These 3 U.S. Stocks Just Caught Ali Martinez’s Attention — Here’s Why They Might Rally

Jakarta, Pintu News – Amidst the fast-moving dynamics of the crypto and stock markets, analysts’ attention is no longer limited to just one asset. One of them is Ali Martinez, a crypto analyst who is known to be sharp in reading technical signals, has now started highlighting several popular stocks from the United States.

Using analytical approaches such as TD Sequential and Fibonacci retracement, Ali identified the potential for significant moves in three major stocks. Do these three really have the potential to surge in the near future? Let’s take a closer look.

Circle

Technical analyst @ali_charts highlights an important signal from the TD Sequential indicator on shares of Circle Internet Group, Inc. traded on the NYSE.

Read also: What Is Stock Investing?

In his December 9, 2025 tweet, he noted that the indicator managed to accurately mark a local bottom at the end of November, indicated by a red “9” and an up arrow, which is a signal of a potential reversal from a downtrend to an uptrend.

After that signal appeared, the price of $CRCL experienced a significant rally, rising from around $71 to peak above $88 in just a few trading sessions. But now, a green “9” signal with a downward arrow has appeared – signaling potential selling pressure or price correction in the near future, according to the TD Sequential indicator.

Price is currently at $83.60, down -2.36% from the previous day, and right around the 78.6% Fibonacci retracement level ($82.65). This is an important technical level: if the price breaks below this level, it could strengthen the bearish signal and open the door for a deeper correction towards the next support area.

Tesla

Tesla stock seems to be entering a correction phase after experiencing a significant rally over the past few weeks.

In the daily chart (1D) uploaded by analyst @ali_charts on December 9, 2025, it is clear that the TD Sequential indicator has generated a sell signal (“9” green with a black downward arrow) right near the price peak in the $458 area.

Following the signal, Tesla’s price immediately came under downward pressure, closing at $443.16, down -2.60% on the day. This indicates that a potential short-term trend reversal is underway. The 78.6% Fibonacci retracement level around $441 is currently the closest support area being tested.

If the selling pressure continues and the price fails to hold above the $441 level, then the next correction target is expected to be around $430, which is the 61.8% Fibonacci retracement area ($428.16) – often considered a key zone in technical pullback movements.

In addition, the S13 (Setup 13) signal that appeared earlier shows that the price has started to enter the overbought area, reinforcing the potential for further correction.

Read also: Real World Assets (RWA) Tokenization Narrative Potentially Could be the Main Driver in 2026

Netflix

Netflix ($NFLX) shares are in a sharp downward phase after failing to maintain an important support level at the 200-day Moving Average (MA-200). In a chart uploaded by analyst @ali_charts, the price is currently at $95.95, down -4.28% in one trading day.

The technical pattern shows that the long-term uptrend that started in mid-2022 has now been broken, marked by the breakdown of the ascending channel that previously supported the price for the past two years.

This downward break opens up room for a deeper correction towards the 78.6% Fibonacci retracement level around $85, which is also an important psychological target (pre-split $850).

This level is now a reasonable target in the short to medium term if the selling pressure continues. This correction is also reinforced by the symmetrical breakdown pattern and volume supporting the downtrend, strengthening the bearish signal on NFLX stock.

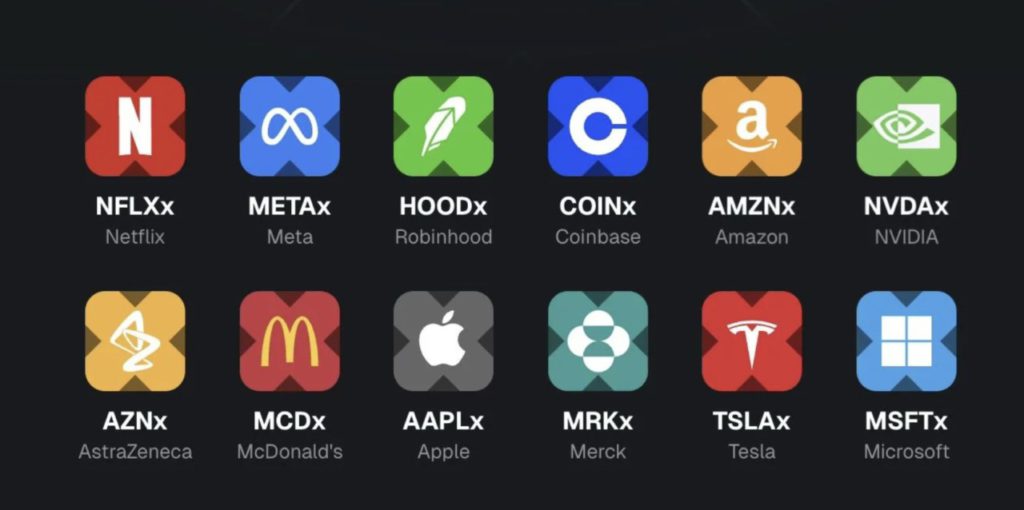

Trading US Stock Tokens on the Door

Imagine being able to buy shares of big companies like Nvidia , Apple , and Amazon in token form for just a few thousand dollars. The good news is that you can now buy/sell tokenized US stocks from xStocks and Ondo at Pintu.

By leveraging blockchain technology, you can now enjoy a faster settlement process for tokenized US stocks, more affordable start-up capital, and a more global investment experience.

Trade on the Door Now!

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Ali Martinez. Accessed on December 10, 2025