Ethereum (ETH) at Critical Decision Threshold, Will it Rise or Fall?

Jakarta, Pintu News – Ethereum is trying to break through the critical $3,000 barrier again, but the effort seems to be stymied. After briefly rising, the ETH price is approaching this support area again, indicating uncertainty in the market. Although bullish momentum is starting to return, investor impatience could hamper the recovery if a clear direction does not emerge soon.

Ethereum Investors May Sell Their ETH

The Long-Term/Short-Term MVRV Difference indicator is approaching the neutral line, signaling a possible change in profit dominance between long-term and short-term holders. This metric measures whether long-term holders (LTH) or short-term holders (STH) are realizing more profits.

For Ethereum, a drop below the neutral line means that STH has the majority of its profits unrealized. This change is important because STH has historically been quick to sell at the first signs of weakness.

If they start taking profits near $3,000, ETH could face renewed selling pressure. This behavior often hampers previous recovery attempts, making sentiment fragile despite broader bullish signals.

Read also: PIPPIN Price Increase Reaches 150%, Will it Continue?

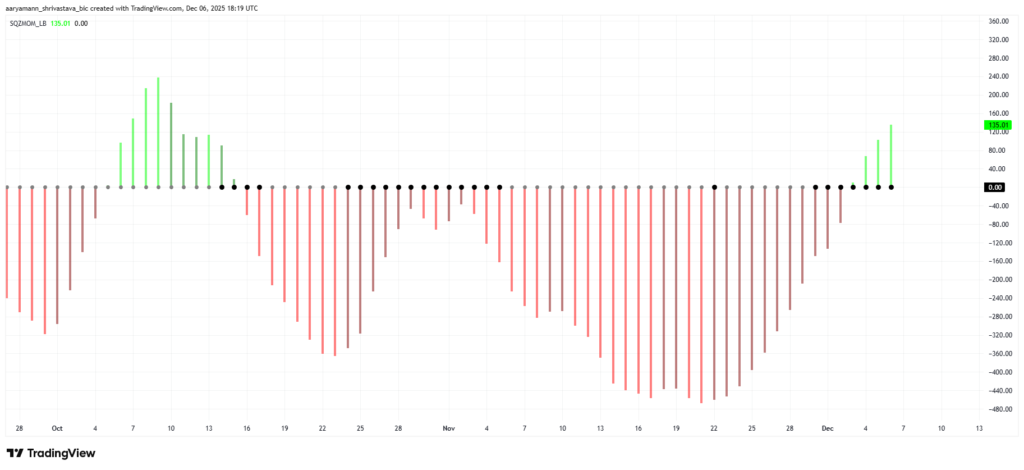

Momentum Squeeze Indicator Adds Complexity

ETH is currently experiencing a squeeze buildup, which occurs when volatility tightens and momentum compresses. This condition usually precedes a strong directional move. The histogram shows that bullish momentum is strengthening, suggesting that once the squeeze is released, a price acceleration may follow.

If bullish momentum continues to grow during this period, ETH may benefit from an upward volatility expansion. This setup has preceded rallies in previous cycles, although confirmation depends on market participation and whether buyers enter at $3,000.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (8/12/25)

ETH price may fall again

Ethereum is trading at $3,045 and remains above the critical $3,000 support level. Over the past few days, ETH has moved closely around this zone, signaling uncertainty among traders as market cues shift. Mixed signals suggest that ETH may continue to move flat near $3,000 in the short term.

A decline triggered by STH profit-taking or broader market skepticism could push Ethereum towards $2,762 before stabilizing. However, if bullish momentum strengthens alongside favorable macro conditions, ETH could rise past $3,131 and target $3,287. A clean break above this level would invalidate the bearish outlook and set the stage for a broader recovery phase.

Conclusion

With various dynamics at play, the future of Ethereum price remains uncertain. Investors and traders should pay attention to key indicators and market sentiment to anticipate the next price movement. Whether this will be a turning point for Ethereum or just a temporary drag, time will tell.

FAQ

What is Ethereum (ETH)?

Ethereum (ETH) is a blockchain platform that allows developers to build and run decentralized applications and smart contracts.

Why is the Ethereum (ETH) price on the verge of a critical decision?

Ethereum (ETH) price is trying to break the $3,000 barrier, with market indicators showing uncertainty, which could affect the next price direction.

What is the MVRV Variance Indicator?

The MVRV Difference Indicator measures the difference in realized gains between long-term and short-term holders, which may influence their buying or selling decisions.

How do current market conditions affect the price of Ethereum (ETH)?

Uncertain market conditions and mixed signals from various technical indicators have Ethereum (ETH) price moving flat and facing potential downside.

What could happen if Ethereum’s (ETH) bullish momentum continues to grow?

If the bullish momentum continues to grow, Ethereum (ETH) may experience price increases, especially if supported by favorable macroeconomic conditions and active market participation.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Ethereum Price Mixed Signals. Accessed on December 8, 2025

- Featured Image: FX Empire