely used in the international crypto market for short-term strategies.

CFDs also carry significant risk as leverage magnifies potential losses. The absence of asset ownership makes CFDs suitable only for traders who focus on short-term movements.

CFD regulations vary by jurisdiction, so it is important to ensure the platform used is subject to adequate oversight. The risk of slippage may also occur in volatile conditions.

4. Short Bitcoin Through Options

A put option gives the holder the right, but not the obligation, to sell Bitcoin (BTC) at a certain price before the maturity date. Buying put options is a relatively safe way to go short as the potential loss is limited to the option premium.

This structure allows traders to profit when prices fall without holding a direct short position. This strategy is often used as crypto portfolio hedging.

However, options have their own complexities as the premium value is affected by volatility, time, and strike price. Not all exchanges offer Bitcoin options with high liquidity. Traders also need to understand terms such as delta, theta and implied volatility. In high volatility environments, option premiums may increase, increasing the cost of the strategy.

Also read: Kevin O’Leary: “December Rate Cut Won’t Move Bitcoin!” What’s the Reason?

5. Short Through Inverse ETF or Derivative Tokens

Some providers offer products such as inverse ETFs or tokens that move opposite to the price of Bitcoin (BTC). If the price of Bitcoin falls by 1 percent, the inverse token may rise by about 1 percent according to the structure of the product.

This instrument is suitable for traders who wish to execute shorts without the risk of direct leverage or asset borrowing. They are generally utilized for short-term strategies as the compounding effect can affect long-term results.

The risk of inverse products lies in the daily adjustment mechanism which can lead to different results than the actual price change. Liquidity is also an important factor as inverse tokens are not always available on all exchanges. Traders should familiarize themselves with the product documentation before using it. In addition, extreme volatility can make inverse tokens underperform.

Start Trading Bitcoin Short Futures Through Pintu Futures

Pintu Futures provides Indonesian traders with easy access to short Bitcoin futures with perpetual contracts, fast execution, and comprehensive risk management features. With its transparent approach and intuitive interface, Pintu Futures supports a variety of short selling strategies in the dynamic cryptocurrency market.

This feature provides the flexibility to efficiently capitalize on both upside and downside price movements. Traders can utilize this platform to implement the short strategy described in this article.

Conclusion

Short Bitcoin futures offer a variety of methods that can be used depending on your goals and risk tolerance. Each instrument has a different structure, cost and level of risk so understanding the mechanics is important before executing a strategy.

With platforms like Pintu Futures, access to short instruments has become easier and more affordable for Indonesian traders. Understanding the dynamics of the crypto market and derivative instruments will help traders capitalize on opportunities more effectively.

FAQ

What are short Bitcoin futures?

Short Bitcoin futures is a strategy that capitalizes on the falling price of Bitcoin (BTC) through derivative contracts, where traders open short positions to earn the price difference.

Why do traders use short selling in the cryptocurrency market?

Short selling is used to seek opportunities when markets are weak or as portfolio protection when volatility increases.

What platforms can be used to short Bitcoin futures in Indonesia?

Pintu Futures is one such platform that provides Indonesian traders with easy access to Bitcoin futures contracts.

What are the main risks when shorting Bitcoin?

The main risk is countervailing price movements, which can lead to large losses especially when leverage is used.

When do experienced traders usually short Bitcoin?

Experienced traders usually short when bearish momentum is strong or when technical indicators show a potential price reversal.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

Trading crypto futures involves high financial risk. Be sure to use strict risk management, including stop losses, appropriate position sizing, and not using funds that you are not prepared to lose. All trading decisions are the personal responsibility of each user, and this information does not constitute an investment recommendation.

Reference

- CMC Markets. Short Selling Bitcoin. Accessed December 6, 2025.

- Ultima Markets. How to Short Bitcoin: 7 Methods. Accessed December 6, 2025.

- Featured Image: Generated by Ai