These 3 Altcoins Have the Potential to Experience Liquidation in This Week

Jakarta, Pintu News – According to the Crypto Fear & Greed Index, crypto market sentiment in the third week of December is still dominated by fear, with scores indicating extreme levels of fear. This negative sentiment has made short positions more dominant.

However, some altcoins have their own catalysts that could potentially trigger the liquidation of these short positions. So, which altcoins are these, and what specific risks do they face?

Solana (SOL)

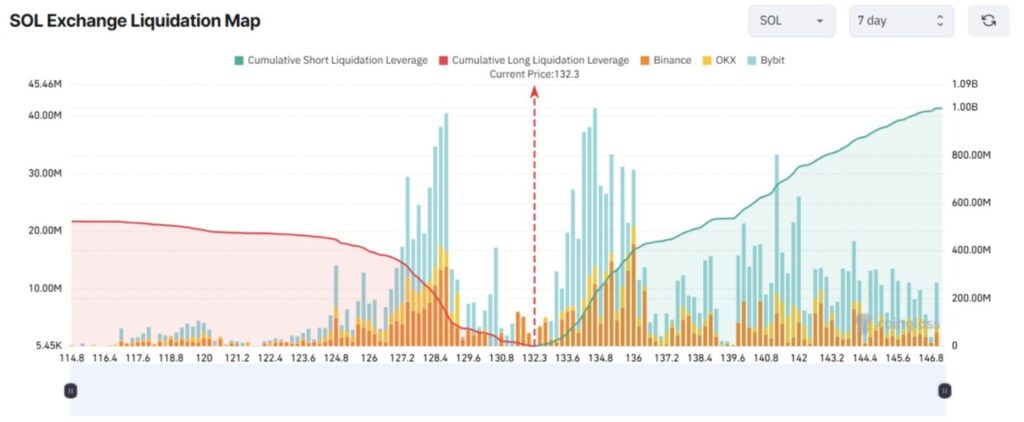

The liquidation heatmap for the last 7 days for SOL shows that the liquidation potential of short (sell) positions is twice as large as long (buy) positions.

Read also: Long-term Crypto Investment Strategy 2026: Here’s How $10,000 Is Allocated

Specifically, if the price of SOL rises to $147 this week, traders holding short positions risk losses of up to $1 billion. Conversely, if SOL falls below $120, traders with long positions could see around $500 million worth of liquidation.

There are several factors that suggest traders need to be cautious when opening or maintaining short positions this week.

Firstly, the SOL ETF recorded seven consecutive days of positive fund inflows last week. Specifically, the Bitwise SOL ETF has posted positive inflows for 33 consecutive days since its launch, and currently manages over $600 million worth of SOL assets. This trend reflects continued institutional demand.

Secondly, in the past four weeks, SOL showed strong support in the price range of $130. In addition, market sentiment improved after positive news emerged about the expansion of DeFi usage by XRP on the Solana network through cooperation with Hex Trust.

With these factors in mind, SOL has a pretty solid foundation to experience a price recovery this week – potentially triggering a large liquidation of short positions.

Cardano (ADA)

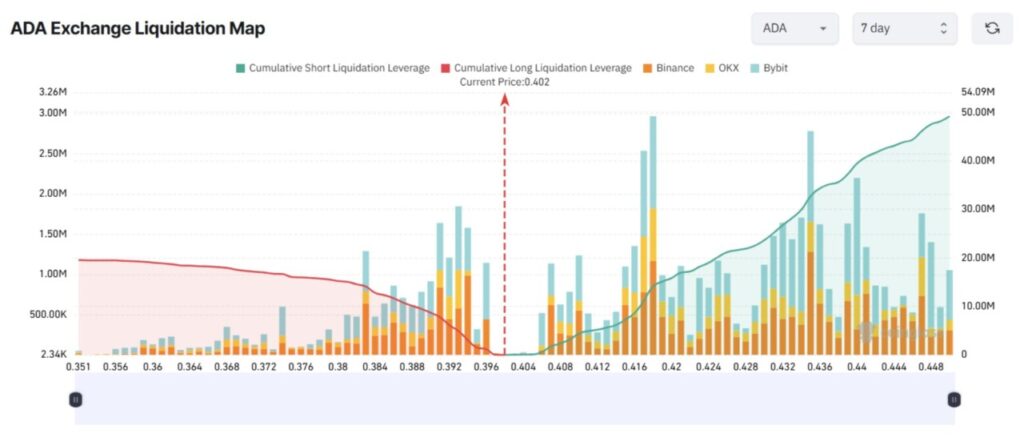

As with the SOL, the generally negative market sentiment has prompted Cardano short-term derivatives traders to increase capital allocation and leverage on short positions.

This behavior led to a significant spike in the potential volume of liquidation of short positions. If the price of ADA rises to $0.45 this week, short positions could incur losses of up to $50 million. Conversely, if the price drops to $0.35, long positions risk liquidation of around $19.5 million.

However, there is one important factor that short ADA traders should consider to reduce risk, which is the positive sentiment surrounding the Midnight project.

Midnight Network is a new blockchain developed by Input Output Global (IOG), the company behind Cardano founded by Charles Hoskinson.

Midnight focuses on privacy through zero-knowledge proof technology, specifically ZK-SNARKs. Its native token, NIGHT, has surged more than 150% in the past seven days.

The increasing demand for NIGHT is also driving demand for ADA. Based on data from the Taptool platform, the trading volume of NIGHT on DEX has surpassed 85 million ADA in the past five days. In addition, ADA holders can also acquire NIGHT tokens by staking their ADA.

These factors provide fundamental support that could strengthen ADA prices in the near term – while increasing the risk for traders holding short positions.

Read also: OpenSea Presents POWER Game Token as a Payment Method in NFT Marketplace!

PIPPIN

PIPPIN is a meme coin that attracted huge attention towards the end of the year. Its market capitalization jumped sharply, from under $60 million to over $350 million in just three weeks.

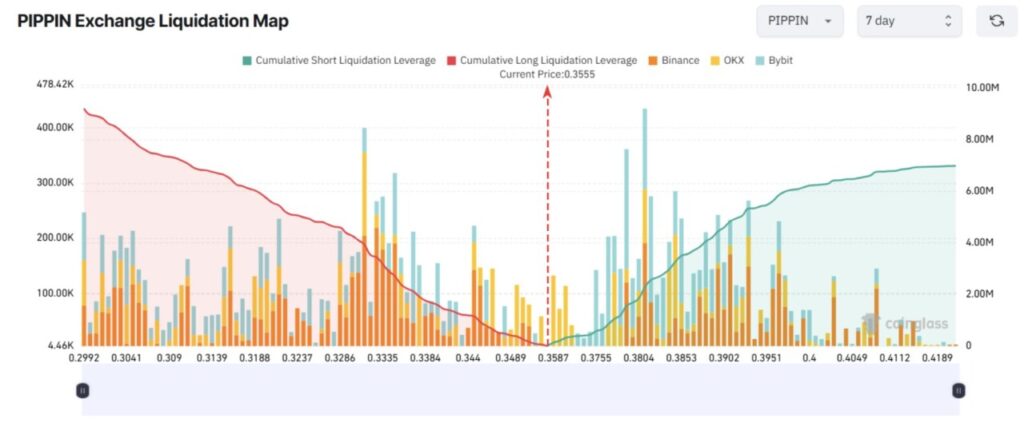

Based on theliquidation heatmap, the cumulative potential for liquidation of long positions (buy) is still higher than that of short positions (sell). This data suggests that many short-term traders are still anticipating further price increases.

However, this expectation comes with great risk. Recent analysis from Evening Trader Group’ s on-chain data tracking account revealed that 93 wallets currently account for around 73% of the total PIPPIN token supply.

These wallets fall into three main accumulation clusters, each of which shows different origins and behavioral patterns. According to Evening Trader Group, it is this massive accumulation that is most likely the trigger for the recent price surge. On the other hand, major selling pressure could also emerge at any time.

Additionally, the project’s official account (@ThePippinCo) has not provided any updates since June. This absence sparked concerns about the development team’s commitment to the project’s survival.

If the PIPPIN price drops below $0.30 this week, more than $9 million in long positions are at risk of liquidation. That amount could grow if PIPPIN experiences a sharp decline – as has happened with several other manipulated meme tokens.

Against this backdrop, traders need to be very aware of the potential extreme volatility that may occur.

FAQ

What is Solana (SOL) and why is its ETF important?

Solana is a blockchain that supports decentralized applications and smart contracts. The Solana ETF is important because it shows the level of adoption and institutional trust, which can influence the price of SOL in the market.

How does the Midnight Network project affect the price of Cardano (ADA)?

Midnight Network increased demand for Cardano (ADA) due to the privacy technology used and the rising price of the NIGHT token. This attracted more investors to ADA, potentially increasing its price.

Why is PIPPIN considered risky?

PIPPIN is considered risky due to the high concentration of ownership and lack of communication from the development team, which could lead to high price volatility and potentially massive selling.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Altcoins Liquidation Risk in December Third Week. Accessed on December 19, 2025