Cardano Price Prediction: Traders Watch Critical Levels While Waiting for “Good Day” Signal

Jakarta, Pintu News – Cardano is entering a crucial phase as traders monitor important technical levels and changes in derivatives activity, while the community awaits a possible update from its founder, Charles Hoskinson.

Currently, ADA is trading around $0.43 after several months of downward pressure, but a number of indicators suggest that the market may be preparing for a change in direction.

Although prices remain below the major moving averages, interest in futures and on-chain activity continues to show strong engagement from traders. In addition, market watchers expect a new direction to emerge as sentiment recovers from the recent uncertainty.

Bearish Structure Persists as Key Resistance Limits Upside

ADA is still showing a defensive pattern on the four-hour chart. The price remains below the 200 EMA around $0.475, which limits the potential for continued gains.

Read also: XRP Holds 2021 Highs as Technical Indicators Point Toward $20 Bullish Target

Moreover, several failed attempts to break this level indicate persistent selling pressure. The 0.236 Fibonacci level at $0.4468 also strengthens this resistance zone.

Every time the price approaches that area, the selling pressure increases again. Currently the market is moving in a narrow range between $0.423 and $0.4468, reflecting indecision and directional uncertainty. However, if the price manages to break clearly above $0.4468, the short-term outlook could change and open up opportunities towards $0.49 to $0.53.

Support remains strong around $0.42. This level has been tested several times and managed to prevent a deeper decline. If this zone is broken to the downside, there is a potential drop towards the swing low at $0.37. Therefore, many traders consider $0.42 as a crucial boundary that determines the next direction.

In addition, the EMAs are currently closing in on each other and narrowing around the current price, a pattern that is often a sign of strong directional movement in the near future.

Open Interest Declines, but Still High

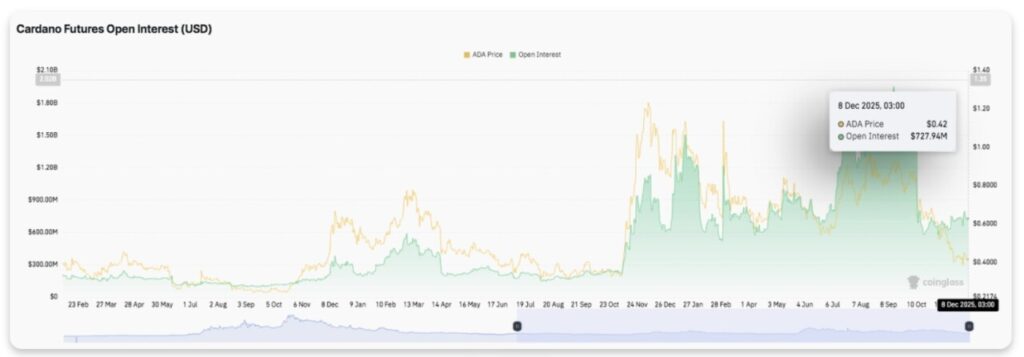

Activity in the futures market showed strong derivatives participation throughout the year. Open interest had jumped from under $300 million to over $1.5 billion during the major market moves. However, this figure dropped to $727 million on December 8.

This decline reflects the reduced use of leverage after a period of high volatility. Even so, the current level of open interest is still significantly higher than at the beginning of the year.

This means that traders remain active even though the momentum is starting to weaken. This pattern indicates a strong interest in the next potential ADA breakout.

Spot Flows Show Weak Confidence as Outflows Continue

Fund flows in the spot market continue to show consistent outflows, signaling weak accumulation. The latest data shows net outflows of around $279,000. In addition, the repeated appearance of red bars on the chart indicates continued distribution in recent months.

The absence of strong inflows reflects weakening confidence from long-term holders. This trend is also in line with the overall bearish market structure.

However, attention is now on the latest message from Hoskinson which hints at “good days.” Many traders are looking forward to new updates that could affect market sentiment.

Read also: Bitcoin Slips to $90,000, But Analysts See Path to $124,000 Ahead

In addition, ADA’s increasingly compressed price structure suggests that the market is preparing to move. Therefore, the coming sessions will determine whether ADA will break the resistance or return to test deeper support.

Cardano (ADA) Technical Outlook

Key levels for Cardano remain clearly visible as the market enters a decisive phase:

Potential Upside Levels:

- $0.4468 – Fibonacci Level 0.236

- $0.475 – Exponential moving average (EMA) 200

- $0.4940 – Fibonacci Level 0.382

If the price manages to break through this resistance zone, then the next target is at:

- $0.5321 – Fibonacci Level 0.5

- $0.5703 – Fibonacci Level 0.618

Potentially Declining Levels:

- $0.423-$0.426 – Local support zone

- $0.42 – Key psychological support

If the price drops deeper, it is likely to test: - $0.37 – Swing main low

Critical Resistance:

The 200 EMA at $0.475 is an important boundary that ADA needs to break in order to recover medium-term momentum. As long as this level has not been successfully broken, any upside attempts are likely to be stifled.

Currently, Cardano is in a descending pattern with a descending compression structure, where the EMA is starting to narrow around the current price. This is often a sign of a big move in the near future, either up or down.

Will Cardano Rise?

Cardano’s short-term trend depends heavily on buyers’ ability to hold the $0.42 zone, long enough to challenge the resistance at $0.4468-$0.475. Technical compression patterns and increased derivatives activity suggest the potential for high volatility in the near term.

If the bullish momentum strengthens and inflows start to improve, ADA could attempt a recovery towards $0.4940, potentially even to $0.5321. However, if $0.42 fails to hold, the current base structure is at risk of breaking and paving the way for a retest at $0.37.

For now, ADA is at a crucial point. Market confidence and the successful re-break of the 200 EMA will determine whether the next move is likely to continue the trend or reverse.

FAQ

What is Cardano (ADA)?

Cardano is a blockchain platform developed with a research-based approach, which focuses on security and scalability. Its digital currency, ADA, is used for various transactions and services within the Cardano network.

Who is Charles Hoskinson?

Charles Hoskinson is the co-founder of Cardano and is also involved in the development of Ethereum . He is a key figure in the cryptocurrency industry and often provides updates on Cardano’s development.

What is the 200-day Moving Average (200-EMA)?

The 200-day Moving Average (200-EMA) is a technical indicator that calculates the average closing price of an asset over the last 200 days. It is often used to determine long-term price trends.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Cardano Price Prediction: Traders Eye Critical Levels as Market Awaits Hoskinson’s Good Day Signal. Accessed on December 9, 2025