Crypto Market is Sluggish, Here are 5 Ways to Short Crypto in Indonesia

Jakarta, Pintu News – Selling pressure in the cryptocurrency and stock markets has led many market participants to turn to defensive strategies such as short selling. In Indonesia, one way to short crypto is through licensed platforms such as Pintu Futures, which provides leveraged derivative contracts for various digital assets. By understanding the mechanics, risks, and instruments of shorting, investors can assess the relevance of this strategy in the face of heightened volatility.

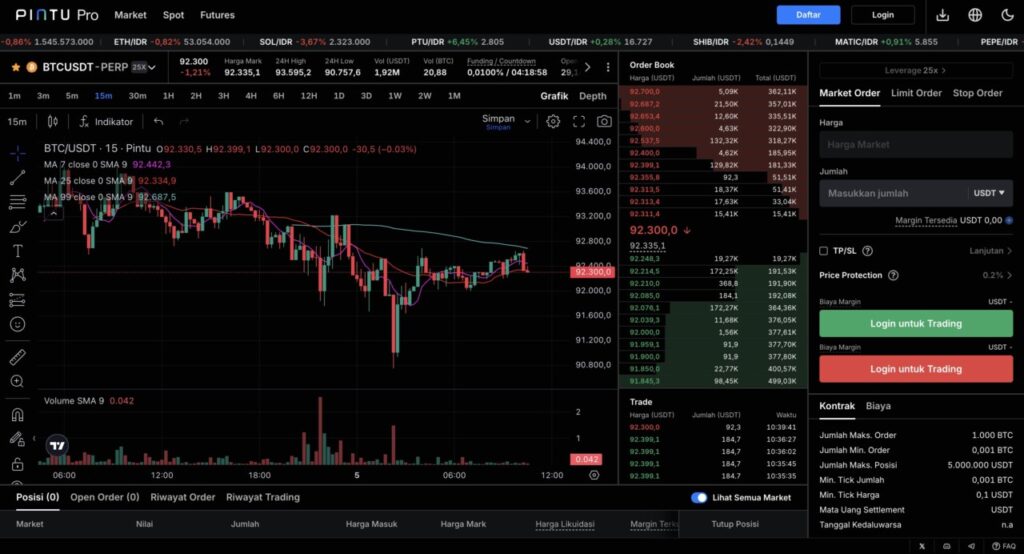

1. Short Through Futures Contracts at the Pintu Futures

Futures contracts are becoming the most common method of shorting cryptocurrencies as they allow opening short positions without the need to own the underlying asset. At Pintu Futures, investors can open short positions on various crypto pairs with leverage to increase exposure to price movements.

These instruments work on a margin mechanism that ensures positions are maintained during volatility. The use of futures provides hedging flexibility, especially when the market is moving in a downward trend.

The margin used in futures contracts is generally smaller than the notional value of the position, thus improving capital efficiency.

For example, a short of $1,000 is equivalent to approximately IDR 16,670,000 at an exchange rate of $1 = IDR 16,670. However, leverage magnifies potential gains as well as losses, making risk management important.

Liquidation may occur if the price moves against the margin threshold. Therefore, technical understanding and setting leverage levels are key components before opening a short position on Pintu Futures. For equity investors, these principles of leverage and risk management also apply, especially when using derivatives such as CFDs or margin trading.

2. Short Using Perpetual Futures at the Pintu Futures

Perpetual futures are a variant of futures contracts with no expiration date, making them one of the most popular shorting tools. At Pintu Futures, these instruments are traded with a funding mechanism (funding rate) that keeps the contract price close to the spot price.

When the market is bearish, investors can open short positions to capitalize on the continuous decline. This instrument provides great flexibility as there is no obligation to close the position by a certain date.

Funding a specific period can be beneficial or detrimental depending on the direction of the position and market conditions. If the market sentiment is negative, the funding rate may favor the short position making the funding cost more efficient.

However, price volatility in perpetual futures can lead to faster liquidation if not accompanied by a prudent margin management strategy. These instruments are best suited for market participants who need long-term flexibility while still having the option of protecting their portfolios from falling crypto prices. The hedging concept is similar to portfolio protection strategies in the stock market when indices are moving in a downtrend.

3. Short Through Leveraged Tokens

Leveraged tokens provide exposure to crypto price movements without requiring direct margin management. For example, a token worth -3x will rise 3 times when the price of its underlying asset falls.

These instruments provide a relatively simple way to short as they do not require personal liquidation calculations. However, leveraged tokens generally have daily management fees and compounding effects that can affect long-term results.

Read also:

In highly volatile market conditions, the performance of leveraged tokens may deviate from their theoretical expectations. As the value is adjusted daily, zigzagging price movements may reduce the effectiveness of the -3x exposure.

These instruments are more suitable for short-term strategies under clear trend conditions. Market participants considering leveraged tokens need to understand these characteristics in order to use them more accurately in shorting scenarios.

4. Short with CFD (Contract for Difference)

Contracts for Difference (CFDs) allow speculation on crypto price movements without owning the asset. These instruments are commonly used on global derivatives platforms that allow leveraged long and short positions.

CFDs offer great flexibility and a transparent fee structure. In the context of going short, profits are made when the price of the cryptocurrency moves down from the point of opening a position.

However, CFDs are not widely available on locally licensed platforms so users should consider regulatory aspects and operational risks. Spreads and financing costs may vary depending on market conditions.

The leverage effect of CFDs also amplifies the risk of liquidation if prices move against you. As such, CFDs are mostly used by experienced market participants who understand the dynamics of international derivative instruments.

5. Short with Options

Shorting with options is done through the purchase of a put option that gives the right to sell an asset at a certain price. When the price of the crypto drops, the value of the put option may increase, making it profitable for the holder.

Options can also be used to protect a portfolio from sudden downturns. They offer a more controlled risk structure as the maximum loss is limited to the premium paid.

Read also:

However, crypto options are not widely available on local platforms and are generally traded on international derivatives exchanges. The value of options is affected by implied volatility so their price can fluctuate even if the spot price does not move significantly.

In addition, options have an expiration date which makes time an important factor in shorting strategies. The combination of price complexity and time sensitivity makes options suitable for market participants who are well versed in volatility analysis.

Conclusion

Short crypto is a strategy that provides negative exposure to cryptocurrency price movements and can be used to capitalize on downtrends. Short strategies are also widely used in the stock market, especially for risk mitigation when indices experience corrections. Futures contracts, perpetual futures, leveraged tokens, CFDs and options have different characteristics so a technical understanding is essential before using them. For Indonesian investors, Pintu Futures and equity investment services such as xStocks can be an integrated solution to manage multi-asset portfolios in dynamic market conditions.

Start Trading Short on the Pintu Futures

Pintu Futures provides secure and regulated access to short crypto through futures and perpetual futures contracts. Featuring leverage, transparent margin mechanisms, and high liquidity, the platform supports both defensive and speculative strategies when the market goes down. Market participants can utilize these features to expand risk management options in dynamic market conditions.

FAQ

What is short crypto?

Short crypto is the strategy of taking a short position in order to make a profit when the price of a cryptocurrency drops; this strategy is done through derivative instruments such as futures or options.

Why is short crypto used when the market is weak?

Short crypto is used to capitalize on downward price trends or protect a portfolio from potential losses when the market goes bearish.

What are the most common instruments used to short crypto in Indonesia?

Futures and perpetual futures contracts are the most common instruments because they are available on platforms like Pintu Futures and have high liquidity.

What are the main risks of short crypto?

The main risks include liquidation due to adverse price movements, funding costs, as well as the complexity of instruments such as options or leveraged tokens.

Is it possible to short crypto without owning the underlying asset?

Yes, most short instruments such as futures, perpetual futures, and CFDs do not require ownership of the underlying crypto asset.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

Disclaimer:

Trading crypto futures involves high financial risk. Be sure to use strict risk management, including stop losses, appropriate position sizing, and not using funds that you are not prepared to lose. All trading decisions are the personal responsibility of each user, and this information does not constitute an investment recommendation.

Reference

- Backpack Exchange. Shorting Crypto: A Beginner’s Guide. Accessed December 7, 2025

- Featured Image: Generated by AI