7 BTC Mining Facts: From Downside Difficulties to Impact on Crypto Market

Jakarta, Pintu News – Bitcoin mining activity is back in the conversation among crypto market participants as metrics such as mining difficulty and hashrate show significant dynamics throughout 2025, impacting professional miners’ operational decisions and fee structures.

Based on the latest industry data, this situation signals both competitive changes and operational risks that need to be understood before assessing the implications for the cryptocurrency market.

1. Bitcoin Mining Difficulty Drops Even though Hashrate is Still High

Recent data shows that Bitcoin mining difficulty experienced a mild decline after reaching its peak, reflecting the network’s adjustment to large miner hashrate fluctuations, according to a Cointelegraph report. P

he decrease shows the Bitcoin protocol’s automatic adaptation to reduced miner activity, although the total hashrate remains historically high. This information suggests that while mining competition remains intense, there are phases where mining becomes relatively easier technically than in previous periods.

Also Read: 7 XRP vs BNB Facts: Tight Competition for Top-3 Market-Watched Crypto Positions

2. Bitcoin Network Hashrate Has Reached Record Highs

According to network data, Bitcoin’s total hashrate briefly hit a record high of more than 1.2 zettahashes per second, making headlines for showing great interest in computational processing on the network despite increasing difficulty. This spike demonstrates the competitiveness of large miners in securing the network through high-level hardware investments. An increase in hashrate is often seen as an indicator of confidence in the strength of the network and the security of the Bitcoin blockchain system.

3. Third Consecutive Difficulty Drop

A report from HTX Insights noted that Bitcoin mining difficulty fell 0.74% on December 11, 2025, marking consecutive declines over the last three adjustment periods. This decline tends to occur as some miners decommission machines that are no longer profitable, especially when Bitcoin price is lower than production costs. As a result, the network difficulty adjusts to maintain block speed.

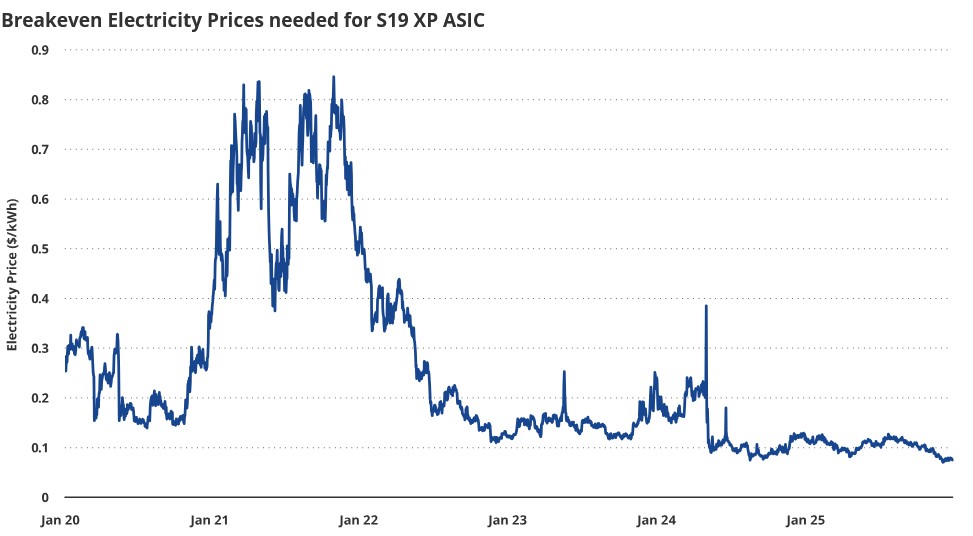

4. Mining Production Cost Increases

Industry data shows that the cost of producing Bitcoin is often already close to or even exceeds the market price of the asset itself when it drops below a certain level. This condition is monitored as it forces many small miners to shut down their operations. As electricity and device maintenance costs increase, profit margins dwindle and only efficient operations with low costs survive.

5. Impact of Hashprice Decrease on Miner

According to a mining analysis report, Bitcoin mining hashprice has remained flat at around $48 per PH/s despite a small increase in difficulty. The low hashprice is one of the important indicators because it shows that the daily revenue per unit of hash power generated by miners is not increasing with the new operational costs. This reflects significant pressure on the profitability of traditional miners.

6. Big Miner Changes Operational Strategy

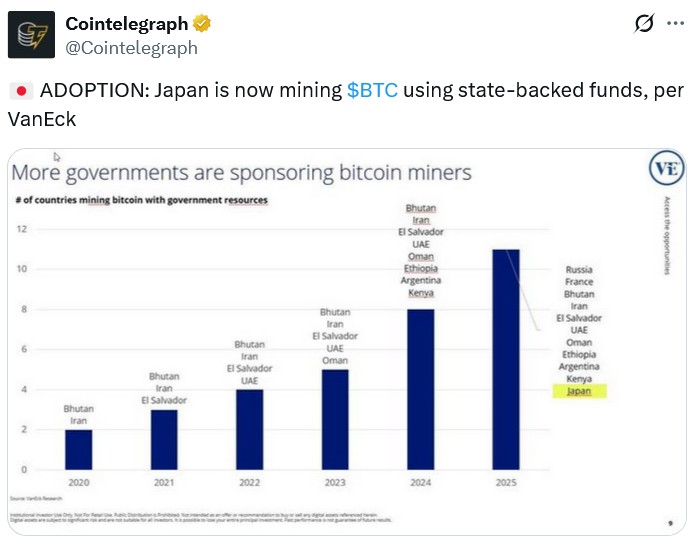

Some large mining companies in the cryptocurrency market are starting to pay attention to diversifying revenue sources, including turning to AI data centers or treasury strategies that incorporate Bitcoin in the company’s balance sheet. This shift comes in response to the uncertainty of the mining industry after the halving and the pressure of rising operational costs. These strategies reflect broader business structure changes within the mining sector.

7. Wide Crypto Market Implications

Changes in Bitcoin mining not only impact miner operations, but also the broader market as it can affect liquidity and selling pressure of Bitcoin (BTC) on exchanges. When miners experience economic pressure, some may be forced to sell their coin reserves to cover costs, which can affect supply in the spot market. This trend needs to be monitored as one of the important metrics in assessing general crypto market sentiment.

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

FAQ

What is mining difficulty and why is it important?

Mining difficulty is a measure of how difficult it is to find new blocks on the Bitcoin network. A decrease indicates that the network hash rate is decreasing, so the prospect of mining could become a little easier for the remaining miners.

Who is most affected by the change in mining difficulty?

Miners with high operational costs and old devices are most stressed as they may no longer be profitable, so some shut down their devices.

When is the Bitcoin mining hashprice lowest?

Hashprice remains flat at a relatively low value through 2025, at around $48 per PH/s, keeping mining revenue depressed.

Where is Bitcoin mining more profitable?

Locations with low energy costs tend to be more profitable because the main operational cost burden comes from electricity consumption, so miners with access to cheap energy are more competitive.

How do mining changes affect the crypto market?

Changes in mining can affect the supply of Bitcoin on exchanges and be an indicator of selling pressure or market liquidity more broadly.

Reference

– HTX Insights. Bitcoin Mining Difficulty Drops for the Third Time in a Row. What Does This Mean? Accessed December 23, 2025