Golden Opportunity for Altcoin Investment Amid Bitcoin Domination December 2025!

Jakarta, Pintu News – In the dynamic world of cryptocurrencies, altcoins often seem to lag behind Bitcoin . However, recent technical analysis suggests that there could be a great opportunity in the making for altcoin investors. Although Bitcoin still dominates the market with a 59.6% share, the current conditions could be an ideal window for altcoin accumulation.

Altcoins Remain Sluggish Amid Poor Market Sentiment

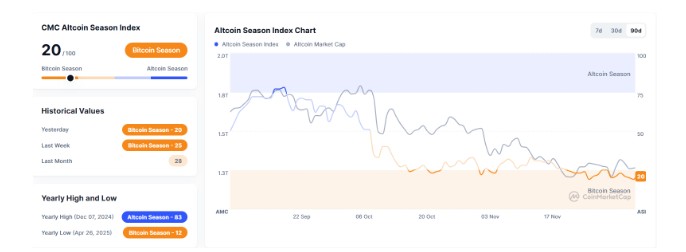

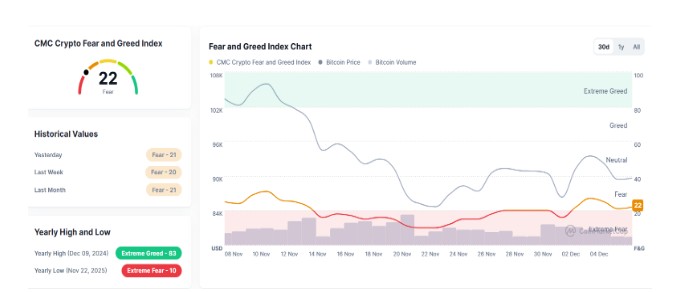

Throughout this year, altcoin performance has not improved and continues to lag behind Bitcoin. Bitcoin’s continued dominance suggests that the capital rotation that usually triggers altcoin seasonality has yet to happen. CoinMarketCap’s Altcoin Season Index is currently at 20, indicating that altcoins are still losing value compared to Bitcoin.

Last year, this index stood at 83, signaling conditions that were very different from the current situation. This instability reflects the worsening market sentiment, where investors seem to prefer caution. This makes it increasingly difficult for altcoins to attract significant investment interest, especially amid broader global economic uncertainty.

Also Read: 5 Important Facts from Bitcoin’s (BTC) Latest Prediction: US$125,000 Target?

CryptoQuant Data Shows High Value Accumulation Window

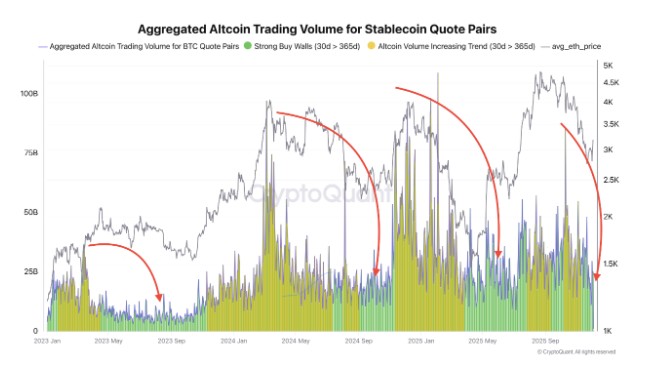

Technical analysis using data from CryptoQuant’s on-chain analytics platform shows that now is a good time to start accumulating altcoins. The altcoin’s 30-day trading volume compared to the annual average shows a decrease, which signals it as a buying zone.

This phase is often a good time to do dollar-cost averaging on certain altcoins. According to analysts, this period of low volume can last for several weeks or even months, giving enough time for investors to gradually build up their positions. This is part of a quieter cycle and often offers the best opportunity to prepare before broader market movements.

Investment Opportunities Amid Bitcoin’s Dominance

Although Bitcoin continues to dominate the market, current analysis suggests that altcoins may not be as bad as they seem. The accumulation window identified by CryptoQuant shows that there are opportunities that should not be ignored. Investors who take advantage of this information could put themselves in an advantageous position ahead of a potential altcoin price rise.

This strategy requires patience and a good understanding of market timing, which can be very rewarding if done correctly. Utilizing these periods of calm for accumulation can be a smart strategy, especially for those looking to diversify their portfolio beyond Bitcoin.

Conclusion

Although the cryptocurrency market currently seems to be dominated by Bitcoin, data and analysis suggest that altcoins may be preparing to make the leap. For investors who are willing to do their research and have patience, this period could be a golden opportunity to accumulate altcoins before the next potential price surge.

Also Read: 10 Ways to Learn Crypto from Zero: Basic Guide to Start Investing Safely

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is Bitcoin and how does it affect altcoins?

A1: Bitcoin (BTC) is the first and most dominant cryptocurrency in the market. Bitcoin’s dominance often affects the performance of altcoins, where if Bitcoin dominates, altcoins tend to be depressed.

Q2: What is the Altcoin Season Index and what does the current score mean?

A2: The Altcoin Seasonality Index is a measure that shows whether the current market is more favorable for Bitcoin or altcoins. The current score is 20, which indicates that the market is more favorable for Bitcoin than altcoins.

Q3: How does the dollar-cost averaging strategy work?

A3: The dollar-cost averaging strategy involves investing a fixed amount in a particular asset at regular intervals, regardless of the asset’s price. This helps reduce the impact of price volatility on the overall investment.

Q4: How long can this period of low volume last?

A4: This period of low volume could last a few weeks to a few months, giving investors time to gradually build up their position in the altcoin.

Q5: Why is it important to do research before investing in altcoins?

A5: Research is important because the cryptocurrency market is highly volatile and risky. Understanding market conditions, trends and technical data can help investors make more informed decisions and reduce the risk of loss.

Reference

- NewsBTC. Altcoins Struggle But Technical Analysis Says a Major Opportunity is Forming. Accessed on December 8, 2025