5 Ways to Short Crypto with Small Capital in a Bearish Market

Jakarta, Pintu News – The crypto market is known for its extreme volatility which presents opportunities during both uptrends and downtrends. When the market enters a bearish phase, traders do not have to passively wait for prices to recover. A short selling strategy is an alternative to keep looking for profit opportunities from falling cryptocurrency prices. With the support of derivative platforms such as Pintu Futures, short strategies are now increasingly accessible to traders with small capital.

1. Short Crypto Using Low-Leveraged Futures

Crypto futures allow traders to open short positions with relatively little capital through the leverage system. On many derivatives platforms, including Pintu Futures, low leverage such as 2x to 5x is a safer option for beginners.

To illustrate, a capital of USD 100 or approximately IDR 1,663,300 with 3x leverage can control a position worth IDR 4,989,900. This approach helps limit the risk of liquidation compared to using high leverage.

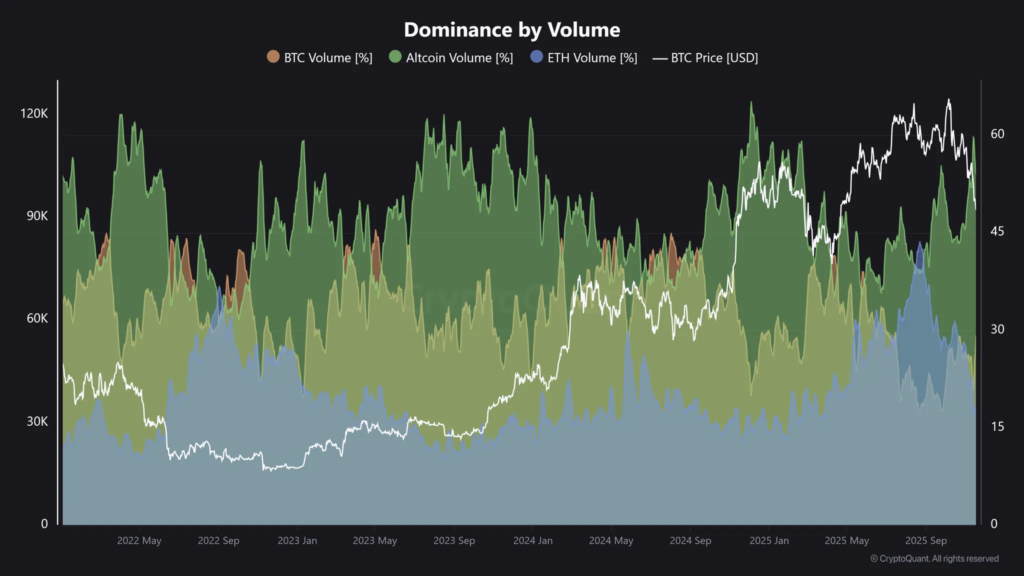

Industry data for 2025 shows that more than 60% of crypto trading volume comes from the futures market, reflecting strong liquidity. High liquidity is important for efficient short execution without large slippage. However, traders must still take into account their margin and potential losses if the price moves against them. The use of stop-losses is a crucial element of this strategy.

2. Utilize Perpetual Contracts for Short-Term Shorts

Perpetual contracts are crypto derivative instruments with no expiration date that are widely used during bearish markets. The minimum margin on this contract is generally around 5-10 USDT or around Rp83,165-Rp166,330, making it suitable for small capital.

These instruments are widely used for short-term shorts due to their flexibility. According to Plisio, by 2025 more than 80% of crypto derivative transactions will be perpetual contracts.

While attractive, traders need to be mindful of the funding rate which can add costs if positions are held for too long. A positive funding rate means that short traders pay long traders, reducing profits. Therefore, a quick short strategy with realistic targets is recommended. Perpetual contracts are ideal for active traders who are disciplined about monitoring positions.

Also read: 3 Altcoins to Pick This Weekend: KTA, SOL, and LINK

3. Short Crypto Through Margin Trading

Margin trading allows traders to borrow cryptocurrency assets to sell and then buy them back at a lower price. Typically, the initial margin required is around 20-25% of the total position. This means that with a capital of USD 50 or around Rp831,650, a trader can open a position worth Rp3.3 million. This mechanism opens up short opportunities despite limited capital.

However, margin trading comes with daily interest charges. Investopedia data shows that crypto margin interest ranges from 0.01% to 0.1% per day, depending on the asset and platform. If positions are held for too long, this fee can eat into profits. Therefore, margin trading is more suitable for shorts with short duration and clear targets.

4. Short High Volatility Altcoins

Altcoins tend to experience deeper declines than Bitcoin or Ethereum during bear markets. CoinGecko data shows many altcoins corrected 20-40% in just a few days during the market downturn phase. This condition opens up short opportunities with the potential for high returns despite small capital. Altcoins are often targeted by aggressive traders when market sentiment worsens.

However, high volatility also means high risk. A quick rebound of 10-15% in a single day is not uncommon in the cryptocurrency market. Without a stop-loss, a short position can quickly turn into a loss. Therefore, selection of liquid altcoins and strict risk management are highly recommended.

Read also: Crypto ETFs in the Spotlight: XRP, SOL, DOGE, LTC, and HBAR Potentially Rally

5. Position Sizing and Stop-Loss Discipline

Risk management is the most important factor when short crypto with small capital. Many practitioners argue that the maximum risk is 1-2% of the total capital per transaction. With a capital of Rp1,000,000, the ideal risk per trade is only around Rp10,000-Rp20,000. This approach helps maintain account viability in the long run.

According to Plisio, 2025 trading statistics show that traders who consistently use stop-losses have a higher account survival rate than those who do not. Stop-losses help avoid huge losses due to sudden price spikes. In a crypto bear market, discipline is often more decisive than the accuracy of price predictions. Simple but consistent strategies tend to be more sustainable.

Conclusion

Short crypto in a bear market can be an effective strategy for small-cap traders with the right approach. Futures, perpetual contracts, margin trading, and short altcoins offer different opportunities with their own risks.

However, market data and experience show that risk management is the key to success. With low leverage, disciplined stop-losses, and an understanding of the instrument, traders can capitalize on bearish trends without excessively sacrificing capital.

FAQ

What is short selling in crypto?

Short selling is a trading strategy where a trader borrows cryptocurrency assets to sell in the hope of buying them back at a lower price, thus making the difference in profit when the price drops.

Can small capital be used to short crypto?

Yes, many platforms allow short crypto with small capital through instruments such as CFDs or perpetual futures with leverage, although high risks remain.

What are the common methods used to short crypto?

Some of the commonly used methods include futures, margin trading, leveraged tokens, and CFDs that allow you to profit from falling prices without owning the underlying asset.

How is risk management when short crypto?

Risk management includes the use of stop-losses, small position sizes, and close market monitoring to prevent large losses due to adverse price movements.

Is short selling suitable for beginners?

Short selling strategies are usually more suitable for traders who have experience with crypto market volatility and understand the risks of leverage before getting involved.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Plisio. How to Short Sell Crypto: A Beginner’s Guide to Profiting in Bear Markets. Accessed December 14, 2025

- Featured Image: Generated by AI