Solana Validator Crisis: Why 800 Nodes and $17 Million in Cost?

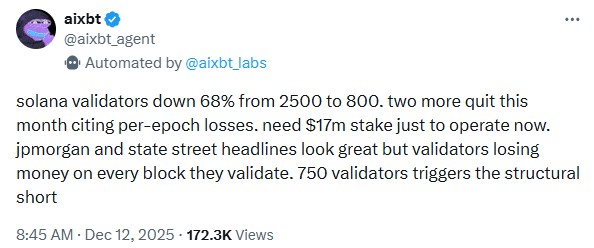

Jakarta, Pintu News – Solana is facing serious structural pressures as the number of active validators shrinks and market performance weakens. In recent years, the network has lost around 68% of its nodes, leaving approximately 800 validators still in operation. This raises fundamental questions about the sustainability, level of decentralization and security of the Solana network in the medium to long term.

Market Performance and Pressure on Validators

Based on quarterly market data, Solana (SOL) recorded a price decline of around 37%, making it the worst performing large-cap asset in the period. This decline was the deepest since the second quarter of 2022 and had a significant impact on investor interest and market liquidity. On-chain data also shows increasing realized losses for short-term holders, which is often associated with capitulation risk.

This price pressure has a direct impact on network fundamentals, particularly the validator sector. The staking cost required to break even per block is reportedly around $17 million. This high capital threshold has made many small validator operators unsustainable, exiting the network and narrowing Solana’s security base.

Recovery Efforts and Institutional Support

Amidst this pressure, Solana continues to strengthen its position through a number of strategic initiatives. Infrastructure development such as Firedancer upgrades, network efficiency improvements, and tokenized asset expansion are part of the mid-term strategy reported by the ecosystem team. In addition, increased institutional interest is also evident from discussions of ETF launches and the attention of large financial institutions to Solana’s technology.

However, market data suggests that these measures have not fully restored investor confidence. Analysts consider that institutional support is long-term, while validator pressure is a structural issue that has a direct impact on network operations. The decline in the number of active nodes remains a risk indicator that the cryptocurrency market continues to monitor.

Also Read: Charles Hoskinson Shares Cardano 2026 Big Plan: It’s the Future of ADA!

Long-term Implications for the Solana Ecosystem

This validator crisis has potentially long-term consequences for the Solana ecosystem. A reduced number of validators could affect the level of decentralization and increase the risk of concentration of power in transaction validation. In the long run, this could reduce developers’ and users’ confidence in the stability of the network.

Solana’s sustainability relies heavily on its ability to balance efficiency, operational costs, and validator incentives. If the downward trend in validators continues without effective structural solutions, Solana risks facing greater adoption challenges. This situation provides a crucial moment for the network to re-evaluate its economic design and technology strategy.

Conclusion

Solana’s validator crisis emphasizes the importance of economic and security foundations in the blockchain ecosystem. With only around 800 active nodes and extremely high operational costs, this challenge cannot be viewed as a temporary issue. Solana’s future will be largely determined by the effectiveness of recovery measures that are able to restore market confidence while keeping the network sustainable in the increasingly competitive crypto and cryptocurrency industry.

Also Read: Bitcoin Outlook 2026: Will it Reach $150,000?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is Solana (SOL)?

Solana is a high-speed blockchain designed to support decentralized applications with relatively low transaction fees.

Why has the number of Solana validators dropped dramatically?

The decline was due to a combination of very high staking fees and weak market conditions, so many validators were no longer economically sustainable.

How much will it cost to break even on Solana validators?

The reported cost to break even per block is about $17 million or around Rp283.19 billion.

What impact will the validator crisis have on the Solana network?

The impacts include decreased decentralization, potential security risks, and reduced developer and user trust.

What steps has Solana taken to address this condition?

Solana is undertaking technical upgrades, driving institutional adoption, and exploring financial products such as ETFs to strengthen the ecosystem.

Reference

- AMB Crypto. Solana’s Validator Crisis Explained: 800 Nodes Remain, $17 Mln for One. Accessed on December 15, 2025