Bitcoin Flows to Exchanges Shrink: A Red Flag for BTC Prices?

Jakarta, Pintu News – Recent analysis suggests that the decline in Bitcoin exchange activity could be a danger signal for price stability in the market. According to CryptoQuant contributor XWIN Research Japan, the sharp decline in Bitcoin flows between exchanges has reduced internal market liquidity. This increases the risk of sudden and large price movements even without heavy selling pressure.

Exchange Liquidity Starts to Dry Up

Since early December, Bitcoin has flattened out between the $80,000 to $94,000 range after experiencing a decline from its October peak of nearly $126,000. While this range-bound behavior seems constructive, on-chain data reveals a more fragile story.

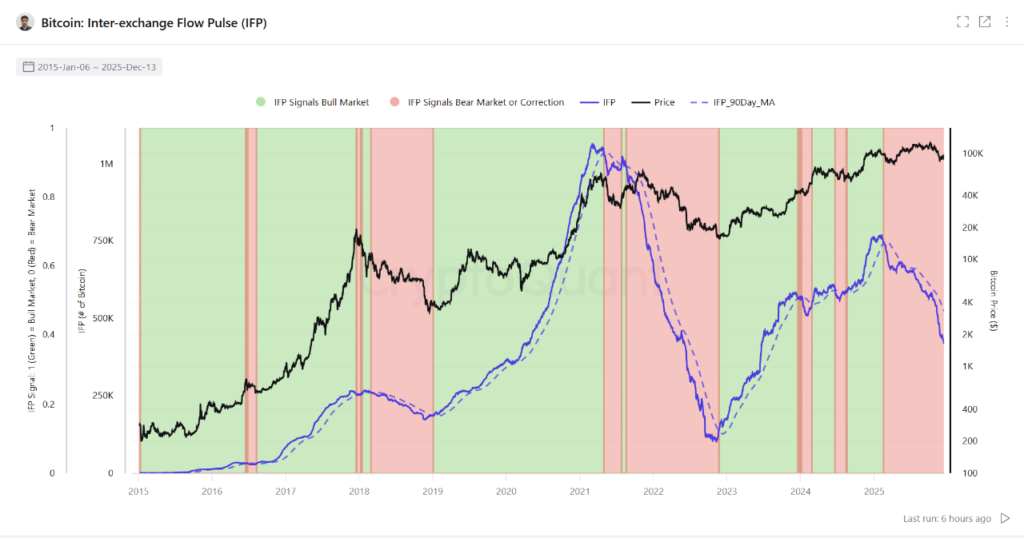

XWIN highlights the Inter-Exchange Flow Pulse, a metric from CryptoQuant that tracks Bitcoin flows between exchanges, which is now showing red as an indication of slowing capital flows between trading platforms. When capital flows freely between exchanges, arbitrageurs favor deep order books and stable prices.

However, liquidity decreases when such flow decreases. As momentum builds, even small trades can start to move prices, increasing slippage and causing sharper price fluctuations.

Also read: 7 Big Token Unlocks Coming as BoJ Prepares to Raise Interest Rates

Derivative Data Shows Adjustment, Not Panic

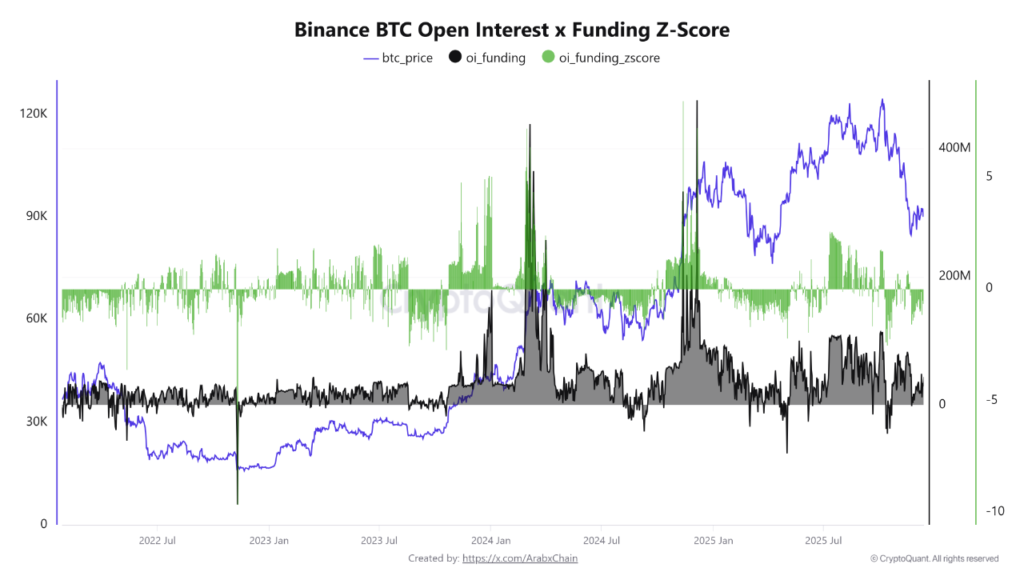

Separate data from another CryptoQuant contributor, Arab Chain, confirms that the market is cooling, not collapsing. The combined Z-score of open interest and funding for Binance’s derivatives metric is close to -0.28, which is slightly below its historical average.

This signal suggests that traders are gradually reducing leverage and overall risk rather than jumping into new speculative bets, most likely in response to previous excesses.

In the past, withdrawals have often occurred after a very positive Z score, which usually comes during periods of overheated markets. The current negative reading tells a different story, one of risk slowly being taken off the table as high-risk positions are paid off over time.

Also read: Bitcoin Danger Signals According to Peter Brandt, $25,000 Extreme Target Highlighted!

Long-term Outlook Remains Favorable

Although activity in the derivatives market has cooled down, Bitcoin has largely stayed around the $90,000 level. There is no wave of forced liquidation driving the withdrawal, but rather traders reducing their leverage. While this has slowed the short-term rally, many analysts see this as a positive reset rather than an indication of more serious weakness.

They warn that until exchange liquidity improves, Bitcoin may continue to be vulnerable to sudden moves in either direction rather than a stable trend, although long-term supply dynamics and institutional adoption are still favorable.

Conclusion

With fragile market conditions and a thin market structure, investors and observers should be aware of the potential for unexpected Bitcoin price movements. Understanding the current dynamics of liquidity and leverage is key to navigating this volatile market.

FAQ

What is Inter-Exchange Flow Pulse?

Inter-Exchange Flow Pulse is a metric from CryptoQuant that tracks the flow of Bitcoin (BTC) between exchanges. This indicator is colored red indicating a slowdown in capital flow between trading platforms.

How does decreased liquidity affect the price of Bitcoin?

Decreased liquidity can lead to less deep order books, meaning even small trades can move prices significantly, increasing slippage and causing sharper price fluctuations.

What does the Z score of -0.28 on Binance derivatives data mean?

A Z score of -0.28 on Binance derivatives data shows that traders are gradually reducing leverage and overall risk, which is indicative of market adjustment rather than panic or renewed speculation.

Why is it important to monitor liquidity on Bitcoin exchanges?

Monitoring liquidity on Bitcoin exchanges is important as low liquidity can make the market more vulnerable to sudden and large price movements, which can significantly affect the value of an investment.

Is the long-term outlook for Bitcoin still favorable despite current market conditions?

Although current market conditions show some challenges, the long-term outlook for Bitcoin is still considered favorable due to good supply dynamics and growing adoption by institutions.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News. Bitcoin Exchange Flows Decline, Market Red Flag. Accessed on December 16, 2025

- Featured Image: Generated by AI