Bitcoin Long Position Surge by Whale on Bitfinex: What Does It Mean?

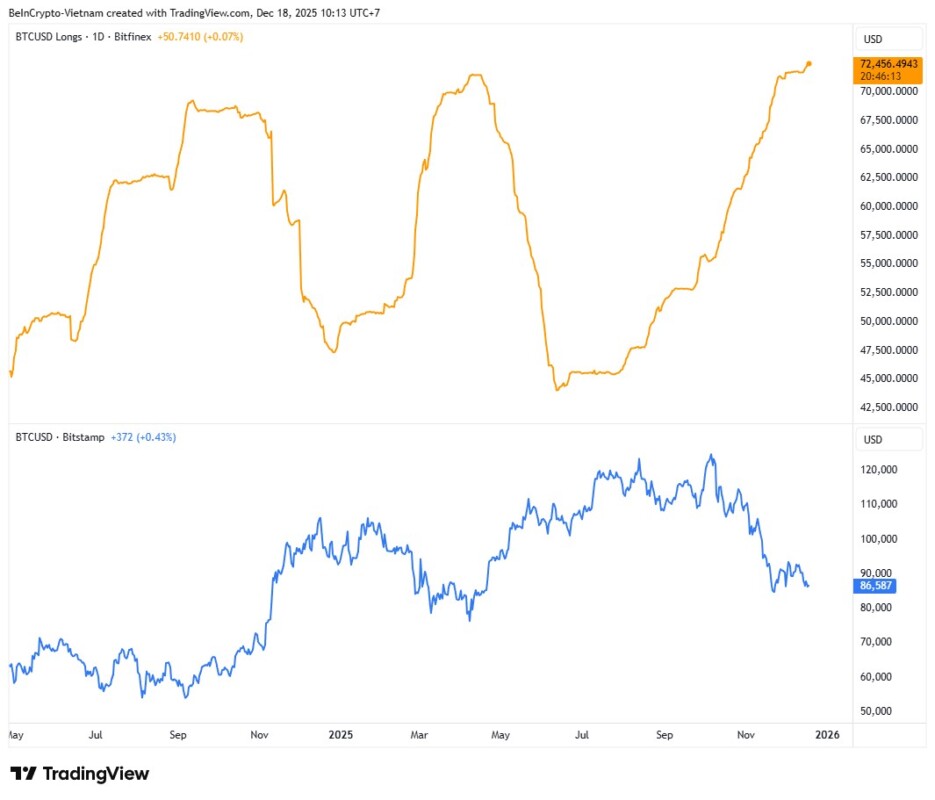

Jakarta, Pintu News – Large Bitcoin investors on the Bitfinex platform are back in the market spotlight. The latest leveraged position data shows a sharp increase in long Bitcoin positions held by “whales”, reaching levels last seen in March 2024. This phenomenon is attracting attention as it represents a unique market dynamic and may provide an indication of the future direction of the Bitcoin price.

Increased Long Position by Whale

According to on-chain analyst, James Van Straten, whales on Bitfinex continue to add to their positions aggressively. Since September, there has been a consistent trend of accumulation, with expansion of long exposure during periods of price weakness rather than during rallies. Bitfinex itself seems to recognize this activity, highlighting that large, experienced traders may be preparing with conviction, while smaller participants are reducing risk.

Recent data shows that long positions by whales have increased by 36%, a move that reflects not only optimism, but also a contrarian strategy in dealing with the market. This increase could be a signal that large investors see the potential for price recovery or at least market stabilization in the near future.

Also Read: How Crypto is Remaking the Financial System, AI, and Privacy Until 2026 According to a16z Crypto

Contrarian Signal, Not a Timing Tool

The long whale metric on Bitfinex has long been considered a potential indicator in technical analysis. However, interpretation of this data requires caution. These traders have a documented pattern of increasing long exposure during downturns and reducing positions as market strength increases.

Van Straten emphasizes that the true value of this signal lies in watching for reversals rather than absolute levels. While a surge in long positions by whales can be considered a bullish signal, it does not necessarily guarantee an immediate upward price movement. History has shown that the Bitcoin market can remain unpredictable, and the actions of whales are often more complex than they appear at first glance.

Implications for the Bitcoin Market

The surge in long positions by whales on Bitfinex may have significant implications for the overall Bitcoin market. If these large investors are correct in their predictions, we could see an increase in Bitcoin price in the coming months. However, it is important to remember that the cryptocurrency market is highly volatile and is affected by various external factors.

In addition, this activity can also affect broader market sentiment. Small and medium-sized investors may make decisions based on the actions taken by the whales, which can lead to larger and faster price movements than would normally occur.

Conclusion

The increase in long positions by whales on Bitfinex is a noteworthy phenomenon for anyone involved in the Bitcoin market. While it is not a definitive timing tool, understanding the behavior of these large investors can provide valuable insight into the potential future direction of the market. Investors are advised to remain vigilant and consider various factors before making investment decisions.

Also Read: 7 XRP Facts on Institutional Finance via VivoPower’s $900 Million Exposure Structure

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

Q1: What is a long position in the context of Bitcoin trading?

A1: A long position in Bitcoin trading is when a trader buys Bitcoin with the expectation that the price will rise, so that they can sell it back at a higher price in the future.

Q2: Who are the so-called “whales” in the Bitcoin market?

A2: In the Bitcoin market, “whale” is a term used to describe an investor or trader who owns such a large amount of Bitcoin that their transactions can significantly affect the market price.

Q3: When was the last time the level of long positions by whales on Bitfinex reached similar levels?

A3: The level of long positions by whales on Bitfinex last reached similar levels in March 2024.

Q4: What impact will the increase in long positions by whales have on Bitcoin price?

A4: Although an increase in long positions by whales can be considered a bullish signal, it does not necessarily guarantee an immediate price increase. The Bitcoin market remains highly volatile and is affected by many factors.

Q5: How should small investors respond to information about long whale positions?

A5: Small investors are advised not to rely solely on whale activity as the basis for their investment decisions. It is important to conduct a thorough analysis and consider various factors before investing.

Reference

- BeInCrypto. Bitfinex Bitcoin Whale Long Positions Hit Record in December 2024. Accessed on December 19, 2025