Ripple CEO Celebrates XRP ETF’s Impressive Achievement

Jakarta, Pintu News – In the world of cryptocurrency investment, Exchange Traded Fund (ETF) products based on Ripple have recorded positive net inflows for 30 consecutive trading sessions.

This stands out when compared to the more erratic fund flows on Bitcoin and Ethereum ETFs. Brad Garlinghouse, CEO of Ripple, recently used the social media platform X to highlight this important milestone achieved by XRP-based products.

New Wave of Launches

In late October, REX-Osprey introduced their quasi-spot ETF which received a lot of attention. However, the wave of spot ETF launches actually started in November. Canary Capital pioneered the way by launching the first XRP spot ETF in the United States, recording record first-day volume for a non-Ethereum altcoin ETF with nearly $250 million in withdrawals.

Following Canary Capital’s success, other major issuers such as Franklin Templeton with the XRPZ ETF, Bitwise with the XRP ETF, and Grayscale with the GXRP ETF, also launched similar products. These successes mark the beginning of many launches still to come, demonstrating the great interest in XRP among institutional investors.

Also Read: Bitcoin, Ether, and XRP Decline Increases Toward the End of 2026, Why?

The Price Paradox

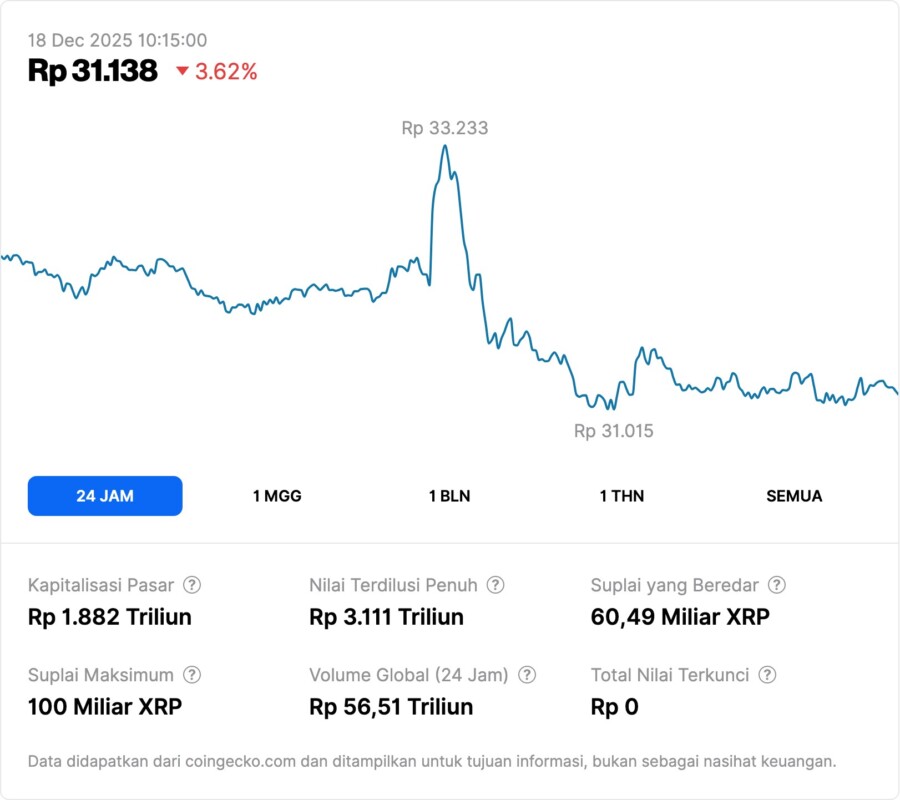

Despite $1 billion in buying pressure from ETFs, the price of XRP has struggled. The token recently lost support at the $2.00 level and is now trading in the range of $1.88 to $1.92. Selling pressure from retail investors is thought to be the main cause of this underperformance, which offset buying pressure from ETFs.

Additionally, when market makers sell XRP to ETF issuers, they may “short” XRP in the derivatives market to protect themselves from price declines. These hedging activities create downward pressure on the price, which adds to the complexity of the current XRP market dynamics.

Ripple CEO’s response

Brad Garlinghouse, CEO of Ripple, has been actively trumpeting this achievement on social media, emphasizing the importance of the continued growth of the XRP ETF as an indicator of investor interest and confidence. According to him, this is proof that XRP has significant potential as an investment asset in the future.

Garlinghouse also highlighted that despite the challenges in the market, this achievement shows that there is strong and sustained demand for XRP. This could be a positive signal for the future of XRP, especially if it can overcome the existing selling pressure and stabilize back above the key price levels.

Conclusion

The achievement of the XRP ETF demonstrates an interesting dynamic within the cryptocurrency market. Despite facing price challenges, the strong interest from institutional investors could be a catalyst for future XRP price recovery. Investors and market watchers will continue to monitor this development closely.

Also Read: 7 Bitcoin (BTC) Facts Drop to Around $85,000, New Losses in the Global Crypto Spotlight

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is the XRP ETF?

A1: The XRP ETF is an Exchange Traded Fund product that invests in Ripple (XRP), allowing investors to participate in the cryptocurrency market through a more traditional and organized mechanism.

Q2: Why has the XRP price struggled despite massive buying from ETFs?

A2: XRP price has struggled due to selling pressure from retail investors and hedging activities by market makers, which created downward pressure on the price despite heavy buying from ETFs.

Q3: How much XRP did whales sell in the last four weeks?

A3: Whales have sold 1.18 billion XRP in the past four weeks, which contributed to the decline in XRP price.

Q4: What impact will the launch of the XRP ETF have on the market?

A4: The launch of the XRP ETF has attracted significant institutional investor interest, although the impact on the XRP price is still mixed due to external factors such as selling pressure and hedging.

Q5: What does it mean to “short” XRP in the derivatives market?

A5: “Shorting” XRP in the derivatives market is a strategy used by market makers to protect themselves from a potential drop in the price of XRP, by selling XRP they own in the future at a price lower than the current price.

Reference

- U.Today. Ripple CEO Celebrates Impressive XRP ETF Milestone. Accessed on December 18, 2025