Ethereum Holds Steady at $3,100 as Exchange Balances Drop 43% — What’s Behind the Decline?

Jakarta, Pintu News – The amount of Ethereum held on centralized exchanges has dropped to a historic low, fueling speculation that there may be a silent shortage of supply in the market.

According to data from Glassnode, the amount of Ethereum on exchanges fell to 8.7% of the total ETH supply last Thursday – the lowest figure since Ethereum launched in 2015. As of Sunday, it was still at a low of 8.8%.

Then, how will Ethereum price move today?

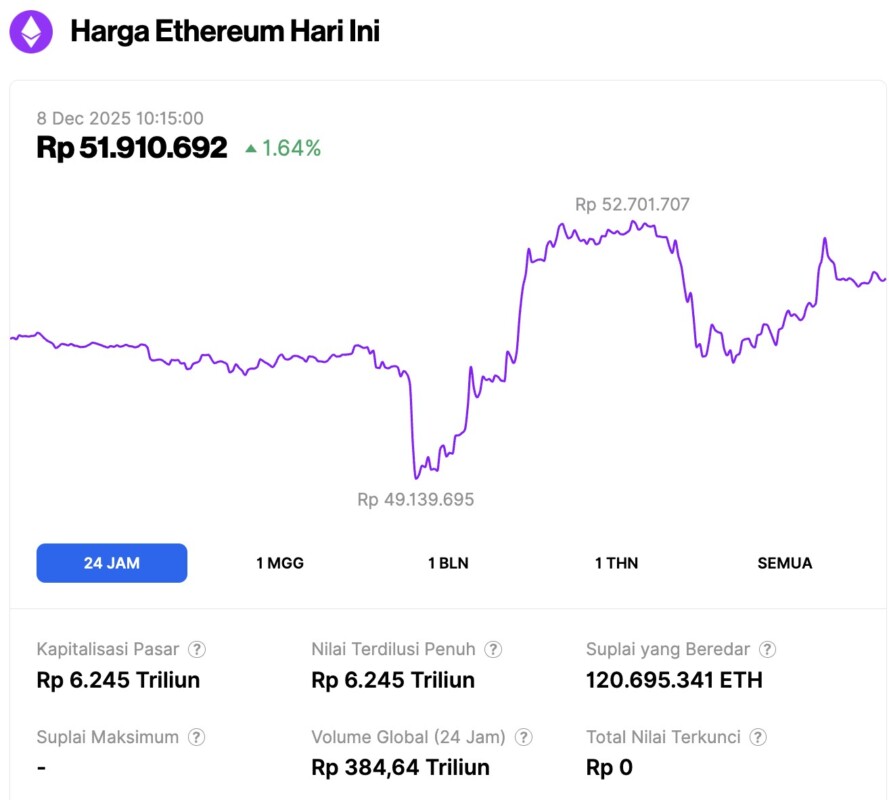

Ethereum Price Up 1.64% in 24 Hours

On December 8, 2025, Ethereum was trading at approximately $3,106, or around IDR 51,910,692—marking a 1.64% increase over the past 24 hours. During that period, ETH had dipped to a low of IDR 49,139,695 and peaked at IDR 52,701,707.

At the time of writing, Ethereum’s market capitalization is estimated at IDR 6,245 trillion, while its 24-hour trading volume has surged by 109% to reach IDR 384.64 trillion.

Read also: Bitcoin Hits $91,000 as Analysts Watch for Signs of a Potential Breakout

ETH balances on exchanges plummet 43% as supply tightens to all-time highs

This sharp decline reflects a 43% drop in Ethereum balances on exchanges since the beginning of July, which coincided with increased institutional purchases of digital assets (DAT) as well as increased activity in the Ethereum ecosystem as a whole.

Macro research platform Milk Road mentions that ETH is “quietly entering its tightest supply state ever”, while noting that Bitcoin balances on exchanges are still much higher at 14.7%.

Analysts attribute this change to a structural shift in how ETH is being used. More and more tokens are flowing into staking, restaking protocols, layer-2 networks, DAT balance sheets, collateralized DeFi positions, as well as long-term self-storage – all of these are purposes that have historically not returned supply back to exchanges.

“Market sentiment is heavy at the moment, but sentiment does not govern supply,” Milk Road writes. “As that gap closes, prices will follow.”

Beyond the supply data, market technical analysts are also starting to see signals that buyers may be starting to take control. Analysts named Sykodelic highlighted the On-Balance Volume (OBV) breakout above the resistance level at the end of last week, although prices are yet to show a similar move.

This divergence, according to him, is a classic sign of “hidden buying power” that sometimes precedes upward price movements.

“This is a sign of buying strength, and usually, the price will follow,” says the analyst, while cautioning that the indicator does not guarantee a specific outcome.

Read also: 3 Crypto RWAs Predicted to be Worth Trillions of Dollars, Why?

He added that overall the current price action “looks bullish”, indicating that ETH is likely to test higher price levels again before experiencing a significant correction.

ETH Holds $3,000 Level as Momentum Increases

Ethereum managed to hold above the $3,000 level for almost a week, although it still faces resistance pressure in the $3,200 range. On December 7, ETH moved sideways around $3,050, reflecting the overall uncertainty of the crypto market.

The ETH/BTC trading pair was also in the spotlight last week after it broke out of a long-term downtrend – a move that some traders took as the first sign of capital flow returning to Ethereum.

Meanwhile, BitMine Immersion Technologies – the current largest corporate Ether holder – continues to aggressively buy despite some top traders predicting further downside potential.

The company bought another $199 million worth of ETH in the last two days, significantly increasing their reserves.

Currently, BitMine controls $11.3 billion worth of Ether, or about 3.08% of the total circulating ETH supply, and is getting closer to their long-term target of controlling 5% of the entire supply.

Last month, market analyst Tom Lee stated that Ether is likely entering the early stages of an explosive growth cycle similar to Bitcoin’s 100x price surge since 2017.

Lee added that the current state of the Ether market resembles Bitcoin’s situation eight years ago – a volatile period that was the start of one of the strongest bull market cycles in crypto history.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. Ether Supply on Exchanges Falls to Record Low, Raising Supply Squeeze Hopes. Accessed on December 8, 2025