Will Bitcoin be Affected by US Economic Data This Week?

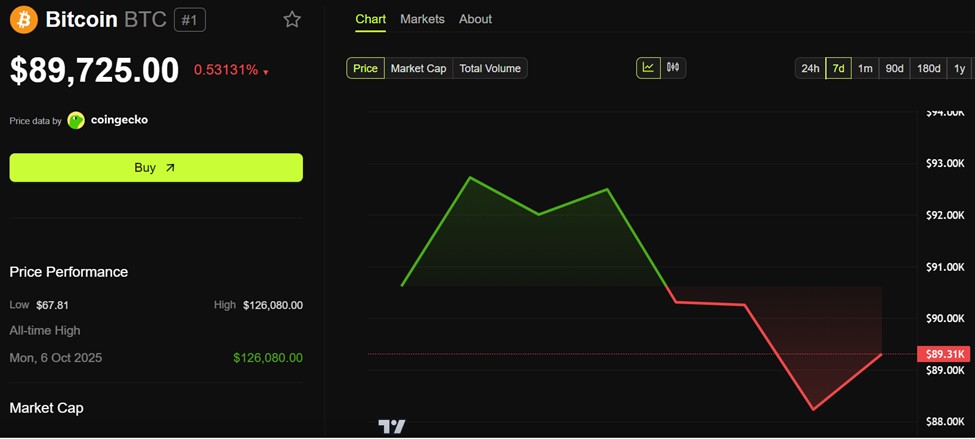

Jakarta, Pintu News – This week, some key economic data from the United States will be important determinants of market sentiment towards Bitcoin . With Bitcoin’s price currently hovering around the psychological $90,000 level, crypto market participants are eagerly awaiting indications from the Federal Reserve’s policies that could affect interest rate expectations and short-term price direction.

Nonfarm Payrolls (NFP): An Overview of US Labor Conditions

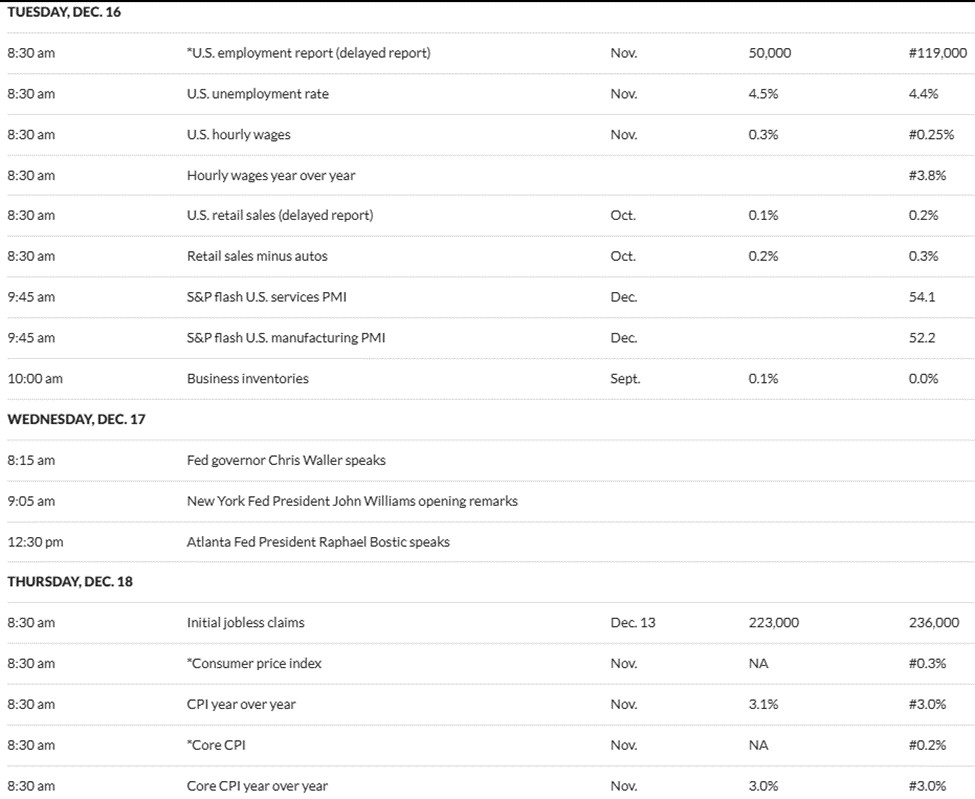

The Nonfarm Payrolls report for November, which will be released on Tuesday, December 16, 2025, at 8:30 AM ET, is the first data to provide a comprehensive picture of US labor conditions since September. This report is very important because it is one of the factors that the market considers in assessing the Federal Reserve’s interest rate policy for 2026.

The report is expected to provide some clues about the strength of the labor market and its potential impact on monetary policy. Analysts and investors will be paying attention to whether there is an increase or decrease in job creation, which could have a direct effect on the Bitcoin (BTC) exchange rate.

Also Read: Ethereum Headed to $5,000: Investment Opportunities Ahead of 2026!

Initial Jobless Claims: An Indicator of Labor Market Stress

The weekly released Initial Jobless Claims data is also in focus on Thursday, December 18, 2025, at 8:30 AM ET. This data shows the number of US citizens who filed unemployment insurance claims for the first time in the previous week, providing an up-to-date picture of labor market conditions.

An increase in jobless claims could indicate stress in the labor market, which might affect the Federal Reserve’s policy decisions. Conversely, a decrease in claims could signal a stronger economic recovery and potentially support Bitcoin (BTC) price gains.

November Consumer Price Index (CPI): The Most Anticipated Data

The Consumer Price Index (CPI) for November, which will be released alongside jobless claims data on Thursday, December 18, 2025, is the most anticipated data of the week. The CPI is an important indicator of consumer inflation that has been delayed by the 46-day US government shutdown.

This CPI report will greatly influence inflation expectations and the Federal Reserve’s interest rate policy. If the report shows higher-than-expected inflation, it could spark concerns about further monetary tightening, which might negatively impact the price of Bitcoin (BTC).

A Decisive Week for Bitcoin

This week, with the release of some key US economic data, will be crucial for the Bitcoin (BTC) market. Market participants will be scrutinizing every detail of the released reports to make investment decisions. The future stability or volatility of the Bitcoin (BTC) price may largely depend on the outcome of these economic data.

Also Read: Bitcoin Stuck Below $94,000: When Will Price Recovery Happen?

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is Nonfarm Payrolls (NFP)?

A1: Nonfarm Payrolls (NFP) is a report released by the US government that shows the number of jobs added or lost in the economy, outside of the agricultural sector. This report is very important as an indicator of economic conditions.

Q2: How do Initial Jobless Claims affect the economy?

A2: Initial Jobless Claims shows the number of individuals who filed unemployment insurance claims for the first time. An increase in these claims could indicate stress in the labor market, while a decrease signals a recovery.

Q3: Why is the Consumer Price Index (CPI) important?

A3: The Consumer Price Index (CPI) measures changes in the prices of goods and services from a consumer perspective and is a leading indicator of inflation. A higher CPI indicates higher inflation, which can affect interest rate policy.

Q4: How can US economic data affect the price of Bitcoin (BTC)?

A4: Economic data such as NFP, CPI, and jobless claims provide indications about the strength of the economy and monetary policy, which can affect investor expectations and the Bitcoin (BTC) exchange rate.

Q5: When will the CPI and Initial Jobless Claims reports be released?

A5: Both reports will be released on Thursday, December 18, 2025, at 8:30 AM ET.

Reference

- BeInCrypto. Bitcoin Price Analysis: BTC/USD Consolidates Below $48,000, BOJ Rate Hike and US Data Risk. Accessed on December 16, 2025