Ethereum Holds Steady at $3,100 as Rising Channel Points to Potential $4,000 Breakout

Jakarta, Pintu News – Ethereum whales have opened massive long positions on Ethereum totaling $425.98 million – a move seen as a bold bet that the price decline phase is over.

Then, how will Ethereum price move today?

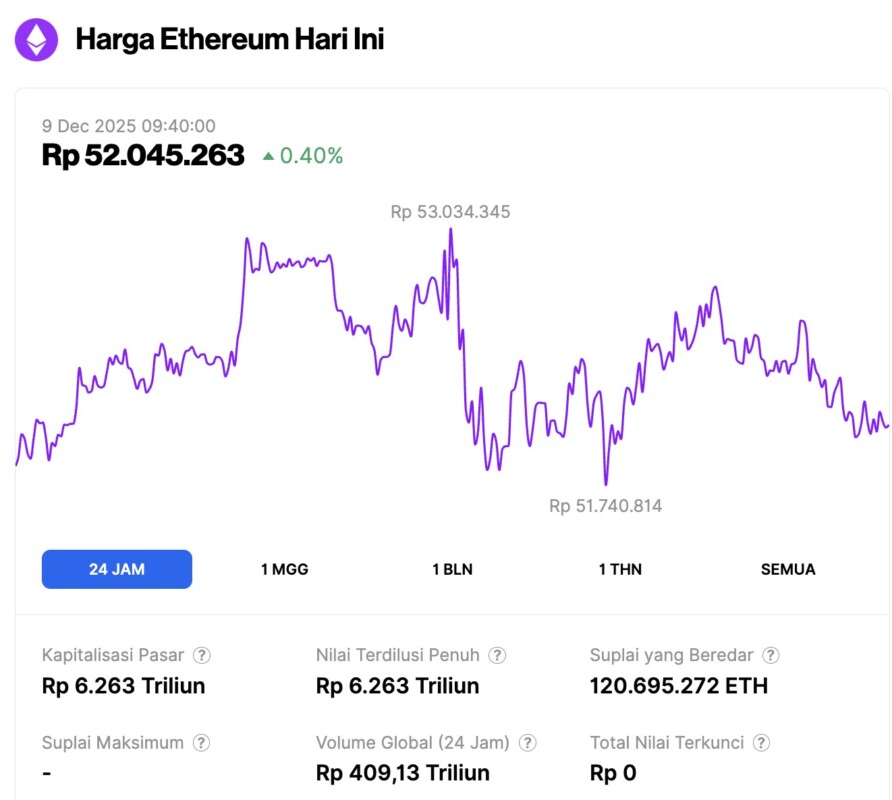

Ethereum Price Up 0.40% in 24 Hours

On December 9, 2025, Ethereum was trading at approximately $3,107, or around IDR 52,045,263, marking a 0.40% increase over the past 24 hours. Within that timeframe, ETH touched a low of IDR 51,740,814 and climbed to a high of IDR 53,034,345.

At the time of writing, Ethereum’s market capitalization is estimated at IDR 6,263 trillion, while daily trading volume has risen by 6%, reaching IDR 409.13 trillion over the last 24 hours.

Read also: 2 Crypto Predicted to Surge in 2026 According to ChatGPT Analysis

Top Traders Open New Long Positions on Ethereum (ETH)

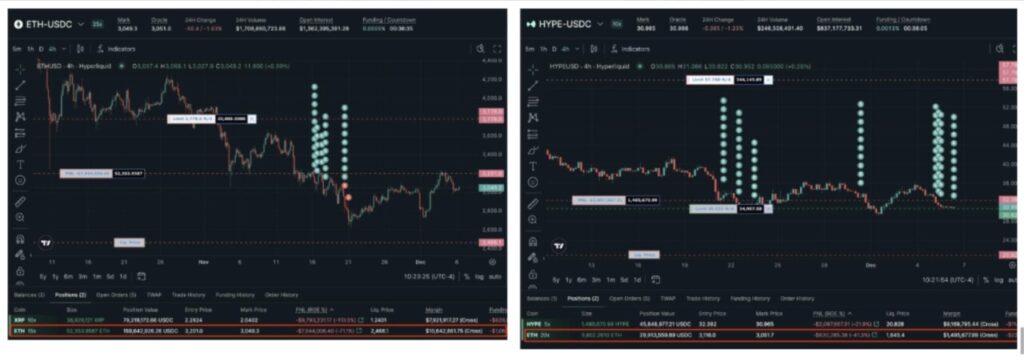

Data from Cointelegraph Markets Pro and TradingView shows that the ETH/USD pair is trading at $3,140 – up 20% from the low of $2,621 hit on November 21. With prices holding above $3,000, Ethereum is giving investors renewed hope ahead of an important moment of volatility in the market.

The Fed’s rate cut decision is scheduled for Wednesday, and the market is currently pricing in a 25 basis point cut.

While market participants wait for the next big move trigger, attention is on three smart whales who are known to have impressive track records. The trio has opened long positions totaling 136,433 ETH – worth approximately $425.98 million – according to data from Lookonchain.

One whale, BitcoinOG (with the account “1011short”), has a long position worth $169 million. The second whale, Anti-CZ, has a long exposure of $194 million. Meanwhile, a third whale, known as pension-usdt.eth, is long 20,000 ETH, or about $62.5 million at current prices.

In addition to these three whales, Arkham Intelligence also recorded another whale, 0xBADBB, who used two different accounts to open long positions totaling $189.5 million in ETH.

This move coincides with BitMine continuing to add to its Ethereum holdings. Last week, the company purchased an additional $199 million worth of ETH, bringing its total holdings to 3.73 million ETH – worth $13.3 billion – making it the largest corporate ETH holder today.

Read also: Pi Network Launches AI Tools to Accelerate Migration and KYC

All of this activity reinforces the narrative that whales and large institutions see the ETH price rebound above $3,000 as an attractive entry point for accumulation.

Ethereum Up Channel Targets ETH Price at $4,000

ETH price movement has formed a classic ascending triangle pattern on the daily chart. The breakout of the medium-term downtrend line on Tuesday strengthens the chances of a sustained recovery.

This pattern will be confirmed if the price manages to break the triangle’s resistance line at the $3,250 level. If this breakout occurs, then the price of Ether could potentially rise as high as the maximum distance between the triangle’s trend lines – i.e. reach a target of around $4,020, or an increase of more than 28% from the current price.

The RSI (Relative Strength Index) indicator is also showing strengthening momentum, rising to the 50 level from an oversold condition of 28 on November 28 – a positive signal that buying pressure is picking up.

However, this recovery could potentially be held back by the strong resistance zone in the range of $3,350-$3,550, where the 50-day SMA and 100-day SMA are currently located. After that, the next challenge is the major resistance at the 200-day SMA around $3,800.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Ethereum ‘smart’ whales open $426M long bets as ETH price chart eyes $4K. December 9, 2025