Bitcoin Price Prediction: Short-Term Holder Behavior Could Block the Path to $100,000

Jakarta, Pintu News – The latest Bitcoin price action shows continued weakness as the asset struggles to find direction amid weak macro signals, resulting in a neutral-to-bullish prediction.

The lack of momentum has seen BTC continue to decline over the past few days. However, the Federal Open Market Committee’s (FOMC) expected decision to cut interest rates by 25 basis points on Wednesday could be the trigger for a change in sentiment.

Whether or not this will be a catalyst depends largely on the behavior of short-term holders.

Bitcoin Holders Can Be a Challenge

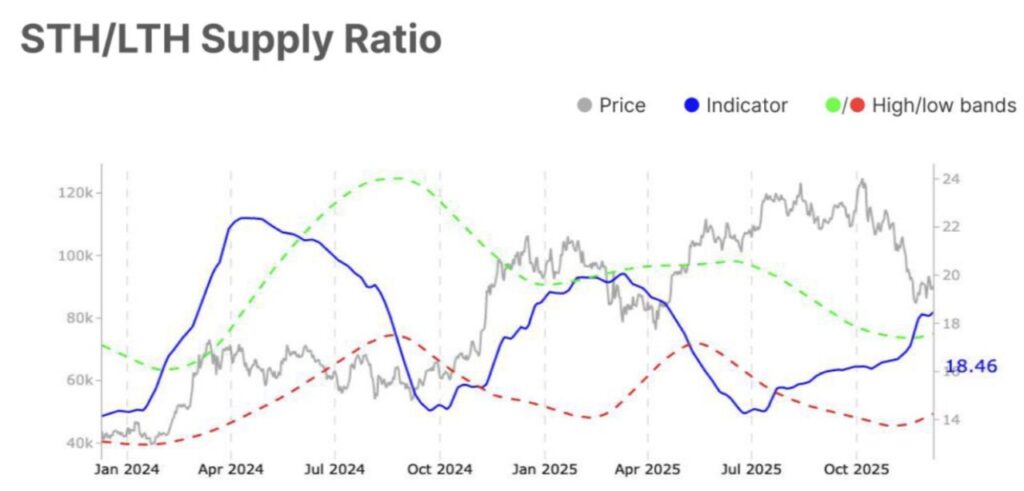

The Supply Ratio between Short Term Holders (STH) and Long Term Holders (LTH) recently rose from 18.3% to 18.5%, crossing the upper limit of 17.6%. This rise indicates the increasing dominance of short-term holders in Bitcoin’s supply distribution.

Read also: Altcoin Season Begins? Analysts Predict ETH/BTC Chart to Resemble 2017 Bull Run

Their presence magnifies speculative activity, which on the one hand can increase liquidity, but also has the potential to create sharper daily price fluctuations. This shift signals a market that is prepared for volatility if conditions change rapidly.

This higher ratio also indicates that short-term holders now have more influence over Bitcoin’s price movements in the short term. Their tendency to sell at a profit often limits the price’s recovery potential.

If the FOMC rate decision triggers a rally, STH’s behavior will determine whether the momentum can continue or fade away.

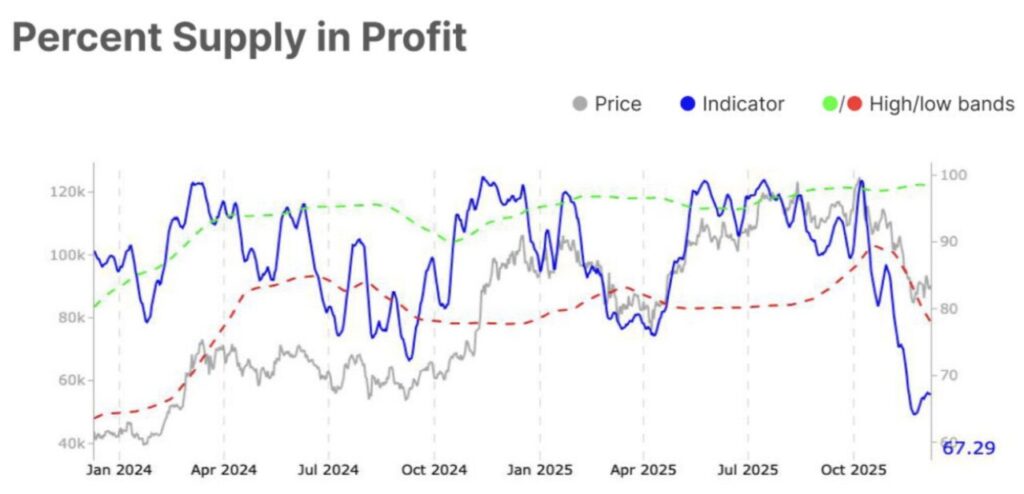

Bitcoin’s Percent Supply in Profit increased from 66.5% to 67.3%, up only 1.2%. While this movement is positive, the figure is still well below the 98.4% upper limit commonly seen in strong bull market phases. This indicates that most of the supply is still below the purchase price, reflecting a cautious market mood rather than excessive optimism.

This low level of profitability is in line with early-stage accumulation behavior. Investors appear selective and wait-and-see, waiting for stronger macroeconomic signals before going deeper.

If the interest rate cut by the FOMC increases interest in risky assets, this profitability gap opens up opportunities for further growth and stronger price movements.

BTC price awaits a breakthrough

Bitcoin price is currently at $90,399 at the time of writing, just below the downtrend line that has lasted for a month and a half. BTC is looking to turn the $90,400 level into a support level, which would be the first step to reversing the downtrend.

Read also: Bitcoin Price Rises to $92,000 Today: Analysts Watch for Potential BTC Spike Ahead of Christmas!

If macro conditions are favorable and the rate cut is able to restore broad market optimism, BTC could potentially experience a sharp rebound. A clean bounce off the $90,400 level could prompt a retest of the $95,000 level.

If the resistance is successfully broken, the path to the long-awaited $100,000 target will be wide open, confirming Bitcoin’s price predictions.

However, if short-term holders choose to sell when the price rallies, Bitcoin could struggle to maintain the upward pressure. A rejection from the $95,000 level or failure to break the downtrend could cause BTC to weaken again towards $86,822, which would invalidate the bullish scenario.

FAQ

What is the short-term holder to long-term holder supply ratio (STH to LTH Supply Ratio)?

The short-term holders to long-term holders supply ratio (STH to LTH Supply Ratio) is a metric that measures the percentage of Bitcoin supply held by investors who hold their assets for less than one year compared to those who hold for more than one year.

Why would a short-term increase in holders negatively affect the price of Bitcoin?

Short-term holders tend to sell their assets faster, which can increase volatility and decrease price stability, as they are often looking for quick profits rather than long-term investments.

At what price is Bitcoin currently trying to break through resistance?

Bitcoin is currently trying to break through the resistance at $90,400, which is a necessary step to reverse the ongoing downtrend.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Prediction: Recovery Difficult. Accessed on December 10, 2025